Beyond common sense: seven useful frameworks for a startup toolkit

Peter Drucker once famously said: "Business has only two functions- marketing and innovation. Everything else is a cost." If the business of a business is to serve the customers, innovation is about creating the value and marketing is about delivering it. There are more than a few companies that have failed to innovate and market. Neither is sufficient. An understanding of innovation and marketing is infested with severe misconceptions. People wrongly assume innovation has to be technological in nature and marketing needs a huge budget. The intent of this article is to challenge some of these assumptions, and infuse a non-commonsensical approach to starting and managing businesses.

Image credit "ShutterStock"

Why do startups fail? Some of the oft-cited reasons are timing, funding, poor market insight and lack of focus, resources or capabilities, in some cases. However, the more important question is: Why don't startups scale and become businesses? One of the most prominent causes of failure is lack of growth. This is true for companies as much as for individuals, both figuratively and anatomically.

My insight on the subject suggests that one of the most overlooked reasons for failure of an enterprise at any stage of its development is in 'relying too much on common sense.’ When well-educated, well-skilled individuals resort to a commonsensical approach of managing an enterprise, the end is in sight. There are essentially three critical issues with running a business using common sense. By no means am I advocating that one must park common sense while leading one’s life, but all I am suggesting is that leading a life is a far cry from running a company, even if you are the only employee!

The first major challenge with common sense is that it is hard to discern between bad planning and bad execution. You never know if you failed because you did not give enough thought to it, or because you simply goofed up on the execution part. Equally problematic is that you don't know whether you were smart or simply lucky. That makes any outcome less repeatable or scalable or even reliable; and scale-up calls for predictability.

The second issue with a commonsensical approach of managing a startup is that common sense is non-transferable, which means that you can't induct your insights into someone else. That severely limits delegation, and hence expansion of the business. Even if you want to share or transfer, you seldom know what exactly is to be transferred. Your approach is so intermeshed with your personality that any change in scenario or applicant results in severe restraints.

Lastly, common sense changes with age, for wisdom replaces creativity as one ages. The ingenuity of solutions when someone is in their teens is far greater than someone in their 50s. That leaves your business in less capable minds as you grow - a serious error.

In summary, common sense is non-scientific, and hence lacks predictability, explanation, and control. Little doubt then that we see all sorts of family business failures around us, for the present times are too complex and dynamic to be manageable by the heuristics of the past.

Now, allow me to offer you seven tools and techniques that I believe are very useful and scientific enough to help you take better business decisions, especially if you are starting off.

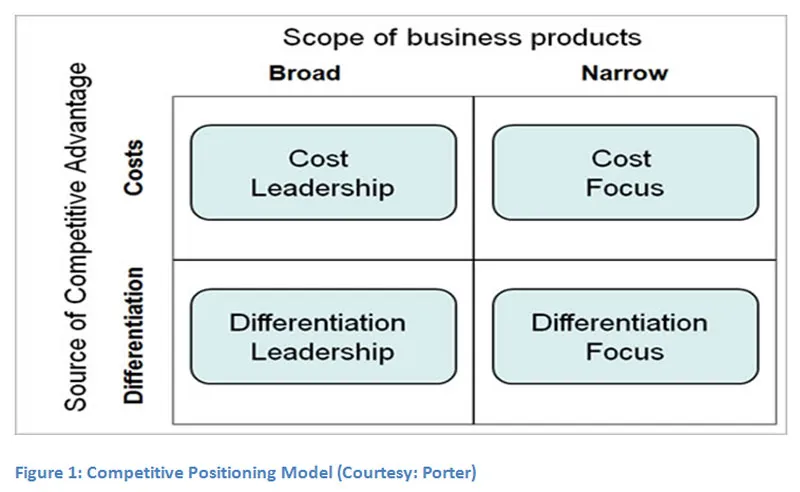

Competitive Positioning

More than a few ventures have folded because they wanted to be everything to everyone. I have always believed and maintain that the future belongs to experts and not generalists. With growing pace of automation, ubiquitous and affordable computing and fragmentation of tasks, you are bound to be more secure if you have identified your niche early. The same logic applies for a business.

Proposed by Michael Porter, the Competitive Positioning Model (Figure 1) suggests that you position your business in one of the four quadrants, based on the scope of your business and the advantage offered to your customers. Your scope, in terms of geography, demography, served needs, or behaviours could be specific versus broad. Similarly, you can either choose to focus on being a low-cost provider or a value differentiator. The means to differentiate could be superior brand, service, quality, innovation, design, or access, amongst other parameters.

