Making sense of the growing app mania among Indian consumer Internet startups

There is an app-craze sweeping India’s consumer Internet world. Founders and CEOs have time only to sing praises of the mobile app and the growth it is driving for startups. But is the growth so spectacular and is it sustainable to justify going down the app-only path?

The growth is definitely strong. Sales of fashion discovery and retail portal Voonik have grown 10 times in the last six months. For Co-founder Sujayath Ali, this growth is ample justification for the Bengaluru startup's decision to shift focus to its mobile app platform. Voonik, which launched in early 2014, is targeting $20 million in sales for the year at the current rate of growth.

Our aha! moment was when we launched our app in August last year,” says Ali, who saw numbers -- from users to revenue -- shoot up almost immediately.

Almost every consumer Internet company has such impressive numbers to share when it comes to growth through mobile in general and through their apps in particular. So much so that some of them are becoming app-first platforms or even creating businesses tailored around mobile apps.

This is the case of Snapdeal, which re-launched Shopo as an app-based marketplace earlier this month. Anand Chandrasekaran, Chief Product Officer at Snapdeal, says the results were almost instant. A new listing gets created on the chat-based marketplace app every five seconds, over 1,000 merchants have listed their products and the app has crossed the 10,000-download mark on the Android play store.

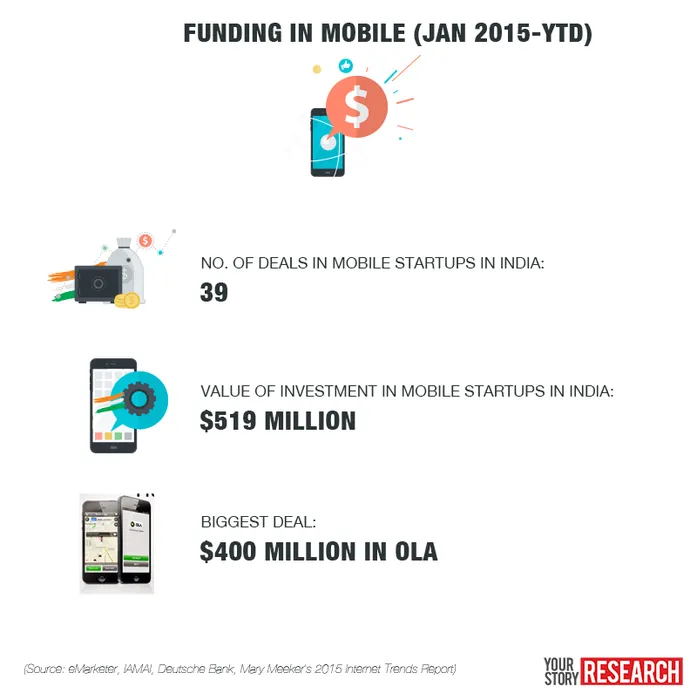

Entrepreneurs, investors, and experts say it is the confluence of a number of factors that is making 2015 the ‘year of the app’ in India’s e-commerce universe.

