Already touching over 46 deals and $285.65 mn, is fintech the name of the game for 2016?

Will the world’s next Uber come from India’s rapidly evolving financial sector? Sharad Sharma, Co-founder and Governing Council Member, iSPIRT, sure believes so. “Financial technology (fintech) startups have the potential to enable service delivery to the 942 million people in the country who have Aadhar numbers,” says Sharad.

Venture capital investors seem to be in full agreement. “Financial services and the fintech market are as big as the e-commerce market. The sector is almost like a parallel economy,” believes Mridul Arora, Principal, SAIF Partners.

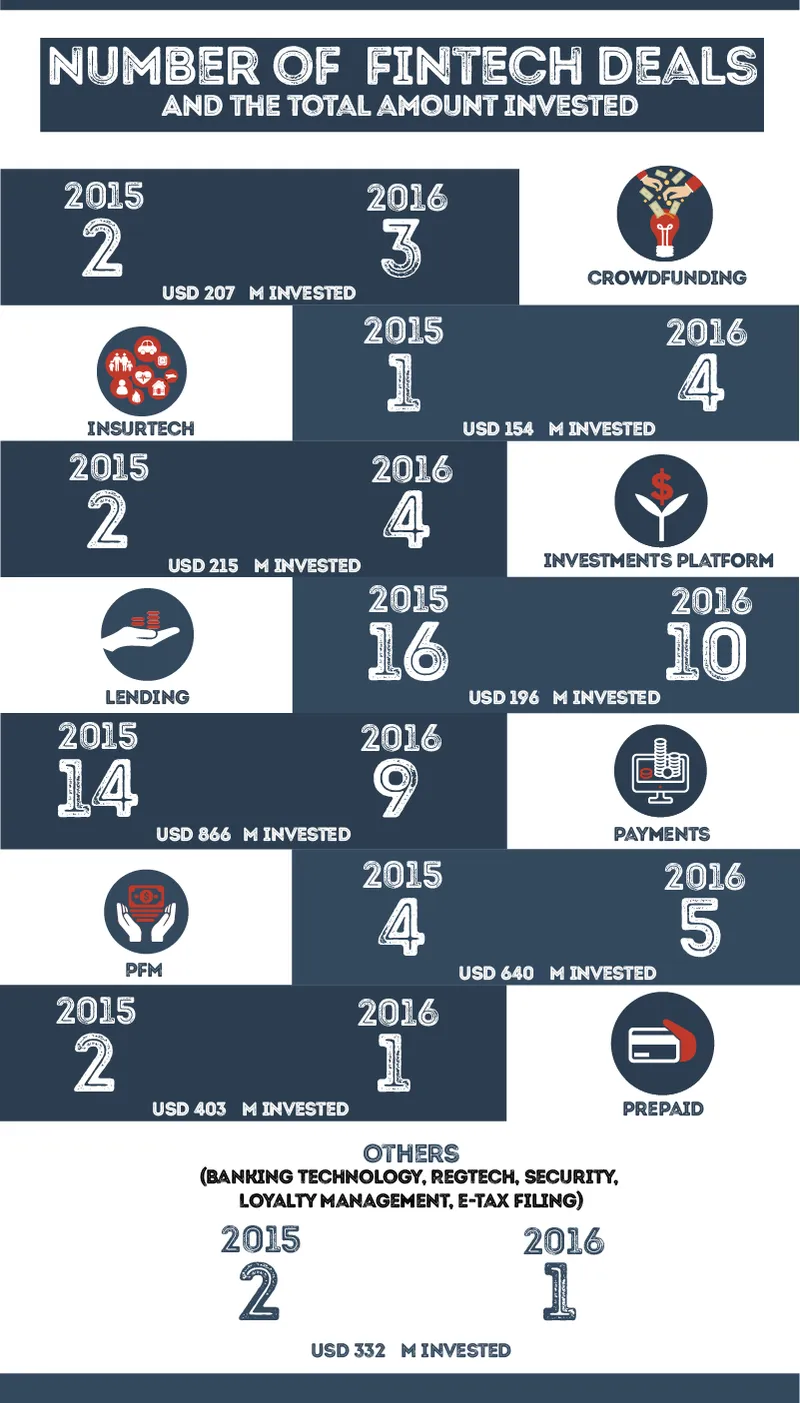

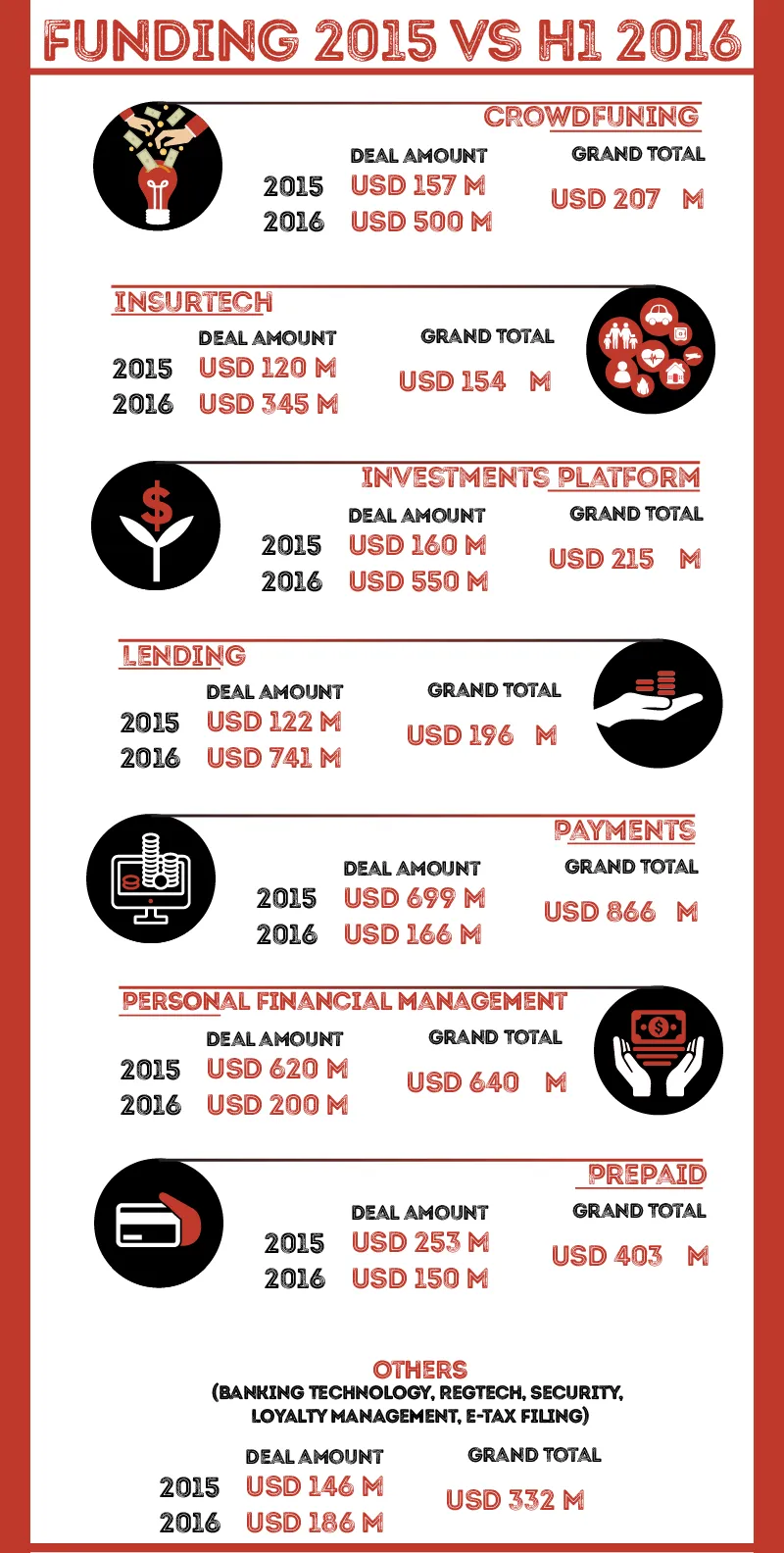

According to YourStory Research, over 47 deals amounting to $954 million were made in the fintech space last year. Within just the first half of this year, there have already been 46 deals amounting to $285 million made in the space.