Most likely the sustainability of a venture depends upon how well it is positioned in the first place, as this allows for conservation of limited resources at disposal. Hence, I advocate a startup to strive for a Differentiation Focus position.

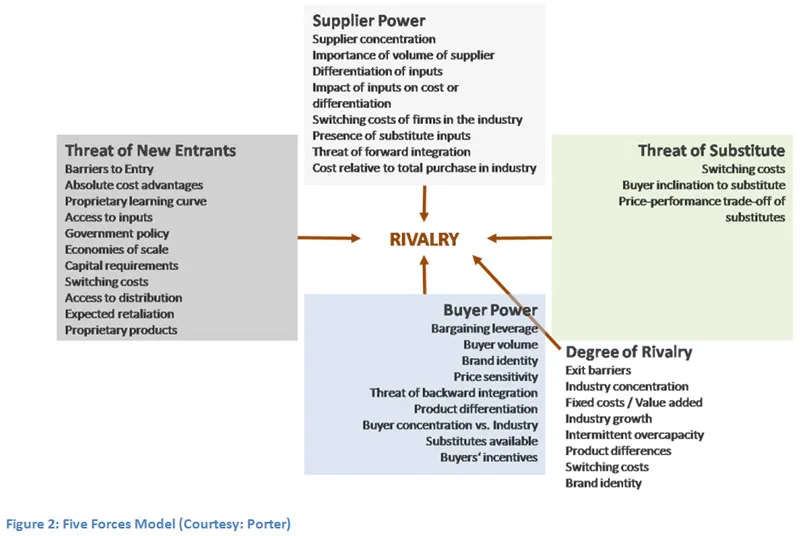

Five Force Model

Another enduring contribution of Michael Porter’s is the Five Force Model, which allows for identifying the industry where a company must operate and the approaches to erect barriers of entry and imitation.

A choice of industry doesn't always exist for an entrepreneur because the decision to venture is driven mostly by factors beyond a sound logic. Still, there is merit in understanding the forces acting on the business situated in a certain industry segment, and approaches to fend off some of the forces. Ideally, this analysis should be done before the Competitive Positioning exercise. However, I believe that competitive positioning offers a greater discretion to the entrepreneur than the Five Force Assessment, and hence my order of priority.

As depicted in Figure 2, a typical business situated in an industry segment is acted upon by five key forces, apart from some others like government policies, exogenous changes and complementary products. A thorough assessment of these forces is critical at the outset for a planning for exigency. Think of the plight of Ola Cabs in India with the advent of Uber, or the fate of Indian Airlines with coming in of low-cost carriers. These are the changes that an entrepreneur needs to be prepared for, and that can only happen by parking common sense.

Again, it is important to pay close attention to new entrants for they can learn from your mistakes and disrupt your business rather quickly. This calls for erecting entry barriers. Some of the means of posing entry barrier include proprietary knowledge, early-mover advantage, earmarking and fiercely guarding a territory, or being a fast mover, amongst others.

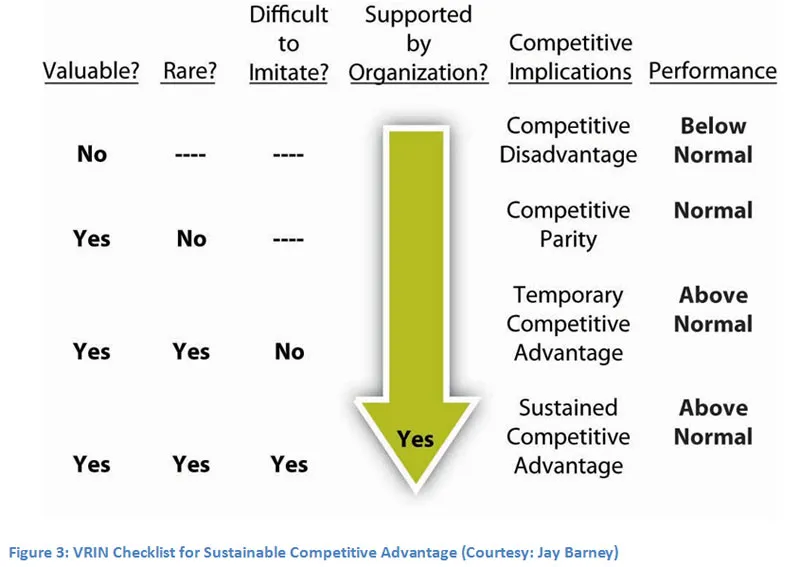

VRIN Assessment

The holy grail of any business is to have a sustainable competitive advantage. Any advantage if easily imitated by others is not sustainable, and hence can't offer sustained profits. One of the most influential and profoundly intuitive insights in strategic management is offered by Jay Barney. He identifies critical characteristics of a company's resources and capabilities to see if such assets offer a sustainable competitive advantage to the firm.

