What if Flipkart, Paytm and Snapdeal formed a 'Mega Alliance' to take on Amazon

Everything is fair in love and war. And the popular adage appears to hold relevance in the Indian e-commerce space too. A few days back, news reports surfaced hinting that Chinese Internet behemoth Alibaba was in preliminary negotiation stage for investing in Flipkart. While YourStory can’t confirm this development independently, it didn’t come as a surprise for market observers and media. If Alibaba invests in the Bengaluru-based company, the horizontal e-commerce battle would shrink to two major companies: Amazon and Alibaba Group.

This is because Alibaba also owns majority stake in Flipkart’s rivals - Paytm and Gurgaon-based Snapdeal (along with Softbank).

Why does Flipkart make sense for Alibaba and how will it impact the industry? A top executive of an industry body says,

The global e-commerce war is being fought between the US and China, and if Alibaba and Amazon have to maintain their momentum, India is the market. Currently, Alibaba owns significant chunks in Snapdeal and Paytm. Flipkart through its portfolio will strengthen its position in Indian e-commerce market.

He also anticipates consolidation across Alibaba portfolios in India.

Alibaba and Softbank are fighting against the US-based cab hailing app Uber in Asian market. China’s DidiKuaidi, US-based Lyft and Southeast Asian GrabTaxi formed global alliance to offer seamless access to cabs in these countries. K Vaitheeswaran, founder of Indiaplaza, says

Based on this experience, I won’t be surprised if Alibaba forms alliance of local players to counter Jeff Bezos-led Amazon.

Market observers believe that Alibaba's possible investment will also bring inevitable consolidation in horizontal e-commerce. KashyapDeorah, author of The Golden Tap, The Inside Story of Hyper-funded Indian Startups, points out

Snapdeal can join Flipkart, Paytm can be a part of Flipkart, so that's Snapdeal plus Paytm. Anything is feasible to up the ante against the mighty Amazon.

He emphasises that consolidation will be underway in horizontal e-commerce space this year, irrespective of whether Alibaba infuses capital into Flipkart or not.

Manu Aggarwal, Founder and CEO, Naaptol, says:

With or without Alibaba in Flipkart, fierce battle for e-commerce crown will continue between the three (Snapdeal, Flipkart and Amazon) for the next 12 to 24 months.

Although Manu sees consolidation this year, he rules out the possibility of the three becoming one entity. He adds,

Flipkart doesn’t own payment and Paytm has been impacting masses with its prowess in payment. I won’t be surprised if they marry each other.

At present, at least one lakh merchants across India send their bills to Flipkart. Unfortunately, Flipkart does not have a wallet mode of payment for the offline world. Imagine the scale Flipkart can reach if it allows a customer to pay at a local store with the help of Paytm. Both Paytm and Flipkart can tieup with banks to help their vendors with channel financing or working capital loans. They can work with small vendors to increase their margins on their platform.

Vaitheeswaran believes that the e-commerce battle will be fought for many years and local players like Flipkart, Snapdeal and Paytm require deep pockets and world-class technology to fight Amazon. “Alibaba is the only option for these companies if they are in a battle to beat Amazon,” he adds.

A TechCrunch report last week also hinted about the possible merger of Paytm and Flipkart. Paytmventured in e-commerce play with its marketplace in early 2014 but Flipkart and Snapdeal are much ahead of the Noida-based company. Alibaba's success is largely driven by its combined strength across various aspects of e-commerce business, like payment, supply chain and technology. If Paytm, Flipkart and Snapdeal (or any of the two) come together, they will undoubtedly strengthen Alibaba's presence in India.

While the three firms continue burning capital on backing of institutional investors to grab more marketshare, investors have now been putting pressure to explore profitability. According to RoC filing, the combined losses of Snapdeal, Flipkart and Paytm stood at about Rs 3,700 crore.

Flipkart reported a loss of Rs 2,000 crore, while Snapdeal’s burn stood at Rs 1,350 crore. Paytm posted loss of 372 crore in FY 2014-15.

Early investors in Flipkart and Snapdeal are also looking to exit and a section of experts see consolidation as the way forward. R Natarajan, CFO of Helion Ventures, says:

Some investors will have to cash out and a consolidation or a merger is a great way for some investors to exit or benefit from the shares offered by the new entity.

Consolidation is key to survival, some others believe. Mohandas Pai, Founder of Aarin Capital, says

There will be consolidation because these players have to survive. It is clear there will be only one or two players. Today, the GMV game has gone on too long with just discounting. It is no wonder that investors will ask them to consolidate and focus on operations.

Flipkart and Snapdeal have been targeting the same audience with similar offerings, while Paytm is building an altogether different business. For some the Flipkart-Snapdeal merger appears to be a more logical option. Rohan Malhotra, Co-founder, Investopad adds,

Paytm is likely to maintain an independent stand and may not go for consolidation, but Flipkart and Snapdeal seem to have more common ground for consolidation.