According to YourStory, there are over 500 fintech startups in India which have collectively attracted over $1.4 billion in funding since 2012.

Rajat Agarwal, Vice President, Matrix Partners, believes that the increased investor focus on the space is because of enormous market opportunity; new business models and distribution methods becoming possible with increased smartphone penetration; slow innovation by incumbents; and strong government push to develop the ecosystem.

Emergence of consumer fintech play

“What has changed in the past three to four years is the fact that technology has come to the forefront in terms of interfacing with consumers. Technology was always used by the financial services industry, but it was not at the forefront,” says Mridul.

Globally, the financial crisis was one of the biggest factors that pushed towards the emergence of consumer-facing fintech. The banks had stopped lending money to several customers after the financial crisis, and this is when platforms like Lending Club emerged and flourished.

In India, the push towards consumer fintech came with the emergence of smartphone penetration and increased internet usage.

Lending

Lending platforms took the maximum chunk of funding made in 2015 and 2016. According to YourStory Research, close to 16 deals amounting to $122 million were made in the space last year. This year, 10 deals amounting to $741 million have already been made. Within lending there are two broad categories — SME lending and personal finance.

Mridul adds that the first era of fintech companies was product marketplaces, which was followed by the listing model. He adds that BankBazaar, PolicyBazaar, and Coverfox emerged during this era.

“They made it simpler to connect individuals and banks. Soon, platforms emerged to bring underwriting or provision of loans in a smarter way,” he say.

Formally, the focus on lending began with the establishment of the credit bureau. While this formalised the space, it also made it difficult for many people, especially those who didn’t have a good credit score, to get loans.

Simultaneously, around 2010–2013, e-commerce had started gaining momentum and picking up traction.

This meant that there were several small businesses that were growing and in need of capital. While traditional financial institutions found it difficult to get data on these businesses, the same was not true of the newer-age SME lending platforms.

They determined creditworthiness and other related factors on the basis of online sources and accordingly matched and disbursed loans. Capital Float, Rubique, and Lendingkart are a few such platforms.

“The advent of Aadhar; the availability of financial data through net banking; increasing digitisation; and finally, the growth of e-commerce, enabling online transactions and thereby creating digital footprints, were big trends,” says Sashank Rishyasringa, Co-founder, Capital Float.

The platforms either tie up with e-commerce platforms to ensure that the sellers on the platform get access to online loans, or they liaise with various banks and non-banking financial companies (NBFCs). The loans are applied for and processed online, all within a span of 10 minutes.

As of December last year, Kalaari Capital-backed Rubique had disbursed close to Rs 150 crore, and Capital Float, which raised $25 million Series B funding led by Creation Investments Capital Management, claimed to have disbursed close to Rs 300 crore as of May. Lendingkart recently raised $32 million in Series B funding.

Though the bureau brought in some order to the country’s personal lending landscape, a large chunk of people fell under the credit-unworthy category.

“The creditworthiness of an individual is determined by a CIBIL score. Although this is a great way to reduce defaults, it doesn’t make it easy for people who have never taken a loan to get a good score or ranking,” says Abhishek Garg, Co-founder of Finomena.

Platforms like Finomena focus on people of the millennial generation, who don’t easily get a loan. They don’t have a traditional source and mode of income, and thus lack the appropriate credit history.

It takes less than three minutes to fill an online loan application on the platform and only 24 hours for the applicant to know the status of their loan. Applicants also have an option to choose the repayment period and the instalment amount that meets their monthly budget.

Many believe it is now time for secured loans, for example mortgage loans, to adapt to technology’s growing presence. It is here that platforms like SwitchMe, which help consumers switch interest rates, come into play.

“The rejection rate in the mortgage industry is high; by building quality and accuracy, we have been able to create a seamless process of understanding interest rates and moving across them, ” says Aditya Mishra, Co-founder and CEO, SwitchMe.

With the growing need to lend to a market that is largely untouched by traditional banks and financial services, the P2P lending segment seems to be growing rapidly.

The RBI recently worked on a white paper to send out guidelines in managing the P2P lending market. Currently, Faircent is one of the largest players in the space, and has raised an undisclosed amount of funding by Mohandas Pai.