A resource is a tangible asset that a firm needs to compete, whereas capabilities are intangible abilities vested in people and processes that utilise those resources to yield value for the customers and appropriation for the firm. The VRIN analysis offers that for an asset to count in strategic terms it must meet the requirement of being: Valuable, Rare, Inimitable, and Non-substitutable.

I believe this to be a very powerful model. The checklist, especially the elements of Rarity and Inimitability, forces an entrepreneur to look at leveraging or accruing the assets that offer a superior value to the upstart. Mostly venture fail because they aren't based on rare or inimitable assets, except for maybe the promoter.

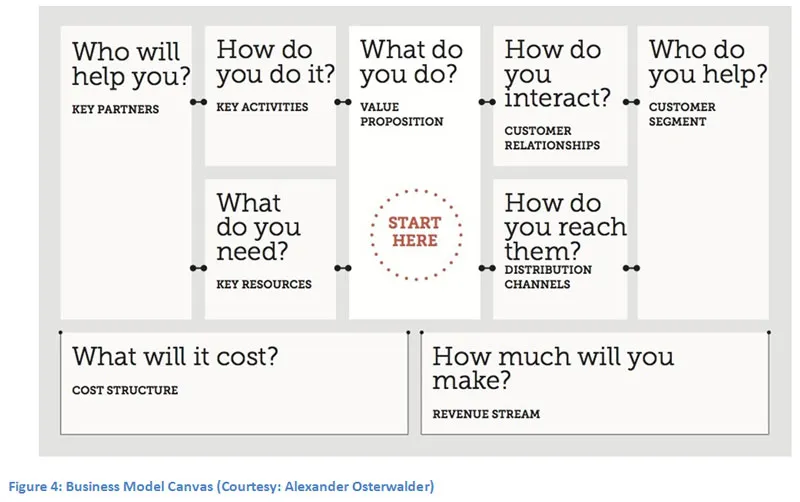

Business Model Canvas

Entrepreneurs and managers are increasingly realising that is it the fight of business models and not just products or services. It was the concoction of iPod, iTunes, and iStore that changed Apple's fortune, or for that matter the combination of cash on delivery, a large delivery fleet, and an online application that made FlipKart a force to reckon with. Products and services don't deliver value in isolation, and even if they do, one of the most powerful ways of erecting entry or imitation barriers is to knit products or services with novel business models.

Proposed by Alexander Osterwalder, a Business Model Canvas offers a comprehensive view of an entire business, right from key customers to be served to the key resources and key activities involved in delivering the requisite value.

One could, in fact, disrupt an incumbent or carve a niche by significantly changing one of the elements of the business model while keeping the rest intact. If an entrepreneur could map the business model of its competitors and then its own business model, there is a high likelihood that new ideas will spring up from the exercise. Even for existing businesses, it's a great exercise.

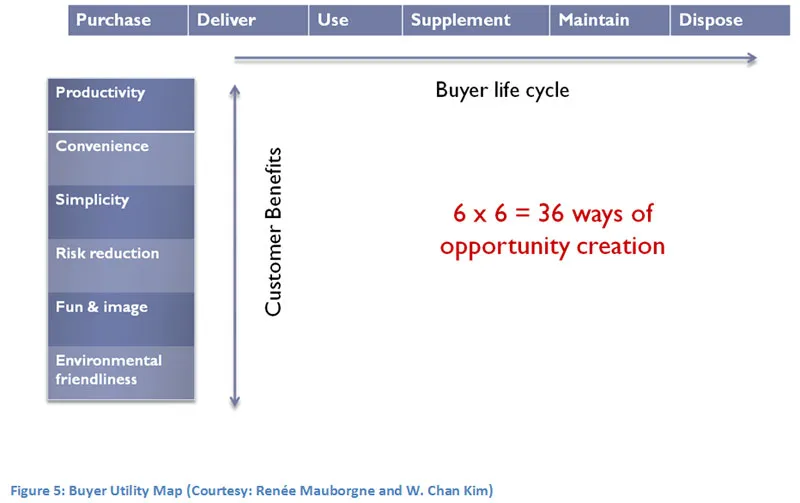

Buyer Utility Map

One of the most influential texts on strategy is Blue Ocean Strategy, a book by Renée Mauborgne and W. Chan Kim of INSEAD. Here, the authors offer powerful tools to carve out positions of competitive superiority while playing in a rather crowded market. One of the highly useful tools is the Buyer Utility Map which offers a matrix comprising of six stages of a consumer lifecycle and six potential value-adds that the company can offer.

