Near-death experience: the ticket to startup success?

At a recent board meeting of one of our portfolio companies, the discussion briefly moved to a topic that has been getting increasingly more attention from VC investors — how fund-raising is likely to get harder.

In other words, Winter is coming.

While this might sound morbid and pessimistic, especially in the aftermath of the bounty of riches that Indian startups have raised in 2015 already, it brings into perspective the opinion that the greatest companies are created in the toughest of times. The opinion seems well-formed since several of the most valuable companies of all time have been created during a time of recession from GE to Apple.

Apple is also the inspiration for the title of this article. It went from almost going bankrupt to becoming the most valuable company in the world. Perhaps more importantly, it also draws upon Steve Jobs’ magnificent legacy of creating breakthrough companies, and upon his prolonged fight against cancer. However, Apple and Steve Jobs deserve a more elaborate post (or several dozens of posts) in the future.

So what does it take to overcome the near death of your startup and use that experience instead as a catalyst for success?

A look at Sequoia’s memo for a seed investment in YouTube reveals an interesting insight. In particular, note the first adjective Roelof Botha uses to describe YouTube’s founders.

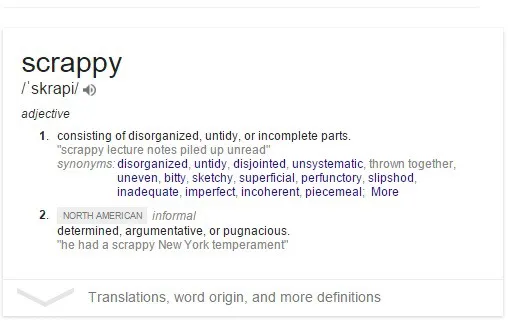

He calls them'scrappy’.

And what does scrappy mean ? This is the first result on Google:

One would imagine Roelof had the informal usage of scrappy in mind when he prepared the memo. But for those of you with some imagination, and who are familiar with the use of jugaad, the first meaning could also represent an individual who is prepared to scrounge and be frugal to make ends meet.

Scrappy is also a word occasionally used by VC investors and almost always as an expression of immense praise, as was undoubtedly the case with Roelof assessment of YouTube’s founders.

While scrappy might share many similarities with 'determination', I would venture to suggest that scrappiness is inherently more focussed on efficiency in order to achieve profitability. In a tough market, investors become more wary of high burn-rates and, therefore, love businesses that are either already profitable or can clearly demonstrate a path to profitability.

Related read: What makes an entrepreneur an entrepreneur? Determination, according to VCs

The following four examples will help us understand why taking the scrappy route is almost always the best route for a near-death situation in a startup.

- Amazon

A great analysis of how Amazon survived the holocaust at the end of the dot com crash is this Quora answer from Rishi Gorantala. Rishi demonstrates how Amazon’s OCF (Operating Cash Flows) and net income trends are a great indication of the company’s prudence and focus on sustaining itself and moving towards profitability.

However, I do not necessarily agree that the timing of the IPO was appropriate. After all, Pets.com also went public before burning through USD 300 million of invested capital in what is regarded as one of the most disastrous deals of the dot com bubble. Ironically, Amazon led the first round of venture funding in Pets.com.

- BookMyShow

BookMyShow belongs to an elite group of Indian internet companies (that also includes the likes of JustDial and MakeMyTrip) that survived the 2001 dot com crash to become household names. Their journey, though, as described by Ashish Hemrajani (Founder and CEO of BookMyShow), is replete with multiple near-death experiences. The devil is in the details :downsizing headcount from 150 to six, micro-managing power and stationery consumption, and even sweating on refuelling his car: all so that they could focus on serving clients and maintain a cash-positive business.

- Craftsvilla

Before Craftsvilla raised its recent Rs110-crore Series-B round, it had to go through a metaphorical trial by fire which led the company into“preparing for the worst no-money scenario before others.”

Indeed, the article by Manoj (Founder andCEO of CraftsVilla) captures the very essence of scrappiness with his structured approach, neatly summarised by

We became profitable to become less dependent on fluctuating VC passion and money. We became profitable so that VCs can chase us and not us chasing them which always has worst outcome.

By popular opinion, WhatsApp’s acquisition by Facebook represents one of the greatest VC deals of all time, both in terms of the absolute value and as a multiple of the return on investment.

They are many lessons to be learnt in how WhatsApp was built. Unlike the earlier examples where the firms faced challenges on the path to growth, WhatsApp was created almost as a response to adversity (Brian Action was rejected when he applied for jobs at Facebook and Twitter). The fact that they chose to redefine the ubiquitous text message with zero marketing dollars and with a team that was only 55-member strong (Having raised nearly USD60 million in VC funding) puts them in the uppermost echelons of scrappy entrepreneurs.

If you are currently facing a near-death situation in your startup and are wondering how things could get any worse, you may want to pause and reflect on the fact that you now have something in common with the greatest entrepreneurs of all time. How you respond to that challenge might well help you cheat the grave and also give them company on the other side.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory)

About the author

Shubhankar Bhattacharya is a Venture Partner at Kae Capital, an early stage VC fund. Prior to joining Kae, he was the Co-Founder and CEO of Yaqsh.com, an online store for diamonds and diamond jewellery. He has also played various roles at CMS Info Systems and Technip. Shubhankar holds a Bachelors degree from NIT Trichy, and an MBA degree from ISB, Hyderabad. You can connect with Shubhankar here on LinkedIn.