Restaurants engagement platform Mobikon makes its second acquisition in a year, nabs MassBlurb

F&B marketing platform Mobikon on Thursday announced the acquisition of MassBlurb, an automated online platform for restaurants.

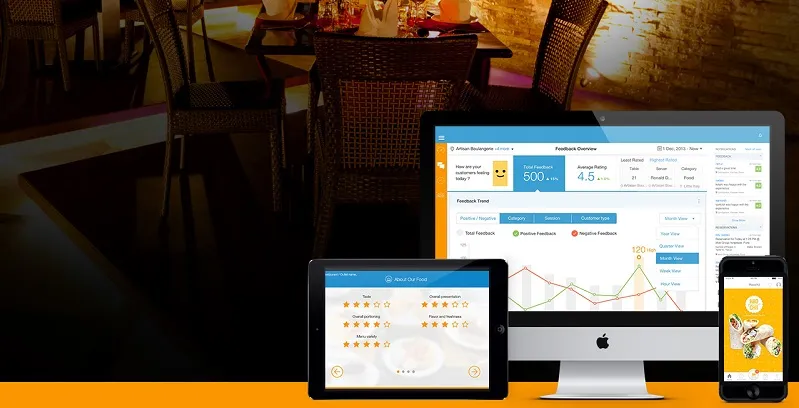

Founded by Samir Khadepaun and Salil Khamkar, Mobikon provides a single CRM dashboard to restaurants for engaging with customers intelligently across tasks of ordering, reservations, feedback, loyalty, and marketing.

The acquisition with MassBlurb will help Mobikon take its customer engagement solution to social networking platforms, allowing restaurants to generate social leads, convert likes and followers to business. Mobikon will also be able to offer website automation, cloud telephony integrated with CRM and automation in social media management.

The founders of MassBlurb, Sanket Shah and Pankit Chheda, will take up key roles at Mobikon. In their new role, Sanket will be managing key accounts and partnerships across the company, while Pankit will be working closely with Mobikon’s CTO for driving new product initiatives.

Commenting on the acquisition, Samir, Founder and CEO of Mobikon, said,

This is a strategic acquisition in line with our vision to be the single marketing and customer experience platform for restaurants. MassBlurb has been successful on social platforms for F&B, and Mobikon, on the other hand, has been very successful in India and South East Asia on its in-store engagement platform. We now have a significant market share with over 650 brands across India and S.E. Asia. We are planning to reach over 800 leading restaurant brands by the end of this year.

Mobikon claims to have been witnessing a growth of 12 percent month-on-month, this year. With the acquisition, it claims that at present it has more than 2,800 restaurant outlets using its brand (from over 650 brands) across the world.

Speaking on the acquisition was Sanket, Co-Founder of MassBlurb, who said,

Our vision for the company was very similar to Samir's. Mobikon has a deep technology suite and with operations in five countries and complimentary products, the synergies were extremely strong. Together we can become a de-facto tool for restaurants over a next couple of years.

Present in six geographies including Singapore, Philippines, Dubai, Macau, Kuala Lumpur, and India, Mobikon claims to be adding over 170,000 new diners month-on-month, while engaging with more than 1,000,000 diners every month. Over the last one year, the company has also grown from 59 to 116 employees; with 18 employees internationally and 98 employees in India.

In July 2015, Mobikon had raised $2.3 million in funding led by Singapore-based Jungle Ventures. The company planned to use the funds to fuel the rapid growth of the company across markets like India, Manila, Singapore, and Dubai.

Previously in 2012-13, Mobikon had raised 2.7 million in funding from Jungle Ventures and other investors like Spring Singapore and Lion Rock. It had also raised an undisclosed amount in October last year from Life.SREDA and Qualgro.

On the other hand, MassBlurb had raised an undisclosed amount in angel funding from Vikram Chachra and other independent investors from Mumbai Angels.

This is the second acquisition for Mobikon within a year. Earlier, it had acquired analytics startup Trii.be for an undisclosed amount in August 2015.

Just this week, it was reported that CRM edged past ERP as the top application software investment priority, according to Gartner analysts.

It is predicted that by the end of 2017, CRM spends will be $36.5 billion, when compared to $34.5-billion spends on ERP. This year, CRM is closing the gap on ERP; spends on ERP were $31.8 billion, while it was $31.7 billion for CRM.

This validates the business potential of enhancing customer experience with both mature and emerging markets emphasising investments in CRM.