Healthcare — standing against all odds

By 2026, our country’s population is expected to reach 1.4 billion, and half of which, according to a CRISIL report, would be aged 30 years or older, compared to the current 40 percent. This would mean that the ageing population would be requiring adequate medical attention.

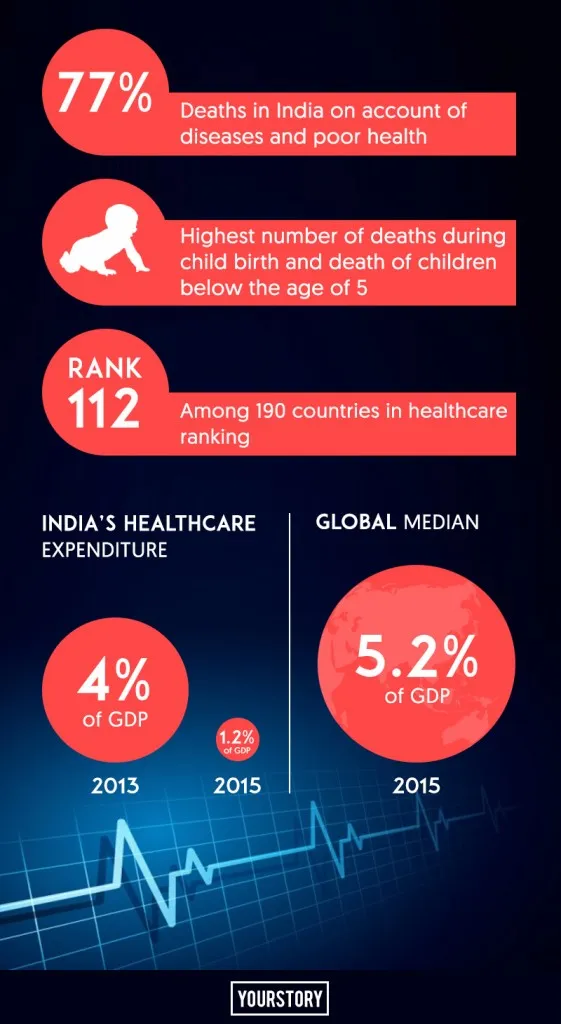

Currently, India's healthcare falls way below the global benchmarks. According to WHO estimates, approximately 9.8 million deaths occurred in 2012 in India, of which 77 percent were on account of diseases and poor health. India leads the world in the number of deaths during childbirth and death of children below the age of five. With a lowly ranking of 112

among 190 countries on healthcare parameters, and with a host of unmet medical needs of a growing and ageing population, the country presents a significant market opportunity.

The dismal state of the healthcare sector is further exacerbated by the government's failure to allocate sufficient funds. India’s total expenditure on healthcare was four percent of its GDP in 2013 (Source: WHO's Global Healthcare Expenditure Database) which fell further in 2015 to a mere 1.2 percent of the GDP, one of the stingiest in the world. With one of the fastest growing population in the world, this allocation is way less than the world median at 5.4 percent. In comparison, US, with a fourth of India's population, shells out 8.3 percent of its GDP to healthcare.

Healthcare startups to the rescue

The startup revolution has touched all sectors in India, the healthcare sector being impacted the most. Healthcare startups have ushered in a change to the status quo, especially with digital solutions. Innovations have helped aggregating and making access to healthcare information and services a lot easier. Healthcare is unorganised in terms of connectivity to doctors, consultancy, medicine delivery etc. “These startups have set up platforms where the entire system can be brought on record and have organised the pain points of the industry,” said Siddharth Singhal, Founder, Vibcare (E pharmacy India).

Some of the early players included Practo, Zoctr, and ICliniq. However, the past few years saw plenty make entry, including Lybrate, which helps connect patients to the doctor directly; eKincare, which allows tracking of health records on PC or mobile devices; Medibox Technologies, which tracks health services across the nation; Mediaka Bazaar, which helps consumers search and compare wellness needs; Medical Unique Identity, which maintain lifetime health records and protecting the data; and BookMEDS, an e-commerce portal for medicines and medical products.

