Amazon will not beat Flipkart in e-commerce till 2019: study

E-commerce in India is growing wider and deeper every day. More players are coming up in verticals and horizontals, but the early beginners continue the stronghold. According to a new study by Bank of America’s investment banking division, India’s largest online marketplace Flipkart will continue to be the number one e-commerce player in the country, at least till 2019.

The Bengaluru-based firm, currently valued at approximately $9 billion, is estimated to have 44 percent GMV market share in 2019 while its rival Amazon will take 37 percent, up from 21 percent in 2015. Currently, the Flipkart app has had 50 million downloads, while Amazon has 10 million.

The Bank of America Merrill Lynch study adds that India will be the second largest market for Amazon outside the US, while Snapdeal will fall to 9 percent by 2019, from 14 percent in 2015.

In fact, Amazon had overthrown Snapdeal in terms of sales a year ago. In the last two months, they have reportedly also beaten Flipkart in sales. Amazon GMV in 2025 will be $81 billion according to the report, which also states that it will generate $5.5 billion in GMV in 2016.

Clash of the titans

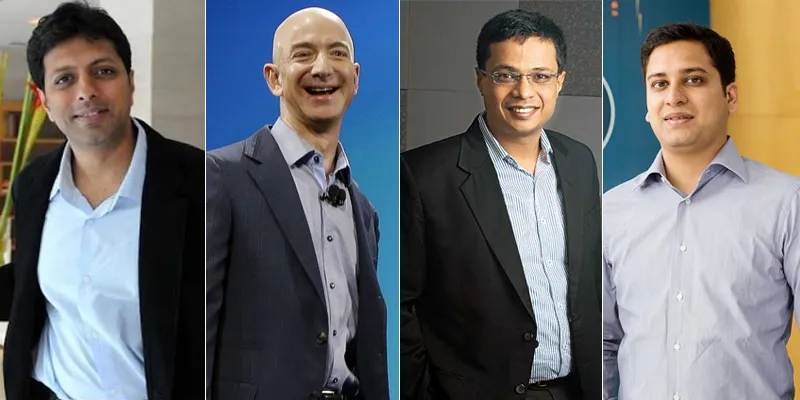

While Flipkart was one of the earliest to enter the scene and shape the industry in India, Seattle-based Amazon — which had earlier employed Flipkart founders Binny and Sachin Bansal — has had the advantage of a steeper learning curve.

With a total investment of $5 billion in India after a failed attempt to make a mark in China, Amazon’s founder Jeff Bezos is clear about his ambitions in the country. Despite the reported annual loss of $1 billion in India, Amazon India - led by Amit Agarwal - has made a mark without too many discounts. In fact, Nielsen’s E-commerce Sellers’ Study of 2016 (Q1) had estimated the brand recall value of Amazon to be 25 percent, while Flipkart’s was 21 percent and Snapdeal’s 20 percent.

Launched in 2013, Amazon India has 85,000 sellers, whereas Flipkart, launched in 2007, has 90,000. While they are competing in services, their strengths lie in different categories. Amazon’s famed subscription service — Amazon Prime — was launched in India in July, and Flipkart responded to it within a month with ‘Flipkart Assured’. Response to both is yet to be seen. Amazon has an edge over Flipkart in terms of fulfilment centres too — 24 to 18.

While fashion has always been Amazon’s Achilles' heel, Flipkart claims to have 35 percent market share in it, and 70 percent through its alliance with Jabong and Myntra. Electronics and mobiles, which both Flipkart and Amazon had focused on for long, give great GMV but low margins, whereas fashion gives great margins.