Convergence of mobile healthcare, wearable and commerce at Mobile World Congress 2016

Under Armor(UA) shook up the world with their acquisitions of MyFitnessPal and MapMyRun in recent years to really step up their play in the mobile health and wellness space. The company has been on a tear with aggressive growth plans in general and has created the benchmark standard at CES earlier this year when they launched the Under Armour Healthbox. With HTC as its hardware partner, Under Armour unveiled a slew of connected fitness devices that make up the Under Armour Healthbox, which is aimed at providing athletes with a more comprehensive experience. At MWC, UA dazzled people with their vision for the future with the HealthBox and UA Record, which is claimed to be the most comprehensive mobile fitness app.

The perspective of UA and others (Fitbit, OM Signal, Fossil) is that customers want a better integrated experience with their software platform and an overall connected fitness system. Hardware is important but the first decision point for any hardware is based on fashion. Function and technology differentiators make a difference post purchase. For customers to really make the best use of connected wearables and mobile fitness applications, a hyper-personalized experience is required at all access points.

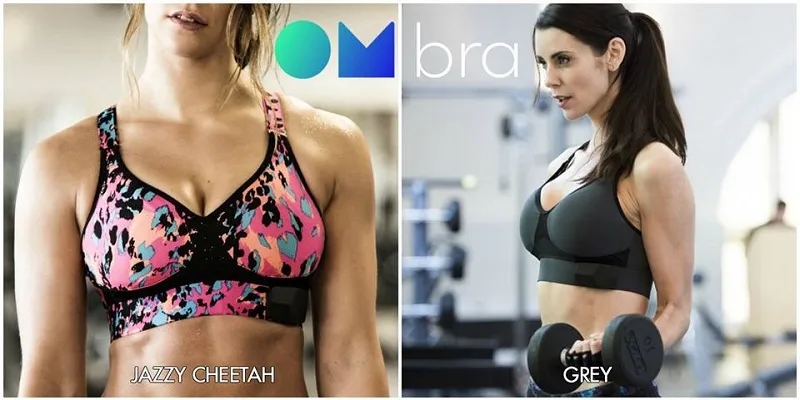

OM Signal has gone a step further – they have come out with connected apparels to further enhance this ecosystem. OM came out with the world’s first Smart sports bra, which detects deep bio-signals in the user and then recommends a personalized fitness and food program. UA and Fossil aren’t far behind in their efforts in this regard. Both have publicly stated that the wrist will only be the gateway to a connected lifestyle – it’s where things start and not the end game. Social connect of these smart devices and apparels (on Facebook, Twitter etc) is another variable that takes non-linear steps for users to go beyond just having something strapped on. Eventually, ecosystems are key to the success wearables and health fitness companies. The massive interest in this space - disruptive companies being formed, M&A activity and key strategic partnerships led by Apple and Google, is simply the trailer for the main show to play out over the next few years.

The other interesting topic which has been around conceptually for years but still remains largely unsolved is how to bridge the gap between physical and digital commerce. This is a challenge retailers and brands are solving all over the world from the US to China and India. Convergence of digital and physical commerce has created several opportunities for everyone in the value – yet most solutions and approaches have flattered to deceive. The landscape of how expansive offline retailers have been is vastly different in the US as it relates to China or India. Yet for all retailers (physical or digital first), the main opportunity and challenge remains on how to get the most out of mobile commerce.

China and India are mobile first and increasingly mobile-only for commerce but retailers in both countries struggle with the issue of low conversions. Mobile needs to be seen as the front door to commerce (online or offline) and here the key concepts of micro-moments (a Google innovation) should be applied. It's fractured the consumer journey into hundreds of real-time, intent-driven micro-moments. On mobile, micro-moments can happen anywhere and not in any particular sequence. Yet, its important for retailers to drive customer intent into transaction at any of these micro-moments – this is the real challenge of mobile commerce. In addition, customer experience is certainly the key in bridging the gap between online and offline commerce and truly creating an omni-channel buying experience. The trend also reflects the broader industry imperative around “omni-channel” retailing, where merchants aim to provide customers with a seamless experience whether shopping online via desktop or mobile device or at a traditional retail store.

Warby Parker as an example, after starting online in 2010, opened its Soho flagship three years later and now has 20 stores nationwide. It has plans to add another 20 this year. FirstCry and Lenskart in India have expanded to 150 and 70 stores across the country, underscoring the same point. A true omni-channel experience should originate on one channel and get completed on another channel. However, customer needs to have a continuous relationship with the brand not the channel. More often, solving is channel problem is where most of the time and capital is spent. Omni-channel behaviour is moving from being a trend hyped up by investors and startups, to being implemented in a practical and scalable manner.