How B2B trucking company BlackBuck is planning to drive $2 Bn worth of bookings through its platform

Each month, when you buy groceries, either from an app or the store, little do you realise that there are several things that happen for it to reach your home. There is a big backend economy in the B2B space, especially in logistics.

From sourcing of the supply, to taking it to the factory, to the mother hub, to distributors and finally the retail store. There are multi-locational and several intercity points where logistics becomes extremely important. It was looking at this opportunity that BlackBuck was established in Bengaluru last year. It is a B2B inter-city full truck load marketplace.

The transporters essentially need demand and B2B clients need trucks. BlackBuck provides these trucks to these businesses. Clients request for trucks based on the size, timing, and other shipment specifics.

Operational for over a year now, BlackBuck has already raised $25 million in Series B funding led by marquee investors like Accel Partners, Flipkart, Tiger Global, Apolette, and Yuri Milner’s Founder’s Fund – DST Global.

Starting with 10,000 trucks, in December 2015 to operating 50,000 trucks in May 2016, BlackBuck claims to serve customers who order close to 20,000 trucks a day to small businesses that order possibly three trucks a month. The team claims to have a month-on-month revenue growth of between 40 and 80 percent.

“If you look at the market, about five percent is taken by intra-city and hyperlocal logistics, which is more consumer facing, and inter-city, which is more B2B, takes up 95 percent of the space,” says Rajesh Yabaji, Co-founder and CEO BlackBuck.

Starting of the idea

An army brat, Rajesh, finished his graduation at IIT Kharagpur and his fascination for operations drove him into taking up internships in the field. Rajesh began his career at ITC.

For two years, Rajesh worked directly under one of the chief executives of ITC, who helped him shape his career and further hone his skills. He believes that what you think or what you can become is usually shaped and defined by your first boss. “I am able to scale and implement most of what I learnt from him to BlackBuck,” says Rajesh.

While working at ITC, Rajesh joined a supply chain project. It was the problem statement of implementing processes, systems and technology that could integrate the different aspects of a 100-year-old supply chain that got him excited.

It was here Rajesh met Rama Subramaniam, an industry veteran with over 17 years of experience in logistics, who later joined in as the second Co-founder of BlackBuck.

From ITC to building BlackBuck

Building a team of 40 in ITC and working along the integration project, Rajesh found that transportation was the hardest to crack. Citing an example, on how fragmented the freight transport aspect of the supply chain is, Rajesh says that each unit has its own transportation, be it factories or production plants, with no synergy, which needed to be integrated.

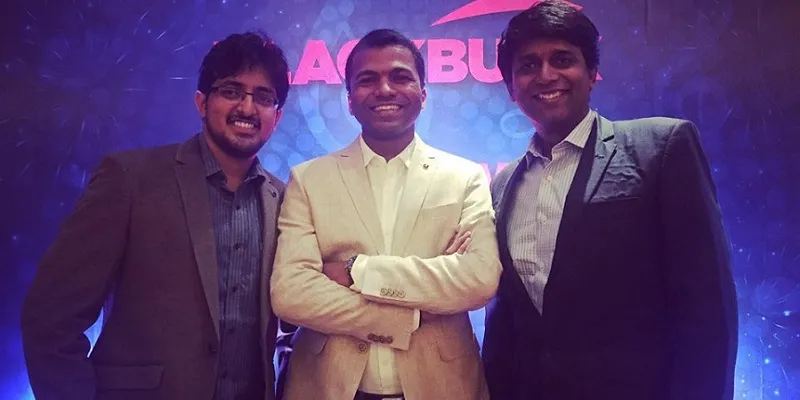

It was during the process of setting the team that Rajesh met Chanakya Hridaya, an intern from IIT Kharagpur, who later became BlackBuck’s third Co-founder. The trio worked together for three years on the project. Here, they found that while the overall cost of the supply chain had dropped to 25 percent, they were only able to get a 1.3 percent reduction in freight.

It was then that the trio decided to step out and build a startup that solved the B2B transportation market and organise the space.