There are many healthcare startups in India, which are scattered and provide a range of services and goods. Broadly, the sector can be divided into:

- Healthcare discovery platforms connect customers to doctors and hospitals, and help them book appointments too. Some prominent ones include Practo Search, CrediHealth.com, and Lybrate.

- Startups using medical devices and diagnostics harness intelligent technology to simplify diagnostic procedures. Perfint Technologies and Biosense Technologies are working in this line.

- Specialty-care startups focus on one vertical of medicine, so that they are able to provide special care to patients. MyDentist and Vasan Eye Care Hospitals fall under this category.

- Digitising and tracking platforms help integrate all medical records of patients and put them in one place. Some prominent ones include Practo Ray and eKincare.

- E-commerce websites like HealthKart, Medidartand Medist help people order medicines and healthcare equipment from various vendors.

Surviving the 2016 fund slowdown

We discussed in earlier reports how there is an apparent slowdown in the startup world after an eventful 2015. The current year is sluggish, with investors tending to their bleeding wounds post the turbulent year and refraining from venturing into new, heavy investments.

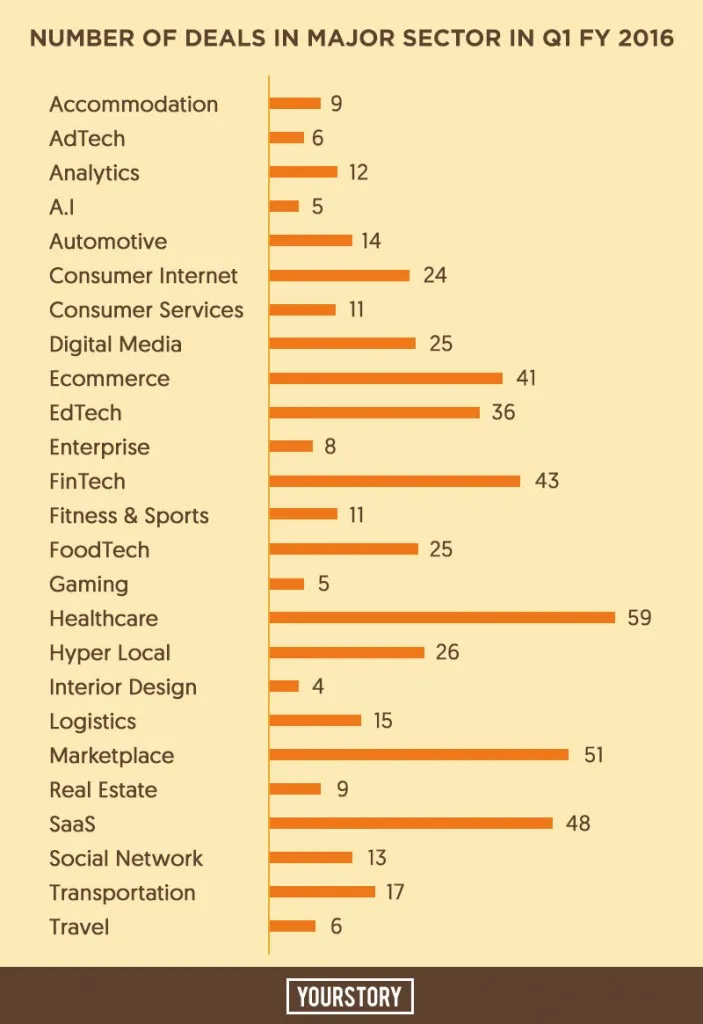

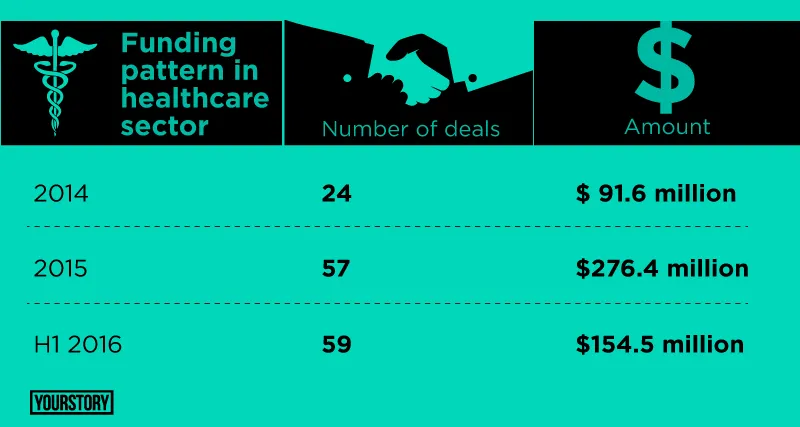

However, contradicting the trends, the funding data for the first half of 2016 shows that healthcare has been able to stand out in times of trouble and attracted the maximum number of deals. According to YourStory research, in the first half of 2016, of the total 552 deals, healthcare bagged the maximum, with 59 deals, and a funding amount of $154.5 million. “Healthcare is an important sector and investors see a lot of opportunity in this sector,” said Arpit Agarwal, investor at Blume Ventures. “Blume has been looking at healthcare for a while and we find the sector lucrative”. Recently, Blume Ventures invested an undisclosed amount in Tricog Health, which builds technological devices that help doctors identify a heart attack within minutes of the patient’s arrival.

A steady rise in the number of deals and amount of funding has been witnessed by the sector. In 2015, the sector attracted a total of 57 deals for the whole year and 24 deals in the year before, with $276.4 million and $91.6 million respectively.

Investors seem confident with the sector's performance despite the regulatory challenges, which could be a reason that could ward off potential investors. “We should resist the temptation of colouring the investment landscape across sectors with the same brush. The excitement in healthcare is due to exciting entrepreneurs scaling sound business models and the fact that investors have made money in recent IPO listings,” said VT Bharadwaj, Managing Director, Sequoia Capital India Advisors.

Sector overview and scope