The 6X6 matrix offers 36 possible interventions where an entrepreneur can possibly identify a niche and start serving the market. Remember, entrepreneurs emerge at the interstices of the economy, the markets which are un-served or underserved by the incumbents.

At the outset, the entrepreneur can map the experience of herself as a consumer, identify the apparent gaps and scale the experiment with incumbent customers. This exercise offers a sharp insight on missing value-adds and possible interventions.

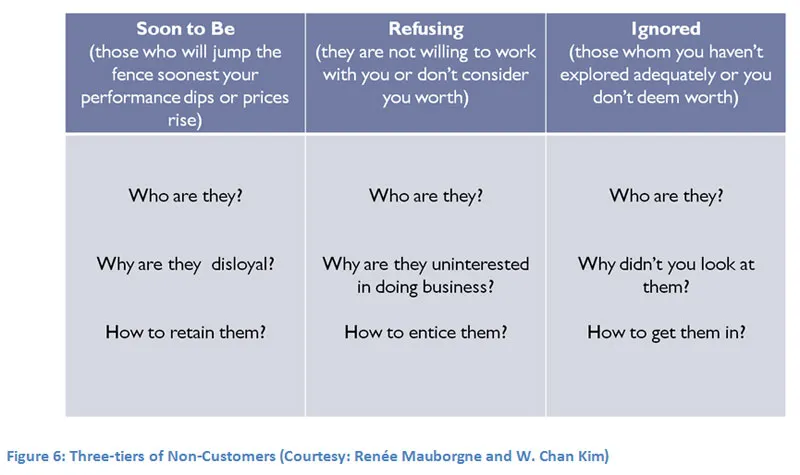

Three tiers of non-customers

Another significant contribution from the stable of Blue Ocean Strategy is the Three-tiers of Non-Customers framework. It is as impactful as it is intuitive. Here, the authors urge a business to look at non-customers, instead of fighting it out to secure more customers. Typically, the price wars meant to poach customers lead to a lose-lose situation, and a near-death spiral for the incumbents. Instead, why not look at the virgin markets?

The three tiers of non-customers are: 1) soon-to-be non-customers; 2) refusing non-customers; and 3) ignored non-customers. An investigation of how to get these customers could offer interesting insights on what more should be done in terms of value add or how to create new markets.

I here offer a modified view of the model which I often adopt in my workshops.

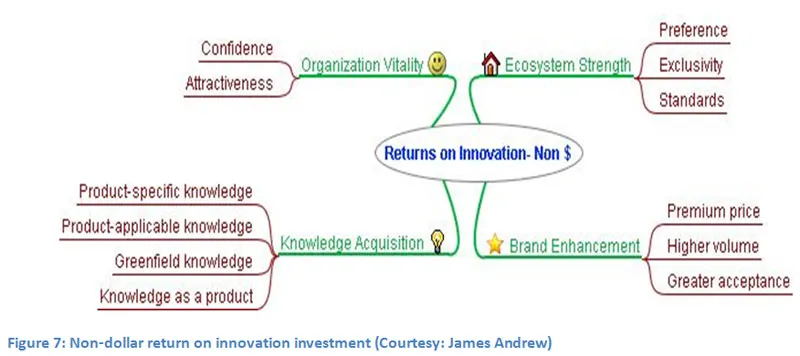

Business Payback

Often, an entrepreneur is at a loss to understand the worth of an investment that doesn't yield direct business benefits or offer cash. This becomes critical especially while scaling the business, for every investment done may not yield cash return. For institution building, there is a lot of intangible required, and this intangible still needs to be measured to offer a sense of orientation to the entrepreneur and the enterprise.

The useful book by James Andrew of Boston Consulting Group titled Payback explains the means of assessing the value of an innovation investment. I liked their concept of non-dollar returns on innovation investment, and believe that this view of looking at the enterprise is very useful at any stage of the investment cycle.

If an investment doesn't offer cash benefits and, instead, offers advantages in terms of brand enhancement, knowledge acquisition, ecosystem strength or even organisational vitality, the investment should be done.

To sum up, I suggest to entrepreneurs and managers alike that there is a lot of useful science available on how to start and run successful businesses. Remember, common sense has its own peril, and you won't even realise when you have gone too far into the mundane. So it is about time that you get back to basics and cut your losses by bringing some method to the madness.