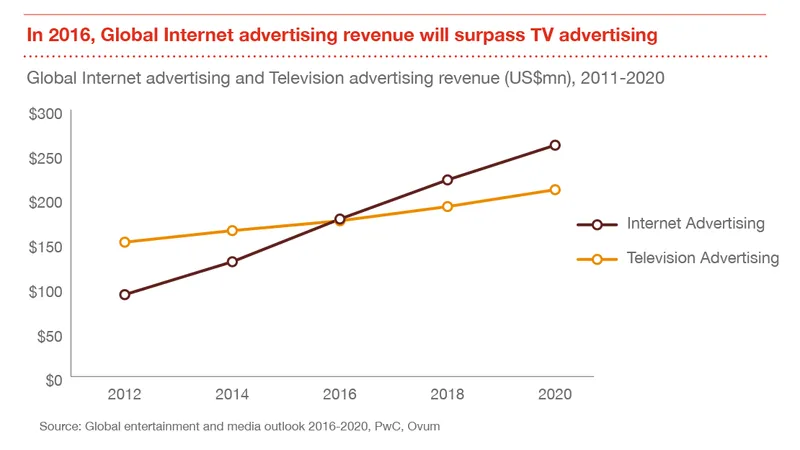

Internet to take over TV in advertising in five years

Online portals, rejoice. Your advertising revenue is about to go through the roof. International services consultancy PwC predicts in its latest report that internet advertising revenue will reach $260.4 billion by 2020, beating TV advertising, at a CAGR of 11.1 percent. Live sporting events and entertainment shows might still be able to keep TV advertising survive, it says.

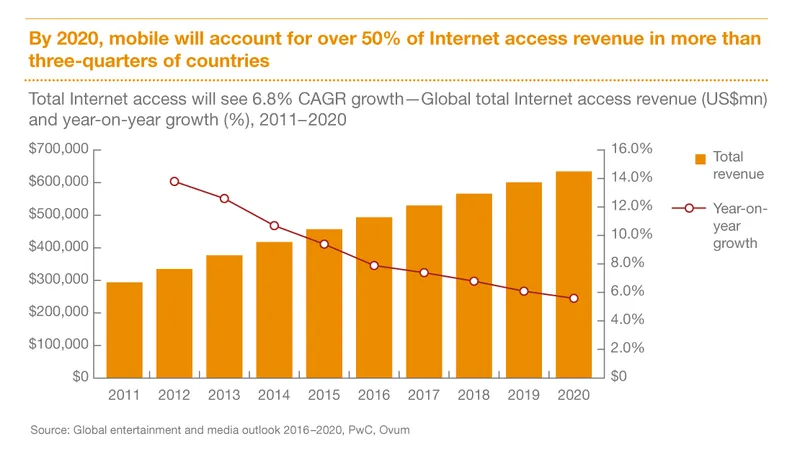

The PwC report, titled ‘Global Entertainment and Media Outlook 2016-2020’, also states that global internet access itself is rising, taking the revenue to $634.8 billion by 2020 – at a CAGR of 6.8 percent. The survey, which was conducted across 54 countries including India, found that by 2020, 50 percent of internet access revenue will come through mobile in more than three quarters of countries.

- More than 1.3 billion people will start paying for mobile internet access for the first time, taking the total to 3.8 billion, by 2020. About 54 percent of these connections will be high speed (between 4 and 30 mbps). High-speed mobile internet makes watching online videos, streaming high-quality music, and making video calls on the move more viable. But high quality videos already rule internet advertisements, and operators will seek to retain customers by upgrading them for free or at low cost. Players like Reliance Jio are already heading in this direction –with on-demand video streaming at “affordable” prices in India.

- Mobile advertising will grow at a CAGR of 19.6 percent to $84.8 billion in 2020; but it will still be only 32.6 percent of total share. In India, mobile is the main source of access to internet, with about 300 million depending on it. But more smartphone users are growing on ad-block apps, which might stop mobile advertisers from exploiting their full potential.

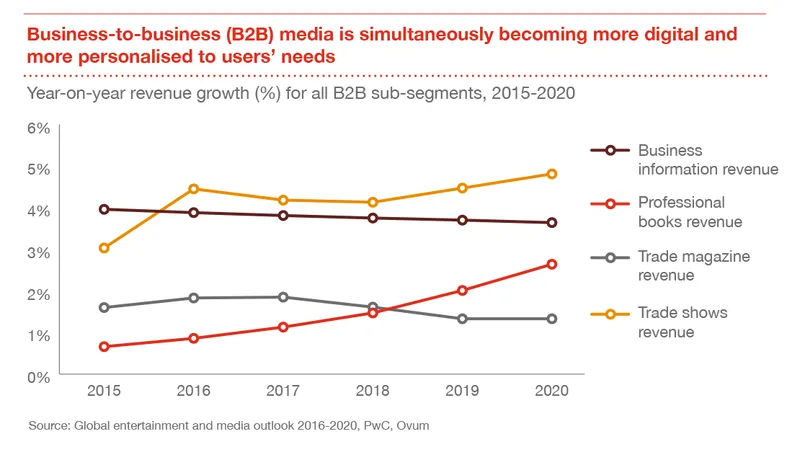

- Overall B2B revenue will rise by three percent, with a better portion shifting to digital media from print. Data analytics and cloud-based information services are supporting this growth – as B2B transactions involve exchange of information and expertise. Chennai-based Freshdesk expanding globally to accommodate 80,000 customers in five years is a direct result of growing trend of digital marketing in business-to-business transactions.

- Streaming will dominate digital format in content, the report says. Digital subscription models are taking over, for the most scalable revenue models, Netflix being an example. The global leader in TV streaming services, which entered India last year, saw their revenue leap by 32.3 percent to $10.9 billion. The PwC report adds that streaming is starting to cannibalise downloads in music. It says: “This model is unlikely to succeed without compelling content – witness how an inability to secure rights to key content has hampered subscription services for books. Free alternatives are a further inhibitor of subscription growth, especially for newspapers and magazines.”

E-commerce and online travel booking companies depend largely on emails for marketing. In fact, the likes of RedBus have used the strategy of engaging their customer with posts on travel rather than bore them with just ads. Online discovery platforms also generate a major chunk of their revenue from advertising.

India’s case is unique. While experts predicted the death of print with the digital media take over across the world, India witnessed print advertising exploding in the country. With the rise of online news media, digital marketing gained prominence, and now accounts for customer acquisition and retention strategies followed by many an online business.