The game is on - e-sellers versus Flipkart-Amazon-Snapdeal

E-commerce is like a family – to make it work, everyone in the ecosystem has to work on their relationships, make compromises, have proper communication, and most importantly, know that the effort is worth it. The buzzword in Indian economy functions only with the cooperation of multiple segments – offline retailers, online retailers, logistics partners, delivery boys, and most importantly customers.

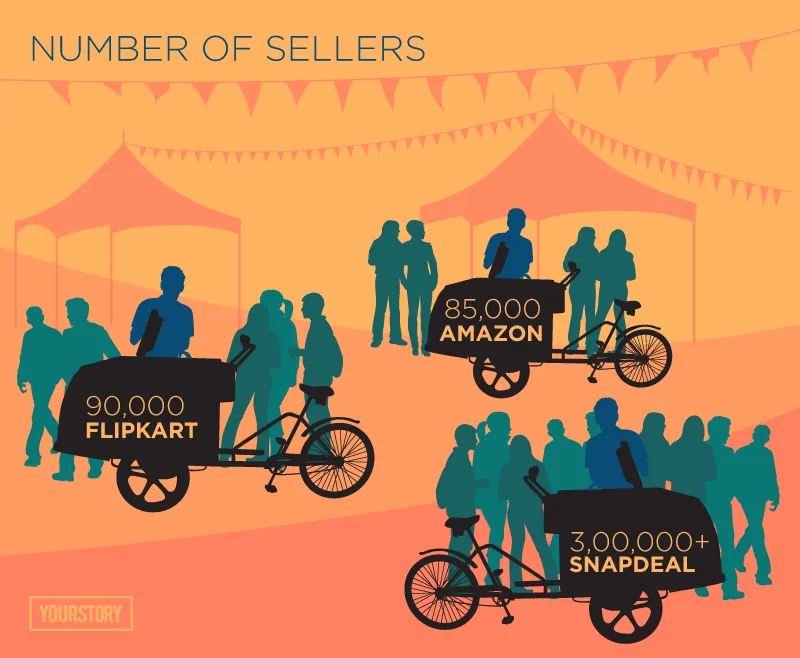

In the last few years, since the country witnessed the birth and growth of e-commerce, all the top players – homegrown rivals Flipkart and Snapdeal, their American competitor Amazon, younger unicorn ShopClues – have been racing to get the maximum number of sellers on their respective platforms: for the simple reason that it provides more selection and possibly more discounts to the customers.

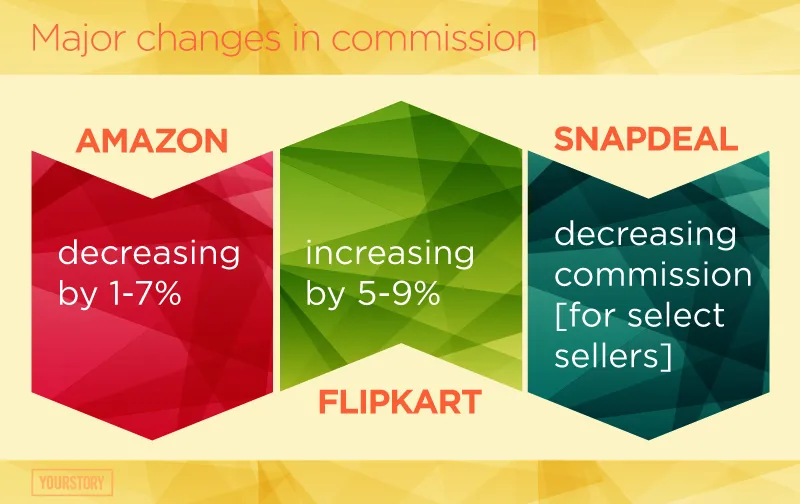

In the last six to seven months, however, e-commerce majors and their sellers have had quite a frictional relationship. Reportedly struggling with funding crunch, Flipkart increased their commission, whereas Amazon – perfectly timing its counter move – decreased theirs. Flipkart’s recent hike in commission has irked their sellers so much that many threatened to quit the platform. But Flipkart so far has not commented – despite an online sellers’ association launching Twitter campaign #SellersQuitFlipkart earlier this month.

