VC funding might be down, but angel investments saw a rise of 62 pc in FY 16

On Tuesday, venture debt firm InnoVen Capital announced the release of the ‘India Angel Report 2016’, which analyses and puts across the investment trends of the major angel groups of the country.

Although not comprehensive, Ajay Hattangdi, Group COO and CEO of InnoVen Capital, believes the report is an effort to highlight the key trends of the Indian angel investment industry. He says,

The main objective is to keep the VCs informed, to avoid mispricing in the future. It is also an ongoing inquiry into the dynamics of the angel investment industry. This report acts as a bellwether for VCs as deals funded by angels will later be funded by venture capitalists. We hear more about the trends in VC funding and less about the angel investment landscape in the country. This report bridges that gap.

The findings

Created in partnership with the Association of Indian Angel Groups (AIAG), the report makes sense of the data provided by member angel groups including the Mumbai Angels, Indian Angel Network, Chennai Angels, Hyderabad Angels and Calcutta Angels.

Citing interesting trends, some of the key highlights from the report show that:

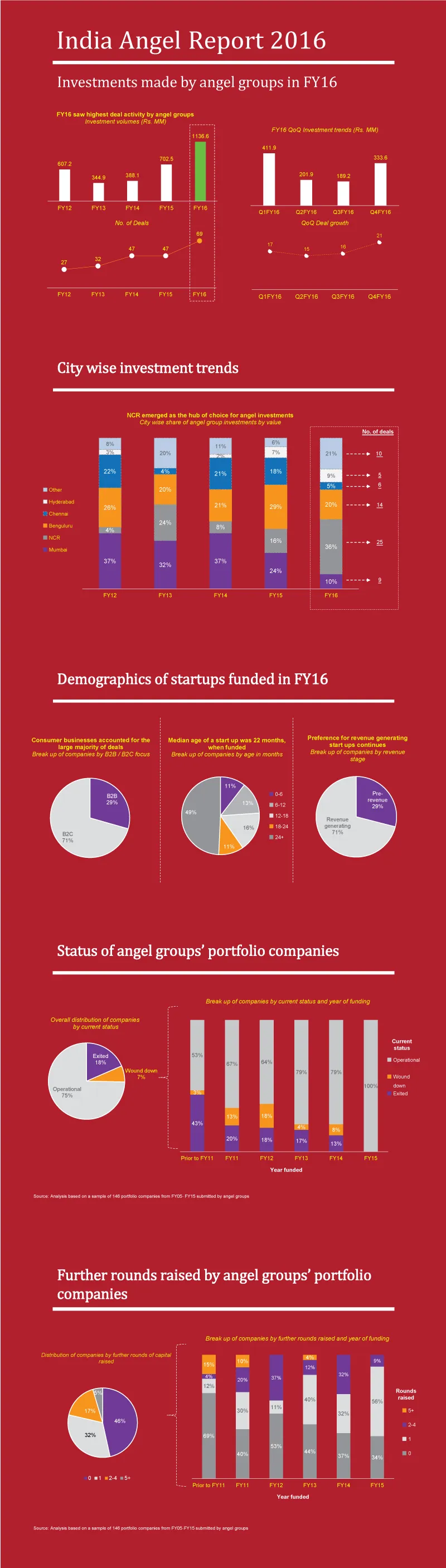

- There has been a 62 percent rise in angel investments in financial year 2015-16 (FY 16) from financial year 2014-15 (FY 15), garnering a total of almost Rs 114 crore in commitments by angel groups. FY 15 saw a little more than Rs 70 crore in commitments.

- There were close to 69 deals inked across last year

- Delhi and NCR was the geography which saw the maximum activity.

The number of deals in the NCR were claimed to be 25; followed by Bengaluru seeing 14 deals; Mumbai saw nine deals while other cities closed 10 deals. The value of the deals was also higher in Delhi-NCR, grabbing a strong 36 percent share, followed by Bengaluru with a 20 percent share of the total investments made.

- The pre-money valuations (the valuation of a company prior to investment) rose by 10 percent last year, with the median (or middle) valuation being almost Rs 10 crore.

- The consumer internet, Information Technology Enabled Services (ITES), food, e-commerce and logistics sector saw high interest from the angel investors.

There was Rs 21 crore invested in the consumer internet and mobile sector, which witnessed a total of 14 deals; next was Information Technology Enabled Services (ITES), seeing Rs 19.4 crore being invested in the sector through a total of 10 deals, with the food sector seeing close to Rs 15 crore in angel investments.

- With regard to demographics, 28 percent of the founders who received angel funding were serial entrepreneurs, and 24 percent of startups funded by angel groups had a female co-founder.

- Another key metric which stuck out was that 71 percent of companies funded by angel investors last year were revenue generating, while 49 percent of the total data set had existed for more than 24 months before raising funds.

According to Ajay, the report clearly shows that angel investment is a workable hypothesis in India. He states that the rise in investments clearly indicates a healthy trend of added confidence amongst the angel community. Further, looking at the successful exits of some companies, High Network Individuals (HNI’s) are now acknowledging angel investment as a viable option to have, apart from the traditional channels of investment like bonds and funds.

43 percent of the companies funded by angels in FY 11 (2010-11) have already seen successful exits.

According to Ajay, these available data points will help the quantum of investors and risk capital in the ecosystem grow for early-stage companies in the future.

While outlining some key trends for the future, Ajay said,

There also needs to be some caution taken by an angel investor while investing. A lot of individuals are investing and not fully pricing in the risk. Therefore, there is a need for angel groups to be diligent in educating the investors about these risks.

But, with the same old sectors being funded, angel investing in India is a classic example of tried and tested models. But then again, one needs to see if the right infrastructure and environment is in existence before investing in a business. Ajay adds

It is all about the right time, the right product and the right place when it comes to investments. Angel investments is a percentage game, one needs to make enough of them to make them click.

Following are the other findings, from the report:

Graphics by: Niranjan