Early-stage deals booming in India, pre-series A deals dominate Dec funding

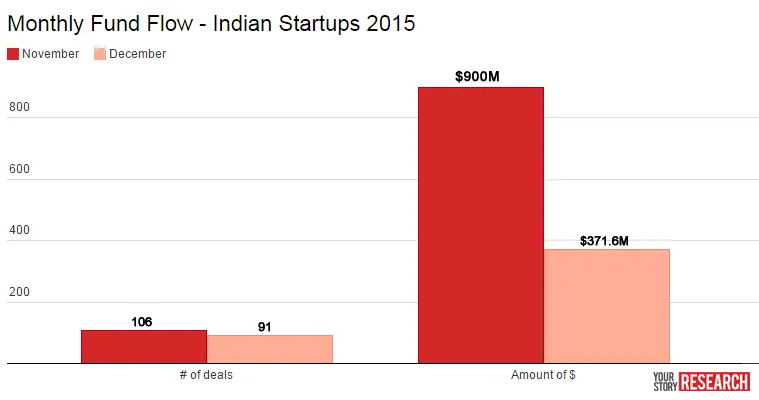

The Christmas week proved a busy one for Indian startups, with Santa clearly favouring early-stage ventures. In the last week of December, startups raised $95.8 million from VCs and Angels, up from $64.3 million in the preceding week. Overall funding in December stood at $371.6 million. Cloudnine raised the single-largest round of funding this month, with India Value Fund Advisors injecting $74 million into the company. Cloudnine was founded in 2007 and has previously raised fundsfrom Sequoia Capital and Matrix Partners. In November, Ola’s series F funding of $500 million accounted for 58.7% of all funds raised that month.

Early-stage deals

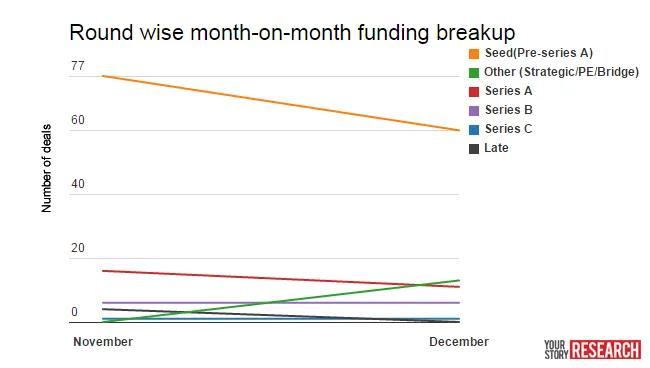

Just like in November, this month too saw early-stage deals dominate funding announcements. At 60 pre-series A deals and 11 series A deals, this was just a shade lower than November’s total. Series B and series C deals were the same as in November – 6 and 1, respectively. There were no late-stage deals in December; instead, the focus firmly stayed on strategic and bridge investments, about 13 in all.

Top deals

Cloudnine topped the list of companies that attracted capital in the month of December by raising $74 million, while Faasos and Rivigo raised around $30 million each. Logistics-related startups have had a good month in terms of fund-raising this month. If you look at the top 10 list, you will find it peppered with the likes of Rivigo, Holisol and Patel. This shows that the logistics sector is at an interesting point in its evolution.