You thought Vijay Mallya is the largest defaulter who owes banks money? Wait till you read this

Even as businessman Vijay Mallya has become the face of bad debt in the Indian banking sector, the fact is that he is only one of the players in an inefficient system that has effectively robbed citizens and taxpayers of hard-earned money. Newslaundry has obtained and assessed the Reserve Bank of India’s Wilful Defaulters and Defaulting Borrowers List, which places the total defaults in the banking system at a staggering Rs 5 lakh crore, as of 24 December, 2015. The list presents corporate bad loans accounted for since 2005 against which banks have not moved the courts — in banking parlance they are dubbed as ‘non-suit filed accounts’.

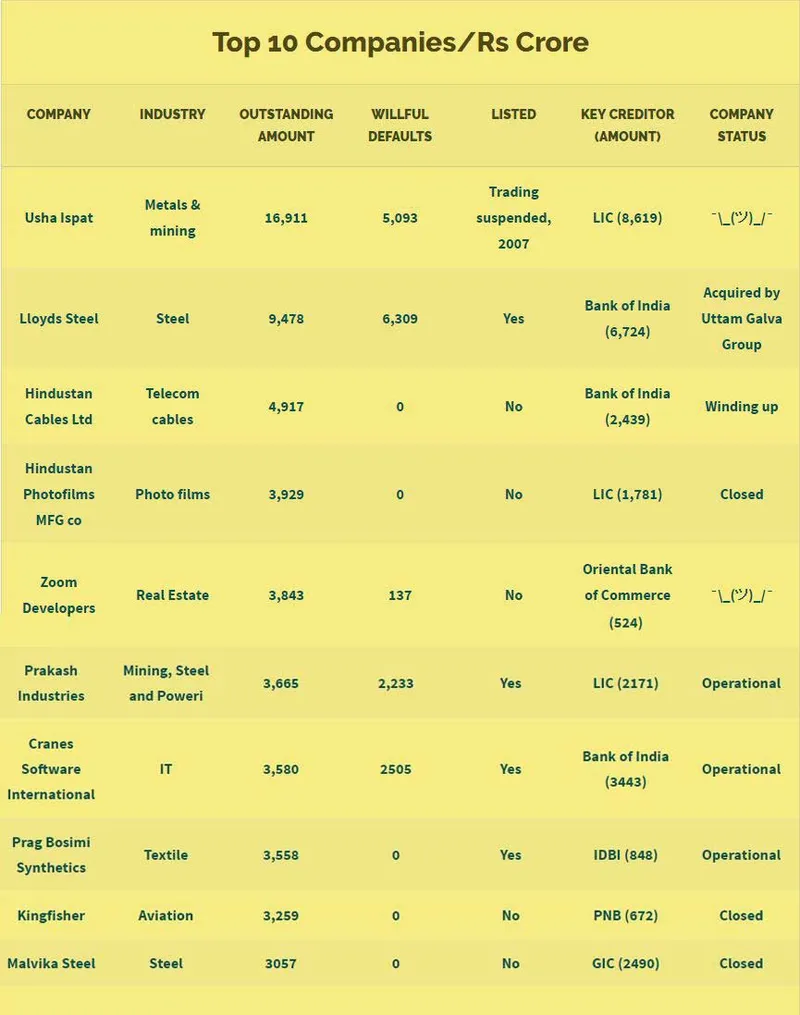

The top 10 corporate defaulters, according to RBI’s list, owe over Rs 56,000 crore to banks and financial institutions. To put this in perspective, this amount is just shy of the budget of West Bengal for the 2016-2017 fiscal year (which stands at close to Rs 57,000 crore). Most of these defaults are to state-owned banks and insurance companies — specifically Life Insurance Corporation of India and General Insurance Corporation of India. The majority of the top 10 defaulters are either state-owned companies or firms with promoters with some political connections. Which means this is public money at stake.

It must be noted, however, that RBI’s Wilful Defaulters and Defaulting Borrowers List is only a part of the non-performing asset, or NPA, puzzle. According to Credit Information Bureau (India), wilful defaults against which civil suits have been filed for recovery amount to Rs 56,521 crore. If we add these amounts, total NPAs stand at about Rs 5.5 lakh crore. Of this, only Rs 1.5 lakh crore (both suit and non-suit filed accounts) are termed wilful defaults by banks. (This does not account for restructured loans.) Considering how wilful defaults are only a fraction of the total bad loans, it begs the question of whether we need to stress on the distinction between ‘wilful’ and ‘non-wilful’ defaults while addressing the NPA issue.

The list assessed by Newslaundry is part of RBI’s ‘Negative List’ and is updated quarterly to be circulated among banks across the country. It is, in principle, a sort of ‘watch-out-for-these-borrowers’ list that banks can look up before extending a loan. It accounts for defaults above Rs 25 lakh since 2005 and was last updated on 24 December, 2015.

To stay updated with more news, please connect with us on Facebook and Twitter.

.