Is India ready to tread the app-only route that e-commerce majors are eyeing?

Introduction

The past few years have witnessed an explosion of smartphones. India and China, with their huge base, have transformed themselves into mobile-first market economies with m-commerce.

In a first, Myntra took a bold step to become mobile-only (app-only) business, foregoing a good chunk of revenue from its website (e-commerce). Flipkart, its parent company, wanted to follow suit and become app only in September, 2015. But the huge business risk coupled with negative comments over Myntra’s app-only policy on Twitter and on other social media made it review its stand and put the concept on hold. With Big Billion days around the corner, Flipkart wanted to bring app again into the foreground by limiting its most awaited sale to the app only. Amazon is also following the same strategy.

Advantages of app

In the startup world, customer acquisition and the cost associated with it are extremely crucial. Browsers and their associates source it with minimum effort, posing a potential threat to e-commerce startups. By going ‘app-only’, e-commerce companies can prevent browsers from analysing its customers.

Apps ensure targeted marketing based on customer tastes and needs. Companies can constantly engage and provide personalised notifications to the audience.

Most important advantage of the app is creating a captive market where companies can sell to customers without bothering about competition. This thwarts the operations of price comparison websites which improve market efficiency by web crawling or through feeds.

Apps’ statistics – Flipkart’s lead

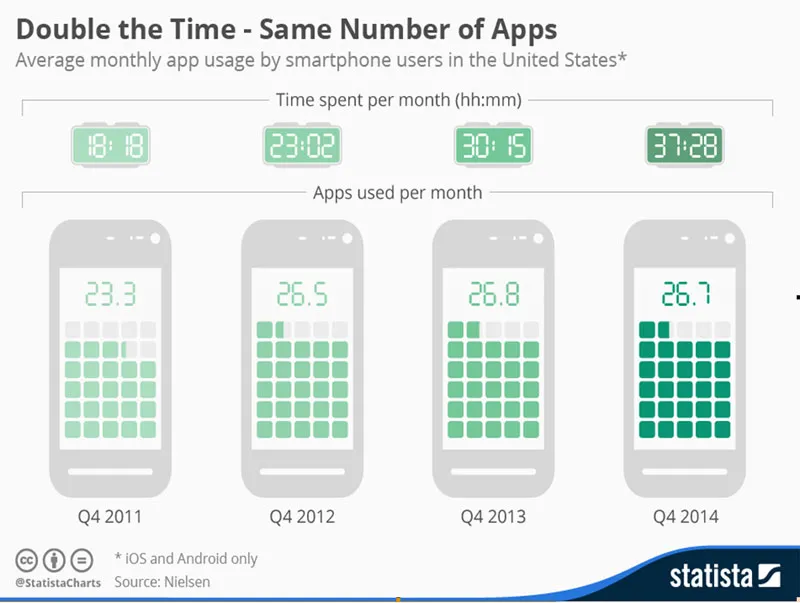

A Nielsen report talks about a stagnant trend of around 26.7 apps used per month in US for the past three years. Which means, all the 1.6 million apps in Apple’s and Android’s app stores have to compete for that dream spot in 27 apps.

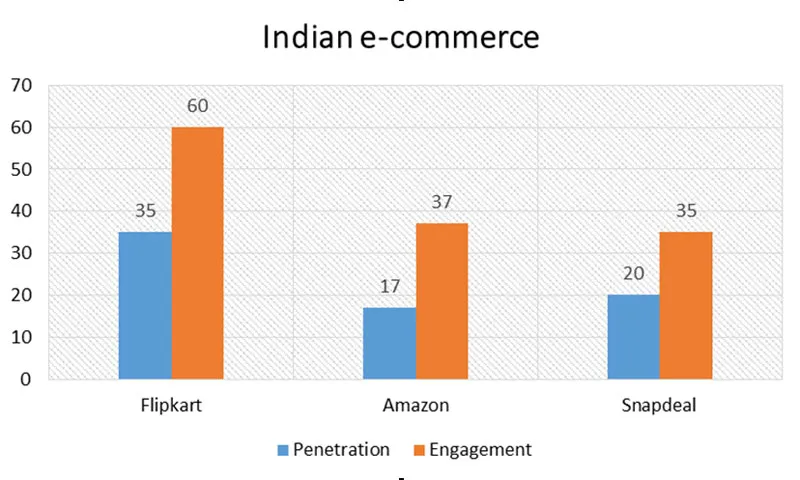

With such stiff competition, rapid smartphone adaptation and high traffic percentage from mobiles (75 per cent for Flipkart), there is a real need for any app/company to drive the consumer behaviour to use its app now. Flipkart, because of its inherent advantages, could take a huge lead as compared to its rivals Amazon and Snapdeal. It has high penetration (35 per cent) and engagement (60 minutes a month). Amazon has 17 per cent penetration and 37 minutes per month, whereas Snapdeal with 20 per cent penetration and 35 minutes per month take second and third positions.

So, Flipkart is in the ideal position to shift to app-only format and reap the benefits of first mover advantage in the long run. Amazon and Snapdeal cannot risk it because of three factors namely, less traffic percentage, penetration and engagement.

Every e-commerce firm’s dream

To obtain a stronghold in the newly shifting market domain, every e-commerce dream mission would be to find a permanent place in every smartphone in India.

In order to do that, Flipkart needs to be the pioneer in changing consumer behavior by instilling the habit of using its app among customers earlier in the game, thereby securing first mover advantage. Flipkart was ready (by trying to be app-only in September) to take the risk by foregoing present revenue from one medium (website), in order to gain future revenue from another medium (app) as a part of its long-term strategy.

Following can be some of the steps in order to achieve the mission:

Flipkart tried to shove the app down the users’ throats without their consent. With all the hue and cry around Myntra’s app-only strategy, Flipkart understood that stick approach wasn’t working. Soon it tried the carrot approach in terms of Big Billion Days, whereby it incentivises customers to turn to app. Effectiveness of this strategy is now under test with the ongoing BBD.

Future of app - cues from TV and real estate

The most important characteristic for the app to be successful is engaging. So today, if we are talking about a good app, it’s all about engagement, engagement, engagement! The good old analog cable TV was very similar in nature. We had the freedom to set the TV channels according to our priorities and interest, which are driven mostly by content and engagement.

Soon, as TV became one of the mainstream media, with highest engagement among all mediums, rapid commercialisation hit the TV industry. Even the TV channel numbers were monetised. So, to place a channel at a particular slot or channel number, broadcasters need to pay money to MSOs or local cable operators.

To benefit from its open source Android, Google pre-installed Google apps which cannot be uninstalled without rooting the phone, which will lose warranty in the first place. Most phone makers pre-install their own apps in addition to those of Google’s. Recently, OnePlus officially declared that pre-installing apps for companies can generate additional revenue apart from its core business.

I think it wouldn’t be long before some India-focussed smartphone manufacturer pre-installs Flipkart or any other e-commerce app on its mobile (I know some smartphones bought off Flipkart had pre-installed Flipkart app, but that’s very few). This strategy can contain low memory issues of smartphones and high uninstall rates of apps, which are persistent in Indian market.

In future, it’s possible to have fixed visibly prominent slots in your smartphones which can be monetised. Or just as there are corner houses and prime locations in real estate, there are home screen apps which are more accessible with a click of a button.

References

http://www.huffingtonpost.in/dhritiman-hazarika/6-reasons-why-flipkarts-a_b_7800628.html (No need to refer in the article)

http://www.statista.com/chart/3570/app-usage-in-the-united-states/

http://qz.com/481830/how-will-chinas-fastest-growing-smartphone-brands-ever-make-money/