Online product discovery platforms—the woman shopper’s new best friend

There was a time when we would fall in love with a pair of trendy boots or a pretty dress in the window of a shop and then buy them. In the age of online shopping, product discovery portals have become the new ‘store windows’.

Neena Sukumar, a 25-year-old Bengaluru-based techie, is an avid follower of fashion trends. But her busy schedule keeps her away from stores. She found Wooplr, a social discovery app which focuses on fashion and lifestyle, a few months ago. Every day, the app’s posts show new styles and products from various online and offline stores. “I check out the posts on Wooplr every other day. It has products of all price ranges and brands, and I get to know the cost and availability on the same platform,” she says. She even gets suggestions on how to put a look together on Wooplr.

If e-commerce brought shoppers to the Internet, online product discovery platforms are changing the way they shop online. Thanks to increasing Internet penetration and rising number of smart phones, more women are shopping online now. A 2014 report by Google and Forrester Consulting found that 40 million of the expected 100 million online shoppers in 2016 will be women.

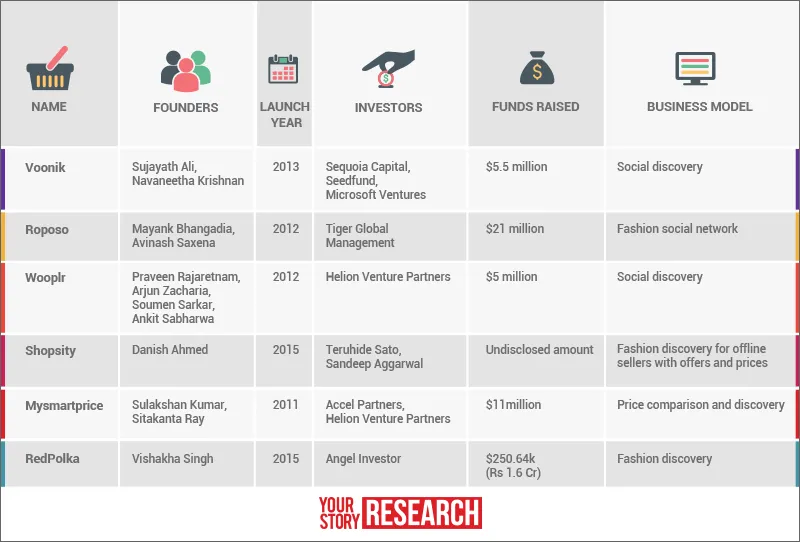

Product discovery portals like Wooplr, Roposo, Voonik, Redpolka, and others are focussed on women. While there are differences in the way these sites provide recommendations to consumers, all of them essentially curate products from multiple sites, personalise recommendations according to the consumer’s usage and directs the buyer to the site from which the product has been sourced to complete the purchase.

Online personal stylists

“Our 17-member team internally generate reports on fashion focus and trend analysis daily. Thus, our app gets curated content,” says Praveen Rajaretnam, Co-founder of Wooplr.

While regular e-commerce websites could have thousands of products, thus confusing the shopper, discovery platforms personalise according to individual tastes. “For someone with taste and curiosity, how will you find out the products that suit you? We shortlist products based on your tastes and current trends,” says Mayank Bhangadia, Co-Founder of Roposo, a ‘fashion social network’ in which users can share their stories, photos, and get recommendations for products.

As a user spends more time browsing on Roposo, the software learns her preferences and accordingly makes recommendations.

Vishakha Singh, Founder of Redpolka, stresses on the significance of curating the content by understanding customer behaviour, especially for women. “Fashion and lifestyle is a complicated space since it is taste-driven. Women are inclined to window shopping because discovery is an inherent behaviour; same happens online.”

Unlike online search, these platforms show products not just websites. Besides, they help you get the look by leading you to buy similar clothes.

“We provide comprehensive data on products, like Google does. But we help discovery and don’t recommend any particular seller,” says Mayank of Roposo. “It is not a generic platform. [Unlike Google] There is a community spirit among the customer base, which includes professionals, students, designers, bloggers, etc.,” says Mayank.

