Startups rise in luxury goods market in India

In Sex and the City movie, when Carrie Bradshaw gifts a Louis Vuitton bag to her personal assistant Louise for Christmas, Louise screams in joy. Louise would not have been able to afford one of her own otherwise, not from the world’s largest luxury goods conglomerate.

Until a few years ago, luxury goods were the prerogative of celebrities and multi-millionaires. But thanks to a handful of startups coming up in the space, a large number of customers are now able to access luxury products. In fact, Anvita Mehra, Founder of Confidential Couture, says that at any given time, there is a waiting list of 30–35 people for a Louis Vuitton bag – which costs above Rs 1 lakh.

According to a report from Euromonitor International, India is the fastest growing emerging market for luxury goods, growing by more than $225 million a year – considerably stronger than Singapore and Australia. Thanks to rising Internet penetration and disposable income, the online segment of the market is also growing, and startups are taking the plunge.

Targeting the upper class

A recent ASSOCHAM study has stated that high-income group consumers spend over 40 per cent of their monthly income on luxury brands, whereas the middle-income group (MIG) consumers spend 8–10 per cent on luxury products.

High net worth individuals (HNIs) are the target for startups in the space. Nakul Bajaj, Founder of Darveys, says, “Flagship store visitors can now get the same products online at better prices. We also capitalise on the first-time buyers of luxury goods, who want to spend only about Rs 6,000.” He added that there are quite a few people who travel abroad at peak seasons like Christmas because the prices are better then. “We make it easier for them to stay at home and buy products online instead of travelling abroad at a definitive period just to buy them,” he says.

Festive season sales are not just for the e-commerce giants like Flipkart or Snapdeal. Seven-month old Zokudo, a platform which provides vouchers for corporates and individuals for gifting, had the highest sale during Diwali. Yash Mehta, Founder of Zokudo, says, “Vouchers were purchased in bulk, as corporates gift their clients, investors, and highly valued employees while individuals want to gift their families. For internal gifting, most corporates go for vouchers worth Rs 500–2,000.”

The luxury fashion market focuses on women than men. In fact, Rashi Menda, Co-founder of the c2c marketplace for pre-owned luxury goods Zapyle, says that her customer base is mostly women in their 20s. Styletag, which provides curated luxury fashion, also aims at women in their first or second jobs, who have an annual income of Rs 5 lakh or more. But the sector has opened up to children too. Kidology, which began in 2010, focuses on children’s apparels by designers like Ritu Kumar and Gauri & Nainika, among others under joined labels. Neha Mittal, Founder of Kidology, says: “The cash-rich time-poor parents are travelling a lot more. They are ready to spend more for kids’ apparels just like they do for themselves.”

Although it remains a niche market, Priya Sachdeva, Founder of RockNShop, says that her online marketplace venture attracts a lakh visitors daily. “Our customers are mostly from households with annual income of 25 lakhs. Although there are no pre-owned goods, we do give 25 per cent off at promotion sales,” she says.

Multiple business models

For a segment which is still in its infancy in the e-commerce sector, startups have devised different business models already. For instance, Zokudo is a platform where customers can gift vouchers to their loved ones who can then shop at luxury malls or flagship stores. Zapyle provides a platform for customers to buy and sell pre-owned luxury goods, and is also planning to provide a marketplace for [first hand] branded products.

The peer-to-peer marketplace model seems to have worked well for the two-month old Zapyle already. Rashmi Paul, 24, researcher at Inme Learning, Bangalore, bought a Louis Vuitton clutch for Rs 19,000 from Zapyle last month. If it was for a fresh piece, she would have had to pay Rs 78,000 at a Louis Vuitton store. “Along with the warranty card, there was a note from the previous owner inside the clutch, which gives a personal touch. I am planning to sell my Tom Ford sunglasses on Zapyle soon,” she said.

However, ventures like Zokudo makes it a point to exclude pre-owned goods. “HNIs want to give that luxury experience to the recipients of their gifts – without any damages to the product. But we do have a plethora of services like swapping, marriage registering, group gifting, etc.”

Sanjay Shroff, who co-founded Styletag with his wife Yahodhara Shroff in 2012, focussed on fresh luxury online. They launched an offline version in 2014 through a kiosk in Orion Mall, Bengaluru, and are planning to launch more. The omni-channel model has created a brand identity and driven their sales, Sanjay says

Selling on its own e-commerce portal as well as on e-marketplaces like Paytm is Kidology’s strategy for a wider reach. They have offline flagship stores too, and sell via apparel stores abroad. Neha of Kidology says that the designers work exclusively with Kidology on kids’ apparels and the products are under their joint label.

Beyond the metros

According to Neelesh Hundekari, Partner at A.T. Kearney Lifestyle Practice for Asia, considering the potential, luxury market should be growing faster in India. Accessibility is the roadblock here. As per the Top of the Pyramid 2015 report by Kotak Wealth Management, 44 per cent of India’s multi-millionaires live outside metros. Luxury stores can’t come up in a street or small towns. Priya of RockNShop says: “We get orders from Chennai, Pune, Kochi, Kolkata, Orissa … the luxury brands cannot open a flagship store everywhere … the future is online.”

Kidology, in fact, gets orders from all over the world, especially during Diwali season, since the NRI market is huge. “We get orders from even small towns in Australia. Since they do not get Indian outfits otherwise, they are pleased with the variety we provide,” says Neha. RockNShop also claims to have foreign customers from Japan, Singapore, Middle East, and parts of Europe.

