Uber-Didi merger: Ola must be bothered, but guess who is excited about the development?

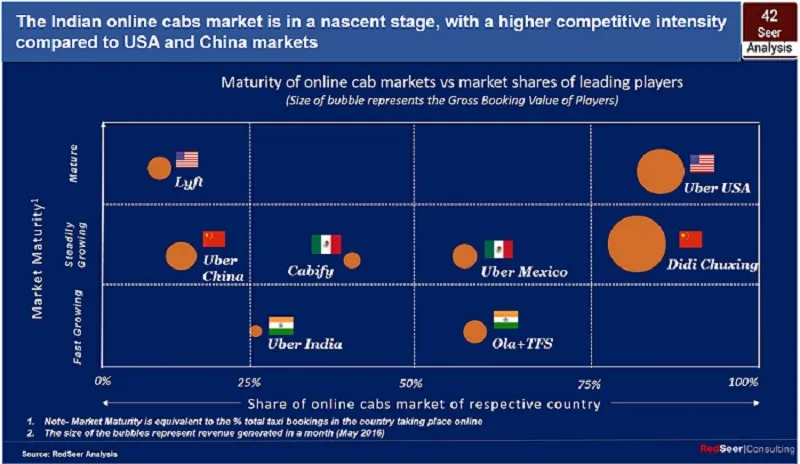

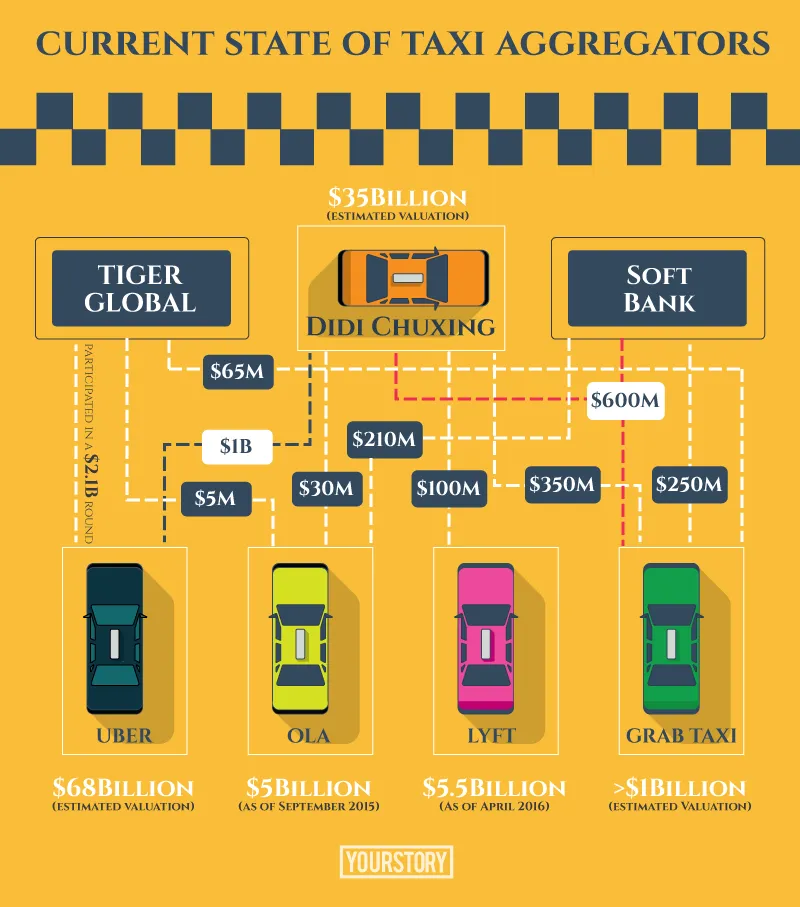

Earlier this week, when two online cab aggregator giants—US-based Uber’s China arm and Chinese market leader Didi Chuxing—announced their merger, at a valuation of $35 billion, the Indian market sat up and took notice. Immediately, discussions swirled around the possible impact the development would have on Indian market leader Ola.

Uber now has a 17.7-percent stake in Didi, which has invested at least $25 million in Ola. Indirectly, Uber now has a share in Ola. Taking this into consideration, speculations are rife about Ola merging with Uber India soon.

But there is a quieter bunch of people who are the most excited about this deal—smaller online aggregators who had no funding and were therefore choking in a market ruled by Ola and Uber with ridiculously low fares and incredible incentives for drivers.