Business model – the key

While this young space has already seen the emergence of a number of players, each site/app has tried to differentiate itself from competition. MySmartPrice, which offers product discovery as well as price comparison, has already tied up with offline retailers in Hyderabad. “Over the next two years, once we have a reasonable number of offline stores in all categories and cities, we will be the ideal starting point for a buyer,” says Sulakshan Kumar, Co-Founder of MySmartPrice. Since they hold no inventory of their own, these platforms generate revenue via commissions. Shopsity, on the other hand, only curates products and offers from offline shops near the user’s location. These online discovery players — who do not sell products themselves — directly help drive traffic to e-commerce sites. “Online discovery platforms do play a major role when it comes to driving traffic to our website. Such platforms help consumers identify and pinpoint their favourite products amongst a variety of options,” says Tushar Ahluwalia, Co-Founder of online fashion retailer StalkBuyLove. He believes portals like Roposo are essentially attempting to make it easier and quicker for people to shop for quality and value-added products by creating user-generated content and reviews.

Miles to go

However, challenges are many for the online discovery platforms, especially in integrating offline merchants onto these platforms.

“It is quite a challenging task for the online discovery players to get the offline merchants to adopt to online behaviour — such as keeping their catalogue updated using their tools. Whoever does it best will have a better chance to win the game,” says Rahul Chowdhri, Partner at Helion Venture Partners. Danish Ahmed, Founder of Shopsity, agrees that this is a challenge. “The space is highly unorganised. You have to build tools that these retailers can use conveniently and yet with all the information that the customers need,” says Danish.

There are alternatives too. Now tied up with 2,000 sellers, including manufacturers, boutiques, retail and wholesale sellers, Voonik is hoping to cross the 10,000 mark by the end of the year. But Sujayath Ali, Co-Founder and CEO of Voonik, says that since the effort put into getting the smaller offline merchants (like some from Commercial Street) is not getting expected results, Voonik is moving to bigger chains among offline sellers.

Others are betting on the user community. “When the entire fashion segment comes online, how do you place yourself in a woman's mind? The kind of user-generated content and the community created sets you apart,” says Praveen of Wooplr.

No to acquisition

But what is the end game for these sites? Can they become large billion-dollar companies, will they remain niche players or will they get acquired by the e-commerce goliaths like Flipkart and Snapdeal? The founders YourStory spoke to said they would remain standalone companies. They believe the sector is still in its infancy and the true potential is yet to be exploited.

“We want to be a standalone $1 billion company in online discovery and price comparison space itself,” says Sulakshan Kumar, Co-Founder of MySmartPrice.

However, experts say that one cannot completely write off possibilities of acquisition. E-commerce and omni channel retail expert Pratham Naik, Global Director of Strategy and Business Intelligence at Anheuser Busch Inbev, says that success of online discovery platforms depend on assortment, pricing, and innovation in price comparison. Companies offering the same service will eventually have to combine forces as markets get more competitive. “Since everyone wants to be part of the e-commerce industry, differentiation of products/services is hard and companies will need to figure out a way to differentiate their offering,” says Pratham.

Acquisitions have already begun. Last year Snapdeal acquired Doozton — a fashion discovery site founded in 2013. Globally too, e-commerce platforms acquiring online discovery startups is not unheard of. Brazil’s Buscape had acquired social commerce and discovery platform Shopcliq in 2012. In late 2014, US discovery platform Wanelo merged with Shopify. In July, Yahoo acquired Polyvore — a major American fashion discovery app.

However, size of the sector is the deciding factor on whether or not a platform can become a large standalone player. Rahul of Helion, says that online discovery sector is the integrating platform that the fragmented offline sector needs. “Hence ,there is a possibility that they will be standalone. Some of them may get offers on acquisition, but in long term, they have the potential to be standalone businesses.”

Yet, how dynamic the startup is in adapting to the ecosystem and learning from its mistakes will undoubtedly decide who survives. Praveen Sinha, Founder and Managing Director of Jabong, says that while the discovery platforms definitely play a role, it has not yet become significant. “How large it will become depends on the community. There is no proven model yet; only time will tell how that model will get evolved and stabilised,” he says.