Working on BlackBuck

Starting BlackBuck in April 2015, the company began operations in July. The idea was to help transporters increase the utilisation of the trucks and have better access to demand. On the businesses side, the platform helps them use freight as effectively as possible.

Apart from the regular GPS-enabled freight management, BlackBuck claims that they enable their clients be in touch with all the trucks. On the other hand, the transporter has the opportunity to increase the number of trips based on real-time information.

There are other features including options in different Indian languages, track and trace, truck mapping, verifications, professional account management practices, and checking the health and condition of the truck. Over a period of time, the platform has evolved and changed, making the product simple for the transporter.

To ensure that the business runs like a well-oiled machine, the trio insured that the first 50 people who joined BlackBuck were through close connections.

“We are simple, and we wanted people who had the passion to build something. Culture is what the leadership demonstrates, if there is indiscipline in the top management, it percolates to the other levels as well,” says Rajesh.

With the product in place, when the trio first approached businesses, the latter were sceptical and gave them only 0.1 of their intercity logistics demand. Rajesh, however, adds that since they had got their funding in April itself, it gave the team some buffer.

Transitions made over time

It nevertheless took the team from April to July 2015 to actually set the ball rolling. It was during this time the team decided to venture into the intra-city logistics space. Explaining their entry into the segment, Rajesh explains that they received their first break with Pepsico.

The giant was working on a unique distribution model in Hyderabad, where they wanted a logistics service that could help them carry out their strategy. As BlackBuck was looking for a client, they took the deal as a way to get their foot in the market.

“We used Pepsi as a reference to rope in other businesses. Though we did the intra-city play from July 2015, we stopped it in September and have since been focussed only on inter-city play,” says Rajesh.

Today, the platform is used by most corporate majors like Hindustan Unilever Limited, Jyothy Laboratories, Hindustan Coco Cola Beverages, AMUL, Haldia Petrochemicals Limited, Godrej Consumer Products Limited, Asian Paints, ITC Limited, Marico and Britannia. Close to 10 to 50 percent of BlackBuck’s wallet share comes from the larger corporates.

Anand Daniel, Partner, Accel Partners, adds that generally models that have potential to scale to large markets and are reasonably underserved by technology, interests the Accel team.

“In the case of BlackBuck, there was a huge underserved and fragmented space, which was interesting to look at. The marketplace model also seemed very scalable,” he says.

Breaking the B2B play

Having a pan-India presence, the now 1,000-member team of BlackBuck works with over 150 B2B clients from across 250 locations. However, the team believes they shouldn’t have gotten into the intra-city logistics space.

Rajesh believes that at that point in time, there were already close to 40 startups in the space. While it was an easy market at that time, it wasn’t something they were looking at. Also, one of the biggest problems of intra-city logistics is that most follow a part-truck load model, where the use of vehicles is only for a limited period, that is, only when there is the demand.

As Rajesh mentioned, there already were several established players in the space making the market crowded. These include The Porter, Blowhorn, TruckMandi and others, who were themselves raising capital and growing big.

“B2B is a large segment, and in that logistics and the intercity play is pegged as a $70 billion market. It is a huge market and very little technology serves that space. The intercity specific focus area interested us, also being an early stage invest, we found the team to be dynamic and strong,” says Anand.

A glimpse into the market

According to the report ‘Logistics Market in India 2015-2020’ by market researcher Novonous, the entire logistics industry in India is pegged at $300 billion growing at a CAGR of 12.17 percent by 2020.

The B2B logistics market is being eyed by giants like Mahindra and Mahindra, who launched SmartShift, a bidding app for transporters to connect directly to businesses. Another big logistics player in the space who can be considered direct competition for BlackBuck is Rivigo, which claims to have a fleet of 800 trucks.

The team believes that B2B logistics problem is a global problem. Rajesh adds that once they penetrate deeper into the Indian market and set a benchmark, they will look at global markets.

In short term the team aims at targeting a one percent market share of the trucking industry, with all 50,000 trucks running everyday generating a revenue of close to $2 billion in the next few years.

Website