Snapdeal, in a self-contradictory move, cut down the commission for sellers with specific ratings, and then put a ceiling of 70 percent for discounts. Vishal Chadha, Senior Vice President of Market Development at Snapdeal, says in an email: “The marketing fee is levied with reference to the services provided by the company to the sellers, and is reviewed periodically as per changing market scenarios, and seller requirements.”

Everything said and done, it is undeniable that merchants have benefitted from e-commerce with a wider customer base, which they otherwise wouldn’t have had access to. Yet, online marketplaces are allegedly making unilateral decisions, worrying sellers. So what is this current tension all about? All the major changes in commissions have happened in the last few days, and Flipkart’s controversial rulings are about to come in practice on June 20. YourStory finds out both sides of the story.

Sellers’ travails

Commission changes sans negotiations tops the list of sellers’ headaches. The marketplaces just send an email notifying new policies with no justification, E-sellers told YourStory. In the latest development, Flipkart is actually restructuring commission fee, collection fee, shipping fee, fixed fee, and cancellation fee. Since this is bound to affect the sellers’ revenue, Flipkart in fact has asked them to watch their pricings very closely. Increasing the referral rates forces the sellers to increase the prices too. In short, the marketplaces are indirectly forcing the sellers to change the prices ‑ although they are not supposed to influence pricing, as per FDI norms.

Additionally, there is a general sentiment among sellers that communications from marketplaces are not transparent. “Flipkart’s recent communications regarding their policy changes are very convoluted. It takes two hours to figure out what they are saying, due to weak language and contradictory statements,” says Sayak Sahu, Co-founder of online gadgets brand Smiledrive. Snapdeal is also said to keep changing their fees and notifying the sellers only by an FYI email.

Additionally, reconciliation is also tough in marketplaces. Suraj Vazirani, an Ahmedabad-based online seller active on multiple e-commerce marketplaces, says: “If I want to check if I have been paid correctly, I can’t access my own data. Past changes are not available on these websites. It is only fair that changes are recorded.”

Gurpreet Singh, CEO and Co-founder of cloud-based inventory management startup Browntape, warns that it is not the GMV and numbers that matter, but how much money you are getting in your pocket. There have been instances of over-charging due to wrong weight, sellers say. Flipkart has initiated action in this regard too. Shipping fees are now calculated based on the dimensions and weight of the courier package, entered by the seller. Also, sellers are now allowed to charge shipping fees to the customer for all categories.

Marketplaces in charge

In November 2015, Flipkart had said that that they will not charge the sellers any commission fee on sales for select verticals. But on YourStory’s queries regarding the latest developments, Flipkart spokesman says: “The new policies will encourage all sellers of quality products with focus on superior customer experience. We have been closely working with all sellers across categories over the last few weeks to ensure a smooth transition. We have even conducted several webinar sessions to address all seller queries. Overall, this policy will bring more transparency and predictability for sellers, and encourage growth of quality sellers.” Their rival Snapdeal, however, has cut down its commission recently, enabling the sellers to pass on the benefit to customers.

Returns, however, are the biggest spoilsport for both the marketplaces and sellers, especially in terms of logistics costs. Flipkart had a return policy of up to 30 days, which they are now changing to 10 days. However, it is conditional. About changes from June 20, Flipkart has said in an email to sellers: “In case of customer returns, you will be charged shipping fee, reverse shipping fee, collection fee and pick-pack fee. Commission and fixed fees will not be charged on any customer return.” The problem is that, sellers say, quite often the returned goods are either damaged or replaced by the customer – making it unsellable again. Add to this, discounts and offers on promotional sales, and sellers getting frustrated is no surprise.

