25 and counting: Ratan Tata & startups’ love story continues

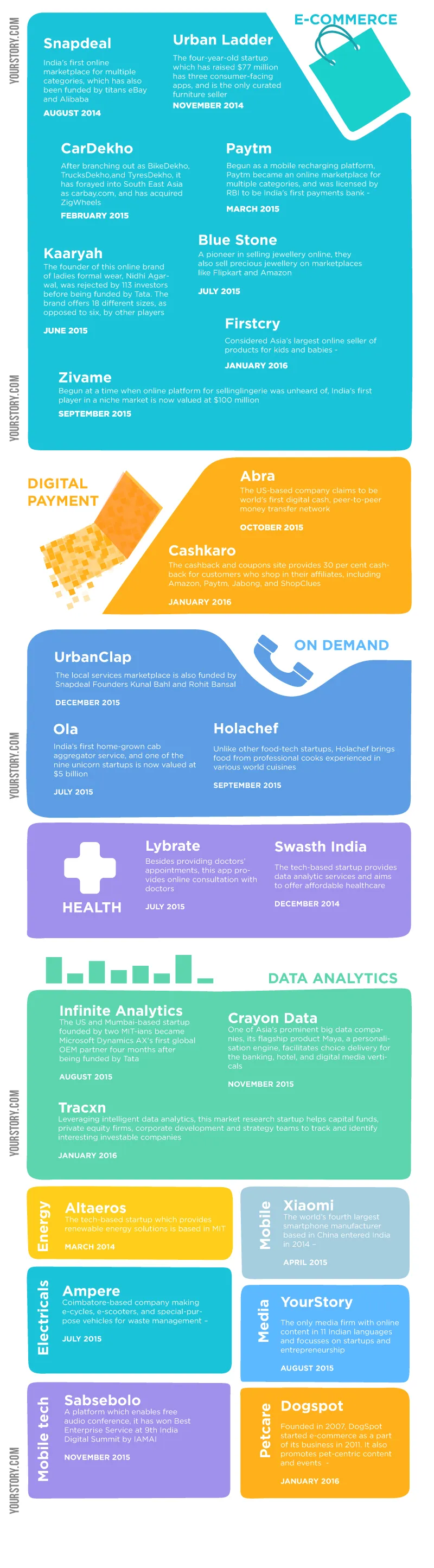

There are few sectors in India which the Tata Group has not left its signature on. Whether it is telecom, software, fashion or groceries, you see its stamp on every industry in the country. Hence it should not come as a surprise when Chairman Emeritus of Tata Sons entered the list of angel investors for startups. But when Ratan Naval Tata does business, he does it in style, and his list of investments in startups is no different. His investment [of an undisclosed amount] in FirstCry, an online seller of baby products, this week is his 25th such venture in less than two years.

In a country which is witnessing an e-commerce boom next only to US and China, Ratan Tata - as an angel investor- has invested in eight different startups in the sector in the last 18 months. In fact, three of India’s eight unicorn startups – Ola, Paytm and Snapdeal – have also benefited from the business tycoon’s investments. He has also poured money into startups working for social causes, like Ampere and Swasth India (Rs two crore). Curiously, logistics is one sector which he has not invested in yet.

It does not matter if you have been funded hundreds of millions already; when Ratan Tata invests, the world sits down and takes note: cab aggregator Ola, which is now worth $5 billion, saw its share prices rising from Rs 15,87,392 to Rs 29, 44,805, according to Livemint report in November 2015.

Although most of his investments are undisclosed amounts, startups which succeed in getting Ratan Tata on board are excited for reasons more than the financial benefits. After Tata’s investment in Ola was declared, CEO Bhavish Aggarwal said that Tata's investment was "a huge endorsement from one of the most respected business leaders of our times and reflects Ola's commitment towards the future of mobility in India.”

While investors often mentor and hand-hold young entrepreneurs, the entry of India’s business patriarch into their list of investors means they have got the best guide possible in the country. Bhavish had also said: “Tata will be the guiding force in Ola’s mission to build mobility for a billion Indians.”

Tata’s investment gives a boost to startups in gaining publicity and brand building. In fact, if statistics are to go by, valuations have also jumped up for some players after Tata’s Midas touch. For instance, BlueStone’s valuation increased from 34.86 per cent to 50.29 per cent, during and after Ratan Tata’s funding rounds respectively, as per the above mentioned report.

Watch: Ratan Tata on early life, learnings and love for startups | Storied with Shradha Sharma | Episode 01

In August 2015, Ratan Tata read YourStory and wrote a cheque, thus joining Kalaari Capital. Qualcomm Ventures, and TV Mohandas Pai as an investor. So far, YourStory happens to be the only media firm Tata has invested in.

In December 2015, renowned US-based non-profit organisation Khan Academy entered into partnership with Tata Trusts. The aim is to provide online vernacular content for students in India, based on NCERT textbooks.

Ratan Tata is also among the advisors for IDG Ventures India, Kalaari Capital and Jungle Ventures. In fact, he has invested in startups that are funded by Kalaari Capital – Urban Ladder and BlueStone, and Jungle Ventures’ protégé Crayon Data. At LetsVenture, an online deals platform, he is both an advisor and investor.

With Tata’s four investments announced in the first three weeks of 2016, it looks like another exciting year awaits startups in the country.

Graphics by Gokul K(Disclaimer: Ratan Tata is an investor in YourStory)