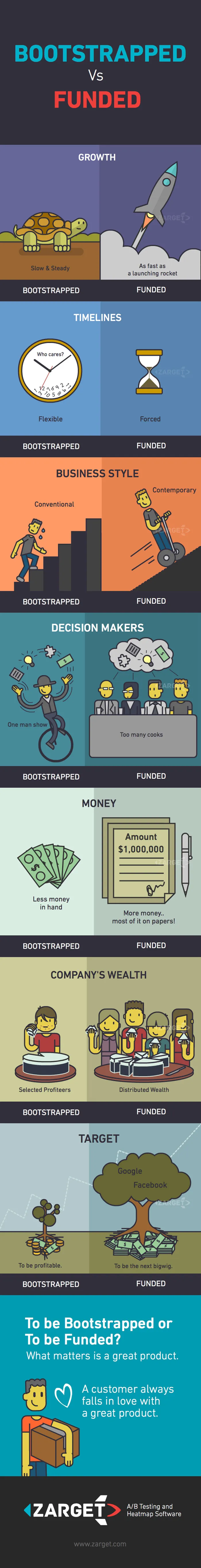

Bootstrapped vs. funded businesses

As a startup founder, the very first question I had to battle was whether to raise funding for my business or to go bootstrapped.

Going with the most likely option, my friends-turned-co-founders and I put together enough funds to start the business, but the crucial question still lingered. Much like everyone else treading on uncharted territories, we cautiously researched the pros and cons of having our business funded and bootstrapped.

First, let me state the obvious: From 2010, we have seen an unprecedented rise in the startup community. So when we spoke to people with real-life tales from the trenches, finding varied opinions on funding and bootstrapping was not too surprising. Our learnings were immense, diverse, and even overwhelming.

For example, I am now more inclined to the opinion that having your company bootstrapped gives you the luxury of freedom in more than one way. Don’t get me wrong. I am not saying that there is no freedom if you are getting investments from an external source but it’s just not the same.

Another alarming observation I made was the amount of time founders spent in meetings, pitching, and re-pitching ideas to angel investors, VCs, and other spokespeople to raise money. During this time, you could be enhancing product ideas, planning your go-to-market strategies, and more.

On the other hand by running a bootstrapped business you probably might not witness the accelerated growth you expected. Unless you come with a very large cash reserve, you might not be able to expand as you wish and often have to watch where you spend. Again, profit is not the only viable metric for a sustainable growth.

By tapping into the option of external investments, you are likely to be merited with several advantages along the way. Investors, themselves, are experienced mentors and come with a wealth of knowledge, connections and advice which are valuable throughout the business journey. With them as advisers, you’d never feel like you are on your own.

Obviously, what you finally choose depends on the endless influences right from the market you enter, your expected growth rate, available funds & resources, cash flow crunches, other risk factors, and lots more. There is no definitive way to equate your decision to be bootstrapped or get funded.

On a lighter note, here is an infographic we created from our consolidated learnings. Remember, what you see are just inferences and not conclusions.