Marketplaces are not to blame entirely though. Brands are pushing them to adhere to a minimum operable pricing [MOP], under which those products should not be sold. This tactic - which aims to keep up the aspirational value for certain products, inevitably asks for discounts on other products to balance the act. In fact, Paytm’s cashback model also drew ire of the sellers as this causes indirect discounting.

The Amazon story

Curiously, while the biggest player Flipkart is constantly at loggerheads with their sellers, a recent survey showed Amazon to be the sellers’ favourite platform. From 100 sellers at their launch in June 2013, they now have 85,000 sellers at a growth rate of 250 percent. However, many sellers have complained that Amazon’s largest seller Cloudtail – a joint venture between Amazon and Infosys Founder NR Narayana Murthy’s personal investment vehicle Catamaran Ventures – sells for cheaper prices, thus affecting other sellers’ business. “There is a preferential treatment there; the policy with Cloudtail itself is very different from that with a normal seller,” says Suraj, who has been running his own ecommerce portal Maniacstore for five years. Suraj, who also co-founded reconciliation software DSYH, says that if a customer returns a product, FBA [Fulfilled by Amazon] will replace it with a new item for free - without the seller’s consent. “After 45 days, if the item does not return, Amazon will reimburse you according to the fair market price. This amount is often less than half of the real price,” he adds.

Amazon recently cut down their commission in high GMV categories such as computers, mobile phones, tablets, other electronics, etc., expecting the sellers to pass on the benefits to customers. However, there is no change in fashion, lifestyle, and home categories, in which they had hiked the referral fee recently. On June 16, Amazon told its sellers by email: “In the event, the exchanged product is of a higher value than the original product, you hereby acknowledge and agree to bear the additional cost of such price difference. In the event that the exchange product is of a lower value than the original product, it will not be clawed back from you.”

In an email, Amazon India spokesperson told YourStory: “We have revised our fees in some categories to increase or decrease commission at a category level. We charge similar rates across other Amazon marketplaces.”

At their launch in India, Amazon had started with promotional referral rates. “We continued with these rates for over two years in most categories and have moved towards our standard rates over the last one year or so. We continually innovate to offer services such as Fulfilment by Amazon, Easy Ship, Seller Flex, etc., to sellers on our platform,” the spokesperson added.

Honeymoon is over?

With a fresh $3 billion fund to back it up, Amazon is focusing on market share, whereas investment-hungry Flipkart and Snapdeal are hoping to hike their revenues. Snapdeal recently started product ads, which are essentially native ads in listings and search pages. They are also integrating machine learning-based decision technology in Capital Assist platform to enable faster disbursal of loans to sellers. Flipkart too has a native ads platform and ‘Brand Stores’, which are aimed at generating higher revenue.

Despite the current tension, sellers have been benefited too. Suraj says: “Two years ago, no banks would give unsecure collateral loans to sellers. But now due to penetration of marketplace, NBFCs are keen.” He adds that Amazon FBA, Snapdeal SD+, Flipkat FA have eased the business for sellers, who just have to procure the goods and send it to their warehouse. For offline sellers, a chain is difficult to maintain, while in e-commerce there is greater exposure.

It looks like the online marketplaces’ honeymoon with their customers is slowly ending, with the sellers having to hike prices. But Gurpreet is hopeful that things will get more efficient. “Marketplaces have a service level agreement [SLA] with the sellers: like they have to ship the product within 24‑48 hours. There must be some changes to get the sellers be more operationally involved – this has been happening in the last few months,” he says.

There is surely need for a framework that ensures level-playing field on the minimum and maximum selling price on marketplaces. With regard to payment cycles too, there needs to be consensus between the stakeholders. Sayak says: “You can pamper your customers but not at the cost of your sellers; once they start seeing losses the sellers will leave the platforms. Only the big brands which can take a hit ill hang around – that is not good for the consumers either.”

We already have TRAI, RBI, DIPP. Various acronyms to deal with various complicated economic structures in the country. There are even efforts to make a Cow Protection Ministry now. How about the Centre pays attention the multibillion dollar industry which is only going to take over a wider audience?