Scope for innovation

While Ola and Uber were burning $30-40 million per month, these players had to seek the state’s intervention. Kaali Peeli taxis even declared a 20-percent off in their fares in Mumbai to woo customers. But now, they are also hoping for an Uber-Ola merger, which will effectively eliminate competition and thus reduce the low fares.

Rakesh Agarwal, Director and CEO of Magic Sewa cab services in Delhi-NCR, told YourStory:

We are very excited since we learnt about this deal, simply because if there is only one entity here, why would Uber-Ola go for cheap pricing? They will control their market so they can charge it as they like. When that happens, small players like us can also take a bite out of the market.

Less competition, more price advantage

Recently, the transport departments of the Delhi and Karnataka governments asked for the installation of physical fare meters to decide charges, rather than the current method of gauging the rate using GPS. This will be impossible for Ola and Uber as digital meters show static per kilometre value. (If digital meter is followed, everyone follows the same fare.) Rakesh said that they are installing it in Magic Sewa cabs in three or four weeks. The fare will be decided on the meter, not GPS, he asserted.

Jaspal Singh, Partner at Valoriser Transport Consultants, believes that Ola and Uber would now understand they cannot survive on the big incentives they give the drivers, or discounts for customers.

“They will have to bring it down. The only way to go forward is when you consolidate, with more innovation in the market, and that needs more funds. If they keep fighting with each other, they can’t make investments in other things,” he explained.

Following the news of US e-commerce titan Amazon partnering with Alibaba in China last year, Alibaba was rumoured to enter India this year. With Uber following a similar trajectory, would it end with Didi entering India? Industry observers dismiss the possibility. The Economic Times had reported that Didi Chuxing and Uber may have signed a non-compete agreement for international markets. The report speculated that Didi “cannot directly operate in markets Uber is present in, which means that in India it can invest a little more in Ola (its stake is in the single-digit percentage) but cannot be the single-largest owner.”

Ola’s options

To be fair, Indian market is big enough to accommodate two big players, in which case Ola and Uber need not merge. But Ola would still have reason to worry, since Uber will be focussing more on the Indian market now. Uber had invested $1 billion in India in July 2105 and recently raised $3.5 billion from Saudi investors. Chances are, then, that whatever Uber may have otherwise invested in China could now come to India.

Ola, on the other hand, is finding it hard to raise funding. Venture funds are reluctant, as money is going to be burnt rather than be used towards growth and profitability, Rakesh said, adding, “After six months, Ola will need even more money but they have had no profit with the huge investments so far. It should focus more on drivers’ conditions and comply with laws so as to have an edge on Uber.”

Ola, today, has nine different products (including shuttle and outstation), whereas Uber has only four. Rakesh said that if you compare the market share of Ola in the four categories that Uber has, they will be 50-50 soon. “To show themselves as the bigger player, Ola has to go into new markets where Uber has not stepped in yet. But some day Uber will,” Rakesh added.

If Ola is to reinvent itself, will it go beyond the nine models it currently has? If so, will it look toward inter-city travel where it already has a competitor?

On the possibility of a competition in future, Raghav Gupta, Country Manager-India, BlaBlaCar said, “Uber and Ola work in a different sector. But if they were to launch a similar model, then obviously it will be competition to us. What they currently have does not overlap with what we do. Theirs is a bigger business because intra-city travel is a bigger business than inter-city travel.”

Blurred lines

Till recently, Didi, Lyft and Ola had an alliance against Uber, in India, China, Southeast Asia and the US. But with the China merger, Uber obviously has an upper hand. But in South Asia, although Uber is growing fast, Grab has a bigger share of the market. In India, Ola still controls a bigger share of the pie. So far, at least.

Jaspal of Valoriser opined that Uber will first consolidate its market in China. “Didi’s focus will be on how to reorganise everything in China and create a larger company. Secondly, they will see how to leverage their investment in Grab, Ola and Lyft,” he added.

Indian turf

Now that Tiger Global and Didi Chuxing have become two parties common to Ola and Uber, the possibility of an Uber-Ola merger is undeniable. Such deals are often pushed by the investors to reach profitability. Ola and TaxiForSure is an example. In China too, investors pushed Uber and Didi to merge as profitability is a necessity now.

For the market to grow and expand, competition between peers is essential. For the benefit of customers getting quality service, may be it is time to let go of minuscule fares. It looks like the maturing process for the sector will begin soon. Will cockroaches beat the unicorns?