Anvita of Confidential Couture says: “We are now penetrating into Tier II and Tier III cities since we have had great responses from Ludhiana, Jalandhar, and Coimbatore among others.” There is some scepticism among the first-time customers since they are often paying five-digit sums for the luxury products. So whether it is a customer in a metro city or a rural village, the startups are agile in their customer service. Confidential Couture sends their items to Spa even if they are absolutely clean. For logistics, Zapyle has tied up with the logistics firm Delhivery. “They take the packaging material to the pickup address, pack it there, and then take it to the buyer,” says Rashi.

Challenges

There is no space for a mistake when it comes to luxury goods’ customers. Yash of Zokudo says: “The HNI is a very unique bunch. One mistake with them could last for a lifetime.” Hence authenticity of the luxury product is of utmost significance. “There is always a chance of one fake among five items,” says Anvita of Confidential Couture. For each product, about 80 photographs taken in a particular light is sent to the outsourcing agency for authenticating in America – ‘Authenticate First’. “Only after their approval do we list it in the website; otherwise we send it back to the customer,” she says. Zapyle’s Rashi says that although they check originality of the products from the logo via image recognition process in the backend, it is the buyer’s call finally. There is a 24-hour return policy.

Although every startup in the field has focussed on the online channels, Neelesh says that in no country has online beaten offline channel in luxury goods. Luxury brands pamper their customers. Even their Indian outlets have improved Italian furniture to keep up their standards. Hence buying itself is a part of the luxury experience. “E-commerce does not offer that, which might dissatisfy habitual buyers,” he says.

Neelesh added that while these products might be cheaper online, it is still not an easy business to scale up. “Discounting can boost online growth. But in case of an increase in demand, how will you find enough supply? Brands will have to sell them directly.” Fresh items from the brands do not come easily. For a bag worth Rs 1 lakh, there will be a duty of Rs 35,000. A customer would rather fly to Dubai and get it from there for lesser price, says Neelesh.

But an exponential growth in this sector needs a major change in mindset among the middle class and upper middle class, he says. “Even if a youngster earns Rs 30 lakh per annum, his mindset may not allow him to purchase luxury items if he has been brought up in a middle class background. But pre-owned luxury goods serve consumers who want to migrate in lifestyle. Those who want to buy but can’t afford expensive items will buy at least the same brand’s fringes – like a clutch instead of a dress,” he says.

YourStory take

E-commerce has had exponential growth in the last five years, with people getting more comfortable buying online. Luxury seems to be the natural entrant in the game. In fact, the Kotak Wealth Management report mentioned earlier states than HNIs spend 18 and 15 per cent of their income in luxury jewellery and apparels, respectively. This seems to have reflected on the online traders too. Styletag which had 100 sales monthly in 2014 now has 200–300 per day.

The market has surely grown in terms of demands, awareness, and online penetration. Although the next few years might see more players coming in, the space may not expand to accommodate all of them unless they define their reach in terms discounts and variety of products. Investors cannot ignore them for too long, and the luxury segment can grow riding the e-commerce wave.

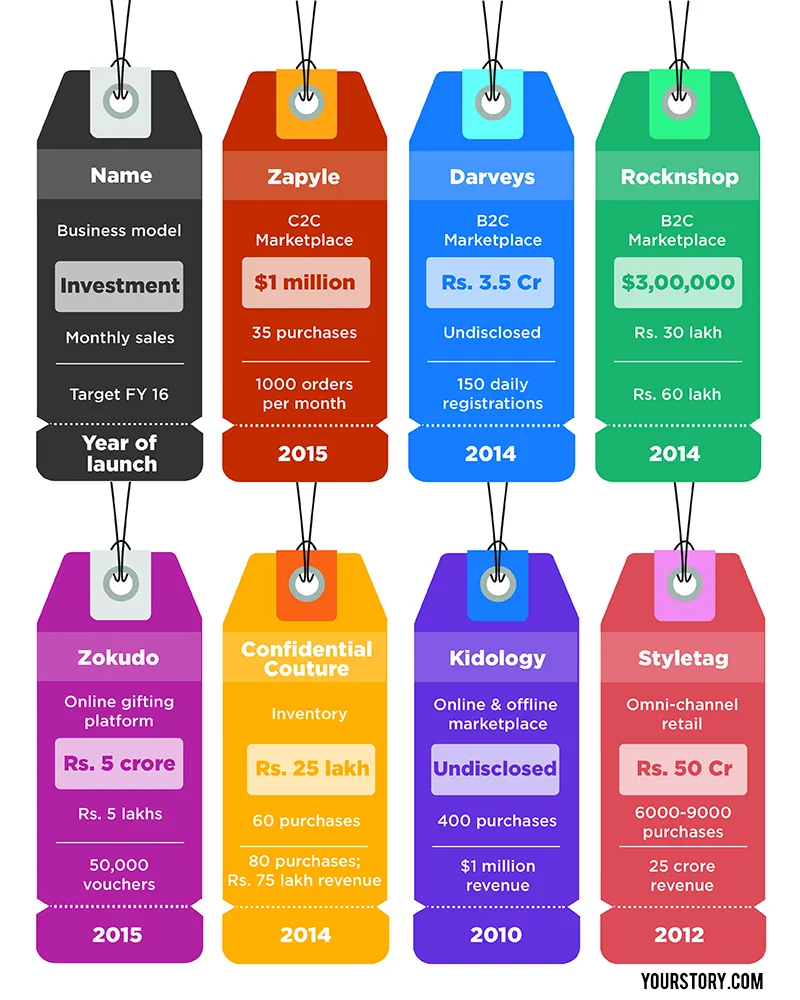

Graphics by Aditya Ranade