Galloping user numbers

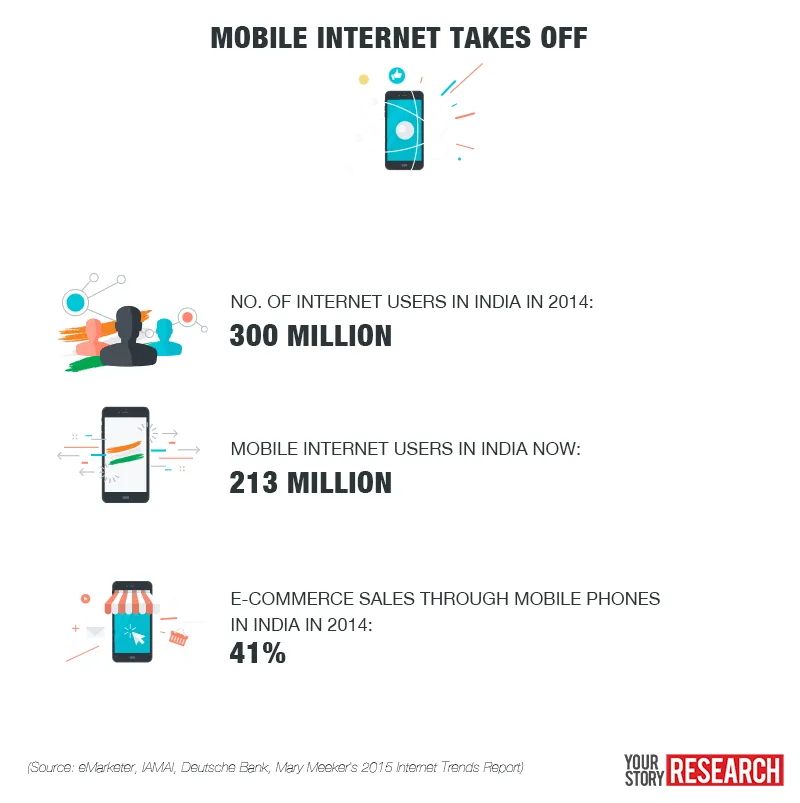

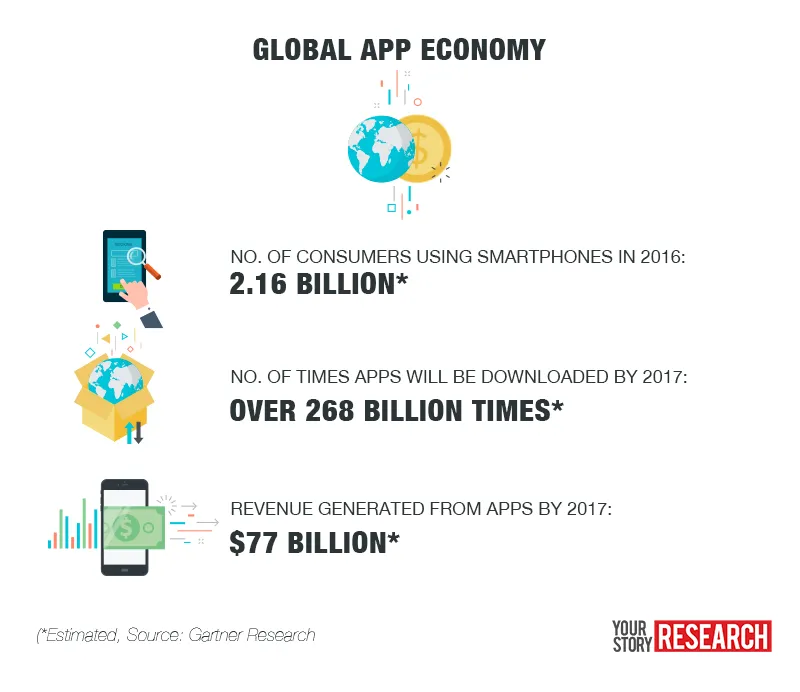

There is no doubt today that the world is shifting to mobile and India is leading that move. Over two billion consumers worldwide will own smartphones in 2016, according to eMarketer, of which 200 million will be in India. A number of Indians are accessing the Internet for the first time through their mobile devices and are conducting transactions and buying products through their phones.

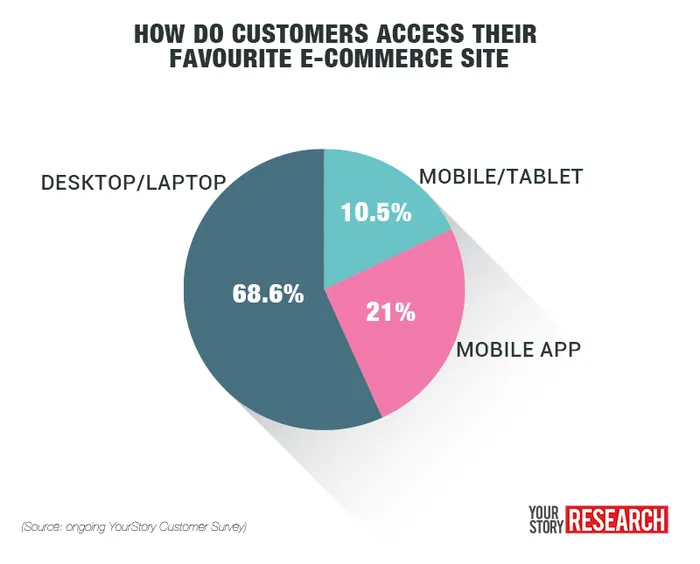

This shift is reflected in the various metrics that e-commerce companies track. Around 75% of Snapdeal’s monthly revenue comes from mobile platforms. Snapdeal did not disclose the revenue contribution from its app.

For Bengaluru-based online grocery site ZopNow, about 50% of transactions come through mobile devices. Its app accounts for 20% of overall transactions. ZopNow is targeting to cross $1.5 million in monthly sales in Dec 2015.

App specific business models

Smartphones are getting smarter every day. “Smartphones are like humans. It can feel movement, can see and hear, even feel the user’s heartbeat,” says Anand of Snapdeal. Anand is spearheading Snapdeal’s 'String of Pearls' strategy, where various products of the group or ‘pearls’ are strung together by a set of common features or services like loyalty points on Snapdeal being used on Freecharge, a feature that will be launched soon. He says the day is not far away when apps make use of these advanced capabilities and automate more aspects of our lives.

Prasad Kompalli, Head of e-commerce platform at Myntra, says apps allow integration with contacts, calendar and camera, which can be used to improve the user's experience. Myntra went app-only earlier this year.