Vinay Mathews, COO and Co-founder, Faircent, believes that the P2P model eliminates banking and financial services, directly connecting customers to customers. It is about unlocking the supply side, because currently there isn’t much happening in the ecosystem that works towards it.

“Faircent says that apart from the few guys on the supply side, there are others who can lend on the platform. People like you and me who have spare cash are now being empowered to make extra bucks by putting the spare money in a platform like ours. I am making each consumer behave like a bank. It is many people giving to many people,” says Vinay.

The disruption happens when retail lenders can come in, as they will reduce the cost for the consumer, because someone who is finding it difficult to get a loan at a good interest rate can find a better option on a P2P platform. Faircent has already disbursed close to Rs 6.5 crore and is planning to close this year with Rs 50-crore loan disbursements.

Credit rating

Lending depends on the credit rating model and determining the creditworthiness of individuals and enterprises.

This led to the birth of platforms like CreditMantri and Credit Sudhaar, which are transforming credit rating and creditworthiness. Although these platforms are yet to see the same kind of investment and traction as the rest of the lending and payments space, CreditMantri is backed by Elevar Equity.

Although there are platforms that give people loans, and marketplaces that connect individuals, banks, and NBFCs, creditworthiness was the basis of loan disbursement.

“In the Indian financial world, unless you’ve applied for a loan and been rejected, you really don’t know what your score is, whereas in other parts of the world it is almost like checking the weather,” says Ranjit Punja, Founder, CreditMantri.

These platforms work on three types of individuals — negative credit history, no credit history, and credit-healthy. They begin with profiling the individuals and creating a ‘Credit Quotient’, where the team learns more about the individual through social media profiles, bank statements, and other data.

By April, CreditMantri had over 45,000 customers seeking to check their credit score, of which 50 percent allowed themselves to be fully profiled. Ranjit adds that there are over five to six credit-improvement services people pay for on the platform.

Over 3,000 people also look for a loan product on CreditMantri. By February, the team had over two lakh customers. Banks have also realised that new-to-credit is a large segment that models don’t yet exist for.

Now, Ranjit says, the focus is on alternative data sources like social media platforms, and telecom and e-commerce behaviour, which are available to make more informed decisions.

Payments

Payments have become synonymous with fintech. It was one of the first segments where startups began to grow and disrupt the way people transact, and it also was among the early regulated players. The second-highest funded space, this year there have already been nine deals. The total amount of funding made in the space between last year and this year amounts to $866 million.

One of the biggest players in the payments space is Paytm, which had gobbled up one of the highest funding amounts from Alibaba last year. Several other payment banks and mobile wallets include FreeCharge, MobiKwik, and Oxigen.

Speaking of how Paytm has evolved over the years, Mridul says:

“In the last three to four years, players like Paytm saw recharge as a use-case, where people were recharging their phones, and mobile wallets emerged out of this idea. Now this has transformed into a beautiful game. Once you put in money into the wallet, any or every use of the money in that wallet can be done on the platform.”

Paytm now has even tied up with financial institutions to provide collateral-free working capital loans for small merchants and kirana store owners.

According to Kiran Vasireddy, Senior Vice-President, Paytm, the chances of getting a loan increases as merchants’ usage on its platform increases, giving the firm more data for underwriting.

The RBI directive for payment banks says telecom operators, supermarket chains, electronic wallets, and prepaid instrument players can open these payment banks for deposits, basic savings, and to provide remittance service for the millions who are presently excluded from the digital financial system.

These payment banks can issue ATM-cum-debit cards to access funds, restricted to holding a maximum balance of Rs 1 lakh per individual customer. The payment banks platform can also be leveraged to distribute simple financial products like mutual funds and insurances, while such entities are prohibited from providing loans.

There has also been the emergence of payment gateways like Citrus Pay and Tiger-backed Razorpay, with the latter closing a strategic investment from MasterCard. Harshil Mathur, Co-founder, Razorpay, believes that in the last year the regulator has transformed the financial landscape and made payments easier.

“With the United Payments Interface (UPI) and IndiaStack coming in, the flow of money will be easier and product development simpler. There is inclusion at the bottom level, and at the top levels, the regulator is opening the ecosystem, making it easier for startups to bring in technology,” says Harshil.

The team is aggressively working towards UPI, which will allow them to launch their newer product lines, which are at present works in progress. It will also make subscription-based and automated payment easier.

