Understanding the Fintech landscape in India

There is a lot of buzz in the Indian media and entrepreneurial circles about a popular catch phrase called ‘Fintech’. Though the western world has been acquainted with this term, it’s relatively nascent in the Indian content. However, the sector in India is in a hyper-growth phase, establishing awareness at a geometric rate.

Fintech is basically a section of companies which are using technology in a big way to define and make our existing financial systems a lot more efficient and effective. So this may bring you to the question - what really are the various types of companies that can be categorised as being a part of Fintech? What exactly are these companies trying to solve? What are these new age Fintech companies solving in the financial services space, which is probably one of the oldest sectors in the world? There could be a ton of questions I could help answer but what I - aim to do through this article is introduce you to the Indian landscape of Fintech and the companies that most likely fall into the category. This should be able to give you a sense of direction on what these companies are doing and why they are doing so.

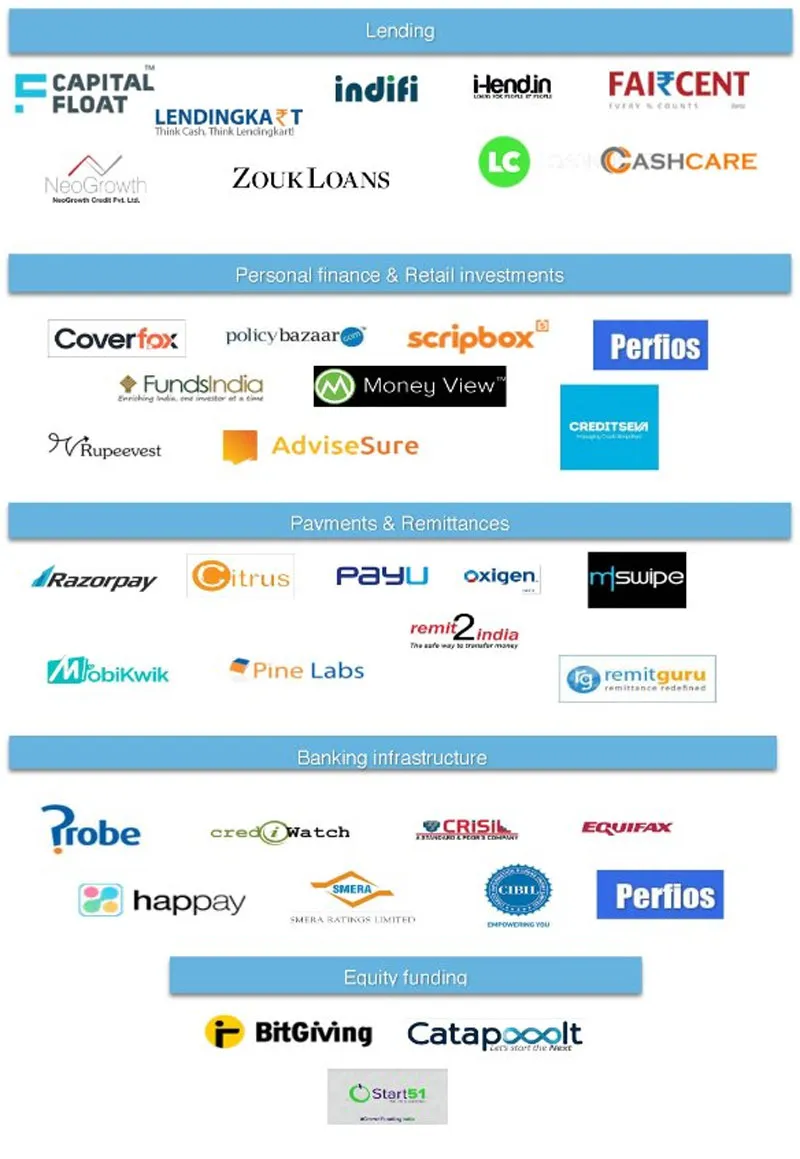

Fintech has a wide range of verticals which are typically classified into the following

Lending services: There are tons of lending services companies that have sprung up in the recent past to service demand from consumers and businesses for access to finance. These lending service startups look to outwit the traditional lending mechanisms and are using alternative credit models and data sources to provide faster access to capital.

Payment services: These companies allow both private individuals and businesses to accept payments over web and mobile. These startups aim to integrate payment processing into websites and mobile apps without having to maintain merchant accounts. To minimise fraud, transfers are made directly into the bank account linked to the payee.

Remittance services: Quite often, inward and outward remittances are cumbersome and - procedural. Sometimes, the charges applied for remittances are so high that a transfer becomes an expensive transaction. To overcome these challenges, a few startups have come into existence to address the gaps and dominance of some monopolies.

Personal finance / retail investment services: Another breed of Fintech companies are those that help individuals save money, manage and invest their own finances. Also, it helps compare the different options available to make a more informed decision based on personal needs of the individual.

Banking infrastructure services: New-age Fintech companies are solving infrastructural issues for traditional banks, institutions and startups by effectively using technology. These Fintech companies have drastically improved the access to information, analytics and digitised data sources which weren't even thought of until a few years ago

Equity funding services: One of the most promising Fintech platforms is crowdfunding as access to funding from venture capitalists has very low rates of conversion, crowd funding provides early stage companies a platform to raise capital from the retail market.

Cryptocurrency: Not seen much traction in India in comparison to other international markets. There are a couple of bitcoin exchange startups in India though - unocoin, coinsecure and zebpay to name a few.

I learn more by the day about this space which is changing by the day. I would love to hear from other Fintech companies out there and I'm aware that I wouldn't have covered other companies in this article and it represents only a sample set of companies in this exciting space.