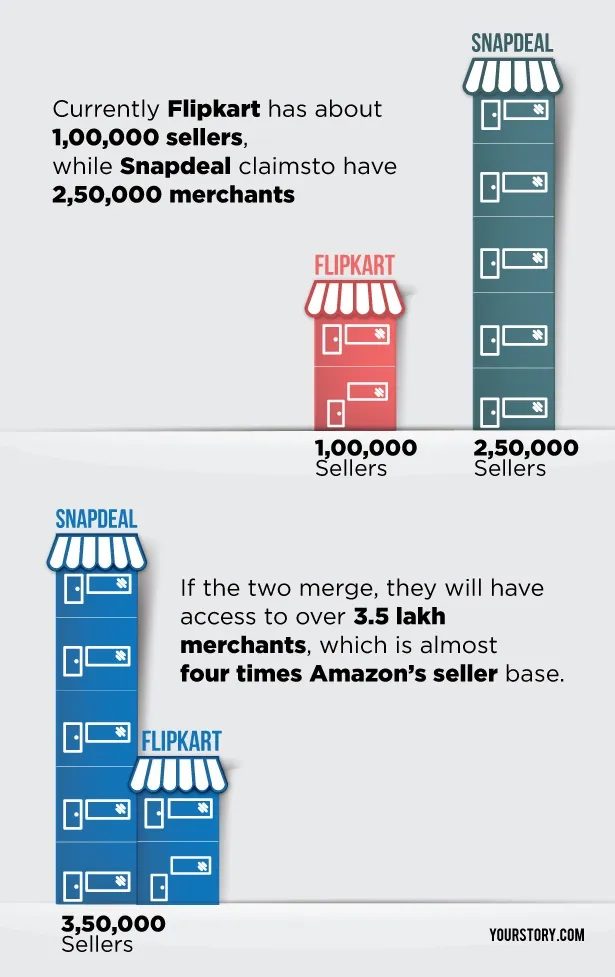

Flipkart forayed with marketplace model in early 2013 and currently has about 1,00,000 sellers, while Snapdeal claims to have 2,50,000 merchants listed on its platform. Unlike Snapdeal, Flipkart has not been so aggressive on the merchant sign-up front. If the two merge, they will have access to over 3.5 lakh merchants, which is almost four times Amazon’s seller base. Additionally, the duo can leverage Snapdeal's wallet Freecharge.

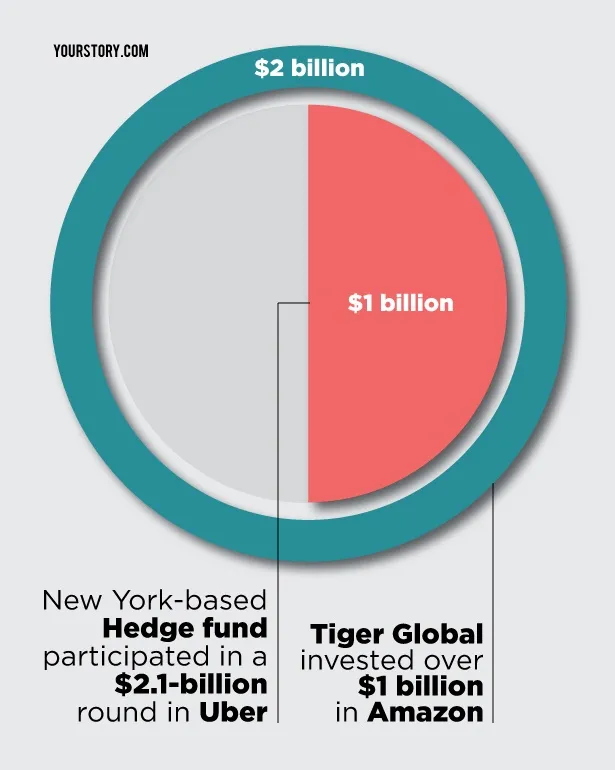

What is confounding observers and the VC community alike and is building a stronger case for consolidation is the investment pattern of Tiger Global, one of the most prolific investors in Indian startup scene. Last November, Tiger invested over $1 billion to bid for 2.44 million shares of Nasdaq-listed Amazon. A month later, the New York-based investment firm participated in a $2.1-billion round in Uber. It is an investor in other ride-hailing startups which are Uber’s rivals, including China’s DidiKuaidi, India’s Ola and Singapore’s GrabTaxi.

Radical change in investment patterns of the most active investor in India will certainly impact the local ecosystem.

“Investments in Amazon and Uber strongly indicate Tiger's realisation that returns from its early bets in India won’t be as big as it expected. Therefore, a Plan B was worked out to invest in its portfolio rivals,” says one veteran angel investor on condition of anonymity.

While experts anticipate consolidation after second half of the current calendar year, consolidating loss-making competitors won’t be a smooth ride. Vaitheeswaran adds,

It would be a complex affair and may not happen soon because we (Indian startup ecosystem) never experienced such massive marriage.

Currently, Snapdeal has about 14 warehouses and 30 smaller centres, while Flipkart owns 10 warehouses including 35 small units. Paytm has four warehouses. Integration of technology, supply chain and workforce would be a daunting task. Snapdeal, Flipkart and Paytm together have an employee base of about 40,000. K V Balakrishnan, Founder, Xfinity Ventures adds,

The question to ask is why would they merge. Are there intrinsic benefits from merging? There must be a meeting of technology or processes. But each of them are different organisations. A merger would still mean that only the data and some pieces of the technology would become important, the rest would be shelved.

Others point to the advantage the two companies stand to gain from merging: primarily a more potent entity to list abroad. “Independently, there are very slim chances to make big in public market,” adds Vaitheeswaran.

Experts believe Flipkart and Snapdeal would stage an IPO by 2018. A pertinent point to raise if these poster boys of the India startup ecosystem merge would be whether they can generate cash from operations, which is the most important aspect of continuing business without raising funds.