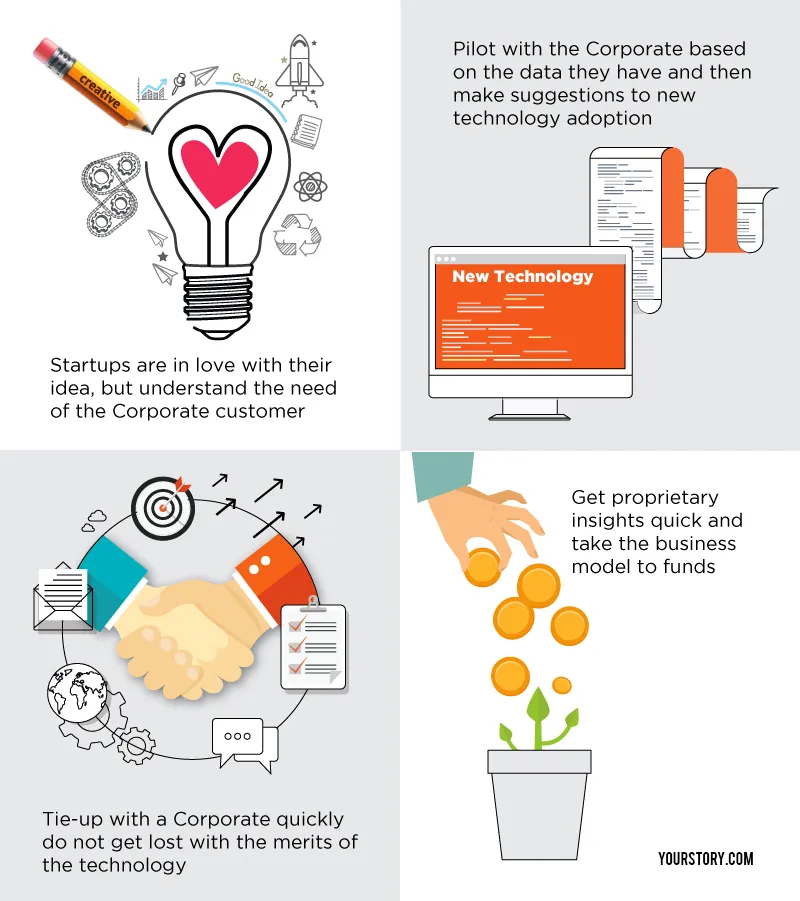

Here is how you make a million dollars, but first know what your potential customer “The Corporate” wants

Often insights, in the B2B industry, are the easiest thing to gather. But it is oversight, on the startup’s part, in thinking that an idea works best, for the customer, which can destroy relationships and the business. It is also the reason why venture capital funds drop investments with angel-funded companies when they approach them for a Series A round. 2015 was a year of learning for several startups because many of them built technology, created a buzz around it, and raised money to rush their product in to the market, which is when they realised that there aren’t many customers (corporate) willing to pay for the product. It signals the end of the line when their angel fund is exhausted and, by then, the idea has got the better of the entrepreneur.

“Remember, such startups have given more precedence to the idea rather than testing it out in business realities,” says MA Rohit, MD of Cloudnine. He adds that many times startups are selling a product idea to him rather than figuring out a solution that works for his company. “We have health records or data that tell us about the business. Startups must build solutions by gathering evidence from our data rather than tell us about the benefit of their technology,” says Rohit.

Proprietary insights, of the customer, is key to survival

“It is best for startups to figure out what a corporate needs before they propose that an idea can gather insights from the corporate,” says Mohandas Pai, former board member of Infosys. Let us take a couple of examples of why startups need to focus on customer problems before fund raising.

There were at least 10 ‘drone’ startups that cropped up in the year 2014 and only a couple of them understood what their customers wanted. IdeaForge won projects based on building a narrative of saving lives and served drones to disaster management and security service departments of the Indian government. Similarly, Garuda Robotics won clients based on the narrative of managing large factories, with drones, without having to employ humans to maintain security. Similarly, in robotics, only Gridbots and GreyOrange Robotics have active clients in the industrial world. Gridbots served industrial robots to Indian nuclear power plants and helped them dispose nuclear waste.

“B2B companies that have evidence of their technology being implemented in corporates shows that their product is marketable and as a result can be funded,” says Uday Shankar, Head of the accelerator program at Axilor Ventures.

Shipping Exchange, a platform which helped shippers to connect with shipping companies dynamically, realised shipping companies did not care about the business as long as someone got them the shippers (SMBs) and reduced the sales cycle. Ashutosh Shrivastava, CEO of Shipping Exchange, realised that if they brought the shipping rates to the small business (shipper), on a portal, by cutting the freight forwarder then the business could be scaled up. “We gathered evidence of 30 exporters and told them that we could connect them to all the shipping companies and offer the best freight rates, where they would save at least 30 percent of the current freight cost,” says Ashutosh.

Another apt example of a why a B2B business fail to collect evidence is because of overkill. There are over 25 payment wallet companies that go to departmental store merchants and sell their apps. What is the evidence that they are gathering here? Is it about the products that consumers buy or is it working capital cycle of the merchant? Again most of them are lost in acquiring customers and merchants. But the real clients, the FMCG companies and banks, are the ones who are not yet engaged with the data procured. Therefore, very few wallets will survive if the objective does not move beyond just the convenience of payments, which is already in the process of being commoditised.

In fact as history goes, Phanindra Sama, the Founder of RedBus, did not have customer insight, in the idea stage, and therefore failed to convince bus operators to use his technology. It was only when his company decided to sell tickets on behalf of the bus operators, rather than just selling technology, did the business become a household name.

Related Stories: B2B strategies of WhatsApp

Gather evidence before you go to a Corporate

Awesummly, a startup which crunches long-form news to a summary on their proprietary automated platform, has been sitting on a gold mine of an opportunity for media organisations. But the team is figuring out the nature of partnerships with media organisations and, if product adoption is delayed, the company will have to look at building its consumer side of the business, which is an app. The lessons do not stop there.

There are several wearable technology startups like Healthifyme and GoQii which are currently on a consumer acquisition spree and have large chunks of consumer data, which they have gathered over 30 months. Now that these startups know the eating and fitness habits of their users, they need to tie up with corporate hospitals, insurance companies, and wellness businesses to generate larger revenues by using the data to work with doctors. “Startups that can produce evidence of corporate adoption will grow in to large companies over the next five years. Only when the corporate gains from a startup will they become vendors of large IT organisations,” says K.V. Balakrishnan, Founder of Exfinity Ventures. No wonder the Target Accelerator picks startups, which can solve its problems. So to cut a long story short, it is better to know the limits of your idea before you take it to the corporate for acceptance.

History is ripe with the need for evidence. In 1994-95 when Infosys was just a $100 million company, 50 percent of its revenues were coming from GE. Only when the company dropped GE and worked with several clients did it realise that it had the potential to become a billion dollar business. Perhaps it is better to move away from the comfort zone and work with several companies rather than gain evidence from just one corporate. The question is will corporates open their doors to startups; however, many are already are. Over 60 percent of Indian startups are in the B2B space. It is time the corporates and R&D let them in to their system to gather evidence and become multi-million dollar businesses.