Can Paytm really be a game changer in the payment banks space?

In a piece of news that has caused a ripple in the finance industry,the Reserve Bank of India (RBI), on August 22, granted ‘in-principle’ approval to 11 entities for setting up payment banks in the country.

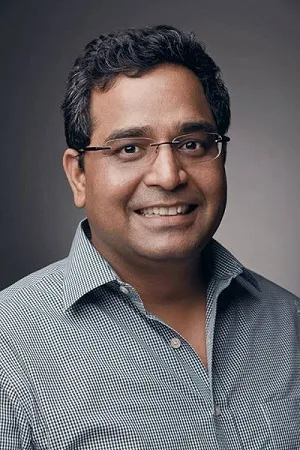

This is a move toward the RBI’s vision of financial inclusion. Amongst the 11 chosen for the license, Dilip Shanghvi, Managing Director of Sun Pharmaceuticals Industries, and Vijay Shekhar Sharma, Chief Executive Office, One97 Communications, the parent company of Paytm, were the only two entrepreneurs to get the license in their names. Although Vijay told the media in reports that he’s got the license on Paytm’s name, the RBI announcement narrates a different story.

At present, Paytm, a mobile payments and commerce company, claims to have crossed 100 millon users in the country, carrying out 75 million transactions every month. However, the number of active users, and number of transactions made by them every week or month is not known.

In February, the Alibaba-backed Ant Financial Services Group pumped $575 million in order to acquire a 25 percent stake in One97. If that wasn’t enough, March saw an undisclosed amount of funding going to Paytm from Ratan Tata. In the same month, the company crossed a Gross Merchandise Value of $1 billion, with a mere 15 per cent of customers choosing the Cash on Delivery (COD) option.

After reporting a 350 per cent growth between 2012 and 2013,Paytm became one of the largest digital commerce companies in India in 2014.

With such behemoth figures, the question arises as to what Vijay Shekhar Sharma plans to do with the payment banks licensing.

What Paytm plans to do?

Talking to the media recently, Vijay said that the payments business will be separated from the e-commerce wing, and will be called Paytm Payment Bank Ltd. This is because RBI has made it mandatory to add ‘Payment Banks’ to the names of new initiates in order to differentiate them from legacy banks.

According to Vijay, the license equips Paytm with the third part of their business model, concentrating around savings, with Buy and Pay being successfully integrated into their marketplace and wallets. Moving forward, the consumers will get added incentives (like interests) to keep balance in their wallets.

Following the same media report, the new entity will be registered in the next three months. One97 will hold a stake of less than 40 per cent, while the majority stake (51 per cent) will be going to Vijay. The remaining stakes will be allotted to One97’s subsidiary. This is in accordance with the RBI’s regulations, demanding that an Indian promoter should have a majority stake in the company.

Havinga separate leadership team with a new CEO, the new company will hire 2000-2500 people in two years, according to Vijay.

Despite different circumstances, this sounds more like the eBay and PayPal spinoff that happened last month. In 2002, eBay acquired PayPal for $1.5 billion; fast forward to 2015, they have split and eBay’s valuation for PayPal is $34.5 billion, a growth of almost 33 times since its last valuation.

Moreover, there is no doubt that PayPal was a driving force in eBay’s revenues. According to reports, out of eBay’s revenue growth of $396 million from Q4 2013 to Q4 2014, PayPal contributed $327 million, making it the industry heavyweight it is.

We tried contacting Paytm to understand more; however, no one was available for comment.

Will digital payments usher the new wave?

According to Abizer Diwanji, Partner & National Leader, Financial Services, Ernst & Young, most of the licensees chosen have two things in common. Either they have a strong distribution in the mobile space or own a complete ecosystem which people rely on.

Out of the 11 enterprises to get payment banks licenses, eight own authorised mobile wallets licenses. Moreover, payment banks open the door to a world of possibilities for mobile wallets to do a lot more, driving inclusion for the unbanked.

Abizer tells us,

“Mobile wallets just allow transactions to take place. However, the need today is to create digital channels and load more outlets where people can pay and receive, rather than just transact. This creation of various digital channels is where the efficiency will come. With lot more innovation coming into various modes of payment, the cost of intermediation will reduce leading to profitable models.”

Thus, payment banks seem to be the next obvious step where mobile wallets will be heading.

Launched four years back, Immediate Payment Services (IMPS) has set the tone for mobile payments in the country, helping transfer funds securely within seconds. Now, with the payment bank licensees with their innovation will take this product of the government to different corners and strata, ushering a truly digital and inclusive India.

So, why only Paytm?

In their insights on the mobile wallet market in India, research firm Technavio identified Citrus Payment Solutions (Citrus Wallet), One97 Communications (Paytm) and Oxigen Services India (Oxigen Wallet) as the three key vendors in the space.

With only Paytm getting a license out of the three, and staggering figures backing its argument, popular predictions remain with Paytm to emerge as a disruptor in this space.

Although, the RBI has stated that it would move towards giving more licenses regularly and virtually, opening opportunities to the other 30 contenders, Abizer tells us,

“The licenses to other players might not come early. This equips time advantage to not just Paytm but also the other 10 companies, since payment banks alone might take 18 months to set up.”

This might mean that distribution of the first set of licenses might be a pilot for the government to see how these companies leverage the platform while building other regulatory reforms around it.

Being the conglomerates that they are, Google and Facebook reached their height of glory by organising their respective spaces -- information and databases of people. Similarly, with multiple digital payment entities functioning in the market, the entity which will organize the fragmented offline transaction space at a scale first will be the real winner in the space.

(With inputs from Emmanuel Amberber)