Both in terms of employment and revenue, healthcare is one of the fastest growing sectors in India. CRISIL's report says the healthcare delivery industry in India is estimated to have grown at a CAGR of approximately 14-15 percent in value terms over the last five years. CRISIL expects the healthcare delivery market to grow at a CAGR of 12 percent and reach 6.8 trillion by the year 2019-2020, driven by population growth, rising income levels, and increase in lifestyle-related diseases, amongst other factors.

The current healthcare condition in India has a vast scope for penetration and innovation. According to Deloitte's latest report on healthcare, India, with an average of seven-hospital-beds-per-10,000 of its population(compared to a global median of 27), has a patchy public healthcare system with underfunded hospitals and clinics, and ineffective health-related schemes. The country’s limited healthcare resources are heavily skewed towards urban areas (with a bed density of two in rural areas and 5 in urban areas), while 70 percent of the population resides in rural areas.

India is desperately short of doctors, with just 0.6 per 1,000 inhabitants, and lacks specialists in many medical disciplines. The problem is particularly acute in rural areas. Along with adequate government intervention, healthcare startups have the scope to revolutionise healthcare in rural areas, by filling in the gaps in the existing system.

Health IT startups, a boon for rural population deprived of healthcare

With such a large population living in rural areas with limited or no access to healthcare, health IT has a huge potential in India. Digital health can be used as a great tool to extend healthcare to the deprived section with minimal manpower and low costs.

With companies like Embrace – engaged in developing affordable healthcare technologies, Yolo health – making healthcare accessible through health screening kiosk, WrigNanoSystems – engaged in technology innovations, Forus Health Pvt Ltd – addressing the healthcare delivery issues through innovative product design, affordable healthcare can be made available to even the remotest areas of the country.

Roadblocks

Neglected by the government – Healthcare sector by nature needs lot of initial capital investments, research, regulatory clearances etc. Assistance and protection at the initial stage by the government is necessary for startups in this sector to survive. The low government spending on healthcare and lack of aids and grants has restricted the growth of the sector to a large extent.

Low literacy and health awareness in the country – Though improving, literacy is still very low in the country, leading to lower health awareness among people. CRISIL estimates that the hospitalisation rate (percentage of people who visit a hospital when unwell) for in-patient is at 84 percent in 2014-15, with the rest either ignoring their ailment or resorting to blind beliefs and godmen.

