Global truce? Uber selling China subsidiary to Didi Chuxing, while Didi invests $1B in Uber

In their quest for global dominance, Uber and Chinese rival Didi Chuxing have been playing a high-stakes game of 'poker' for the past few years. Uber now seems to have folded its cards and is walking away from the table in China.

Earlier today, Bloomberg reported that after incurring losses trying to capture the Chinese market, Uber is selling its Chinese subsidiary to Didi Chuxing in a deal that values the combined entity at $35 billion. But as a part of the deal, Didi will be making a $1-billion investment in Uber at an estimated $68-billion valuation, according to Bloomberg and Recode.

This deal comes just a month after massive fund raises. In June 2016, Uber had raised a $3.5-billion funding round from Saudi Arabia’s sovereign wealth fund. Not to be outdone, Didi Chuxing announced that it had raised $7 billion, which included a $4.5 billion in funds from multiple investors (including $1 billion in funding from Apple, $600 million from China Life Insurance) and a $2.5-billion debt package from China Merchants Bank Co.

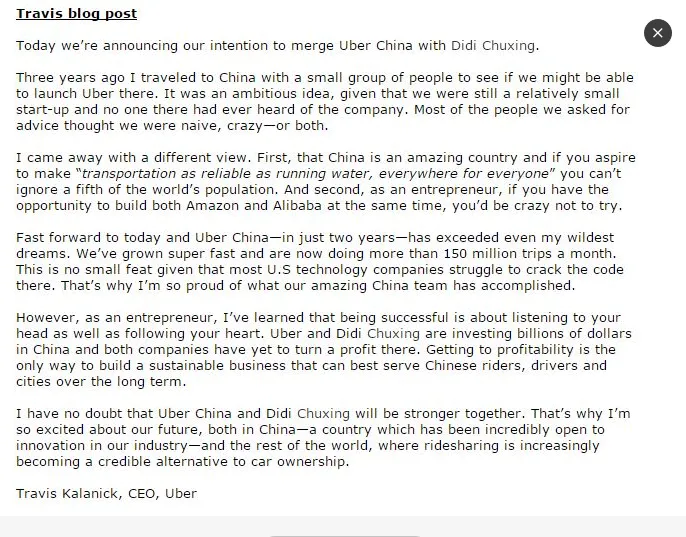

On the thought process behind this surprising deal, Bloomberg quotes Travis Kalanick, CEO of Uber, from a blog post that it gained access to. In it, Travis notes that he has learnt that to be successful one has to listen to their head and also follow their heart.

Image credit- Recode

Bloomberg notes that Uber’s investors had been pushing the company to sell off its China assets. Both Uber and Didi have been spending significantly to compete in China, with Uber spending an estimated $2 billion. But both companies have not yet turned profitable there. So Travis believes that this deal would be the only way to build a sustainable business and also best serve the Chinese riders, drivers and cities in the long term.

Talking about the financial aspects, Recode notes that under terms of the deal, Uber will get a 20-percent stake in the combined entity of Uber China and Didi Chuxing. This will value the combined Chinese entity at $35 billion, up from its previous $28-billion valuation.

As stated earlier, Didi is making a $1-billion investment in Uber at a $68 billion valuation, as confirmed by Bloomberg and Recode. YourStory had reached out to Uber India, but has been unable to independently verify this statement.

Implications- global truce?

In December 2015, Ola, GrabTaxi, Lyft and Didi Kuaidi had formed a global alliance to take on Uber. But this deal has all the signs of a global truce, with Didi and Uber joining hands in China.

Another result of this Uber-Didi alliance is monopoly. With no real rival in China, Didi could set its own price points and not have to indulge in price wars. Uber and Didi could also negotiate 'on turfs' in different geographies and capture different markets. It is too early to say anything concrete, but the days of consumers enjoying extremely low fares on cab rides could be over within the near future.

What about implications for India? Uber and Ola already have a common investor in the form of Tiger. Now Didi becomes yet another link. Could this deal in China be a precursor to an Uber-Ola deal?

[Update 3pm IST]

Travis, CEO Uber has confirmed the merger of Uber China and Didi and about Uber owning 20 percent stake in the combined entity, in a Facebook post.

Recomended reads: ‘Success of company turns people into stars, not vice versa’: Thuan Pham, Uber CTO

9 ‘geek’ lessons to entrepreneurs from Travis Kalanick, CEO, Uber