"We are going to launch a visual search soon. Flipkart has already launched it. You can also ask your friends and family suggestions on a look as the app is integrated with the contacts list,” says Prasad.

He says the call to shut down other platforms was taken as the team wanted Myntra to be a full-fledged fashion solution for users, offering everything from style advice to shopping, and not just a shopping site.

It is the app platform’s salient features that led Snapdeal to keep Shopo an app-only marketplace.

Shopo is highly chat driven. From engineering perspective we wanted the chat to be stable and functional for both the merchant and buyer. We make massive use of camera and editing tools. That is why we decided to go app-only for Shopo,” says Anand.

It was, similarly, an obvious choice for Ankur Singla when he decided to change Akosha’s business model from a complaints resolution platform to a concierge services provider. Delhi-based Helpchat, as the new avatar is called, gives consumers access to concierge services from help with deciding on what laptop to buy to laundry pickup through its chat-based mobile app.

Use case of chat was more valid on mobile. Our decision to become app-only came from the business model. We got to 30,000 chat sessions a day within six months. It took us four years to reach 8,000 complaints a day on the web," says Ankur, who launched the product in January.

Changing the consumer’s behaviour

Experts suggest that the mobile app also helps create more loyal customers.

Typically a consumer will not have five different shopping apps. It changes consumer behaviour by inducing loyalty. It also increases frequency of purchase,” says Aashish Bhinde, executive director (digital media and technology) at financial services firm Avendus Capital.

In a way, the consumer becomes a captive audience if he prefers a particular online retailer and only the app available.

The cost of customer acquisition also comes down. “Once the download is done, the customers will come to the app directly. The sites don’t need to pay Google or Facebook for customer acquisition,” says Rahul Chowdhri, Partner at venture firm Helion Ventures. Helion is an investor in e-commerce firms like Livspace, Shopclues and Bigbasket.

Voonik’s Sujayath echoes this view. “On an average a customer spends one hour on the app per month. Repeat customer rate on the app is 45%, while it is 30% on the desktop,” he says. Sujayath says focusing on the app helped create differentiated identity in the minds of consumers.

Why shut down the site?

This is the question many are asking, with reports indicating that Flipkart too will follow subsidiary Myntra and turn into an app-only retailer.

App-only route in my mind is a disaster. If anyone thinks consumers are married to them--that’s a misnomer,” says Mukesh Singh, Co-founder and CEO of ZopNow.

While smartphones might have become smarter, storage is a major issue especially for lower-end smartphones, which are still popular in India. Consumer Internet and shopping apps need to compete for a limited number of slots.

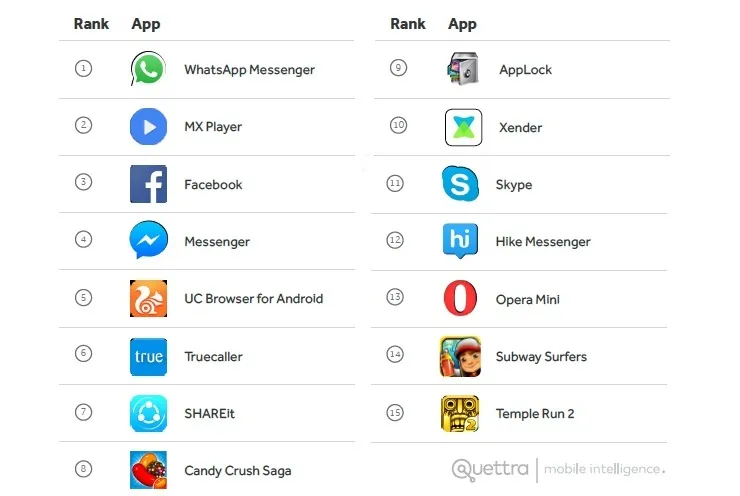

The graphic above shows that not a single shopping app features in the top-15 preferred apps that are installed the day a new phone is purchased. Google apps like Gmail, YouTube, Maps and other commonly pre-installed apps have been excluded from the study done by mobile intelligence company Quettra for the month of June, that only considers Android users. “You have to compete for around 10 spots. There are 3,000 apps competing for that spot. It is like IIT entrance exams,” says ZopNow’s Mukesh.

With consumers being bombarded with apps and storage not improving by much, uninstall rates remain high—at up to 90% in India, according to industry estimates.

Helion’s Rahul too says he does not believe the app is the only way to go. “If my app is on the fourth screen of the phone, then that is as bad as going through the browser,” he says.

Others like Avendus’ Aashish question the logic behind shutting down the mobile site, especially at a time when the mobile has become the primary platform for most consumers.

Many feel the decision should be left to the consumer.

“We don’t want to do something artificial and make it an either-or for consumers. That is why Snapdeal will not go app-only,” says Anand.

(Want to find out the latest in mobile? Check out MobileSparks)