Sluggish Growth – Though there lies huge scope and not much competition in the sector, the sector has a sluggish growth due to the nature of being data-driven. Implementing any new innovations needs extensive testing, approvals, and proven efficiencies. Fund-starving fledgling businesses generally do not have the bandwidth to sustain these delays and extensions and thus surviving in this sector can become a challenge in initial stages.

Absence of technology penetration in parts of the country – Though new technological innovations can solve the problem of scarcity of doctors and diagnostics laboratories in the huge market of rural India, these areas have very less technological and education penetration. No electricity, illiteracy, superstitions and other such issues can be a big roadblock to these startups in capturing the rural market.

Regulatory issues – E-Pharmacy has been in the news lately regarding concerns over misuse of technology, safety concerns on electronic prescriptions and opposition from offline chemists. Players point to the lack of regulatory governance specific to the e-healthcare industry in India. There is only some basic level legal e-commerce framework provided by the Information Technology Act, 2000 (IT Act 2000), which is the cyber law of India. But there are no specific regulations and guidelines for e-healthcare, explained Anil Bajpai of Zigy, an e-pharmacy player, in a press conference held by IIPA in June.

The business of online pharmacy is attracting high traction from investors in the past couple of years, and has seen funding to the tune of $92.6 million so far. The $18-billion market is set to grow to $55 billion by 2020 and is fast coming into the spotlight for its the potential to grow in the coming years. Some of the heavily funded companies include Practo ($124 million in three rounds), Portea Medical ($46.5 million in two rounds), and 1 mg ($22 million in three rounds). The sector is at a very nascent stage, with most companies being formed in the last year alone, and in the early stages of investments.

Lack of transparency has led to online pharmacies being harassed, and having to face stiff resistance and unwarranted disruptions from the government machinery and trade association. Lack of a proper regulatory framework has proved to become a stumbling block for many players keen to start e-pharmacies.

A recent statement from Drug Controller General of India (DCGI) that approved the online pharmacies to operate on e-prescriptions is another setback to the industry. On one hand, to the industry’s respite, the government did recognise the business model. However, it laid guidelines that are impossible to adhere to. “E–prescription is a very new concept in Indian scenario and most of the doctors are either too busy or are computer-illiterates to be able to issue e-prescriptions” said Singhal of Vibcare.

The Medical Council of India (MCI) Code of Ethics Regulations, 2002 states “soliciting of patients directly or indirectly, by a physician, by a group of physicians or by institutions or organisations is unethical”. This regulation brings the aggregators under grey area too, as the code strictly prohibits naming doctors or their credentials on any platform. Though not much fuss has been created on this yet, however, the undefined boundaries add to the vulnerability of the sector.

Stiff competition from existing pharma giants

E-pharmacies do not have much encouragement from the established giants in the industry. “The startups in this sector are playing with the loopholes in the system and do not have a very long-term approach,” said a person on the board of a pharma major who spoke on condition of anonymity. “These can also become a point of entry for counterfeit medicine, which can derail the entire pharmaceutical industry,” he added.

Also, the already very strong associations of the holding agent, stockist, and pharmacy chain are reluctant to let these businesses enter and eat into their margins.

The numerous challenges have however not dampened investor sentiments. “Though challenges are there, people in the industry are working hard to get through them”, said Agarwal of Blume Ventures.

E-pharmacies are in line with Prime Minister Narendra Modi’s vision with Digital India and Startup India campaigns. All these companies, mostly started last year, are at the nascent stage and need support from government.

“Everyone is watching how the regulatory landscape is evolving across pharmaceuticals and healthcare services. But the core drivers of demand, the large market size, and significant gross margin in the sector will continue to keep this as an area of focus for Sequoia” added Bharadwaj, of Sequoia.

A promising future

Huge population, and growing awareness and spending have rendered healthcare sector a lucrative one. The sector does have a few regulatory concerns, but investors are confident that these issues will soon be sorted.

The second half of the year is expected to keep the first half’s tempo and see more investments flowing in. “Investment will continue to happen as the fundamentals of the sector are very strong” said Agarwal. On how the rest of 2016 would shape up for healthcare, Agarwal adds,

Should be an exciting year, no different from prior years. Sequoia continues to be keen on identifying entrepreneurs in the space and partnering with them on their vision to build a large business.