“We are working on newer modes of payments, automated debits, and subscriptions. We are looking to expand into South East Asia and the Middle Eastern countries in the coming few quarters,” says Harshil.

Insurance

With the various players coming on board, consumers today are aware of the options, and there is no longer room for cookie-cutter models. This year, over five deals have been made in the space, which amounted to $2150 million.

Like lending, insurance too began with an aggregator and marketplace model like PolicyBazaar, after which came players like Coverfox, Turtlemint, and Easypolicy. Coverfox managed to get an IRDA ‘Direct Broker’ licence in early 2014. It has raised a Series A round of $2 million and followed it with a $12 million Series B round in April, 2015 from Accel Partners, and SAIF Partners.

Insurance is one of the largest and fastest growing markets. Dhirendra Mayhavanshi, Co-founder, Turtlemint, believes that it is a $70 billion market and will touch $120 billion by 2020. At present, the penetration is at 3.4 percent, while globally it is around 5 percent.

“Every individual has a different risk profile and each profile needs a customised risk-mitigation process; a mere aggregator doesn’t work. The profile and risk mitigation need to be matched to get the right product,” says Dhirendra.

Brokerage

While a relatively small segment in the overall financial landscape, brokerage in India seems to be slowly picking up and being disrupted. Platforms like Zerodha, BullBear Device, MyValueTrade, and Traderji are working towards making online trading simpler.

What the brokerage platforms do is remove the middle-men, and make stock- and commodity-buying simpler and more consumer-friendly. The investment in this space is relatively low compared to payment banks and lending platforms.

Zerodha, one of the big players in the space, is bootstrapped, and has memberships on all the stock, commodity, and currency exchanges in India. The team is believed to be one of the first in India to disrupt the existing pricing structure by introducing a flat fee-per-trade model.

“When we started, there possibly weren’t even any blips; in the last one-and-a-half years, there has been a lot of innovation. People’s interest has been piqued by the space. We have started getting résumés from developers and programmers; there has been a cultural shift towards fintech,” says Kailash Nadh, Co-founder, Zerodha.

Kailash believes that until a few years ago, brokerages didn’t have much competition and users didn’t have a choice. “While everything else was changing, trading software in India still had a long way to go, so we decided to transform this and focus on user experience,” he says.

Beyond brokerage, Zerodha is also looking at personal finance, retail and taxation, and different aspects of the fintech space. Towards the end of last year, Zerodha claimed to have over 80,000 clients across the country, who were contributing close to Rs 8,500 crore as average daily turnover in various exchanges.

With the burgeoning growth in the space, while fintech seems to be next big thing, Ramakrishna NK, Co-founder and CEO of RangDe, believes that while there have been different models working on the financial inclusions, until a year ago the space hadn’t seen much traction.

What can we expect next?

“Having a bank account with zero transactions is of no consequence. But the new regulations have got in a change. With the regulations for the P2P platforms, we are hopeful it will give much relief to the truly underserved,” says Ramakrishna.

RangDe is also keeping a close watch on the payment banks and how they can partner with them and bring in inclusion.

“Up until now we haven’t had access to banks or banking, which is counter-intuitive, because if a person gets a loan and they can’t keep the money in the bank, then it doesn’t help. We are hoping that with the regulations, this will change,” says Ramakrishna.

Rajat believes that there still is lot that can be disrupted in the financial services landscape. For example, he adds that in insurance and wealth management the opportunity is large and products in the space are being mis-sold. There is still room for innovation at the product and distribution level.

He adds that this year and the next will be the years of maturity for some of the fintech startups.

“If you look at the digital NBFCs focused on SMEs, Capital Float and Lendingkart have out-executed their competition. Similarly in other spaces we should start seeing a gap develop between category leaders and others. Also fundamentally undifferentiated players in the payments and wealth management space may face problems scaling up,” says Rajat.

If implemented well, UPI will also be an interesting innovation in the fintech space, as it will truly transform and disrupt the way payments will be made.

“There are close to 2,500 banks in the country, and with over 1,000 customers in each of them, many don’t have the bandwidth to build technology. There is a large opportunity there as well. Banks, at best, should be storehouses of money, and everything else can be automated and simplified,” says Rajat.