Coinbase sets eyes on India, makes bitcoin wallet available

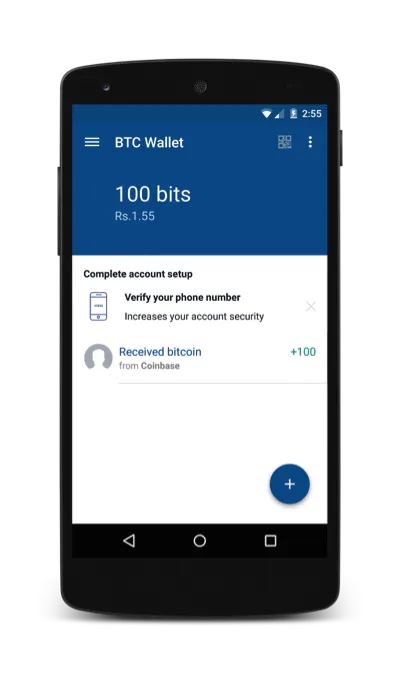

If you’re a YourStory reader based in the US or the EU, this comes as good news. Popular bitcoin wallet provider Coinbase is giving free bits for all its new users. As new users create a verified account, Coinbase gives out 100 bits, which can be securely stored or sent to a friend anywhere in the world.

Coinbase was founded in 2012 to make it easy for merchants and consumers to transact with the new digital currency on its bitcoin wallet and platform. It has raised (USD 106 Million), the largest ever VC amount raised by a bitcoin company. The platform allows users to instantly buy bitcoin on mobile. TheUS and European users in supported jurisdictions can connect a bank account, verify their mobile number within the app and instantly transfer USD and EUR to buy and sell bitcoin.

Ankur Nandwani, mobile and growth Engineer at Coinbase, tells YourStory, “Currently, Coinbase integrates with bank accounts in 26 countries, and we plan to be in 40 countries by the end of this year. India is a country which is high on this list as a part of this expansion.”

Earlier this year, Brian Armstrong, Coinbase CEO, said, “In India, there are 100 million phones that are connected to the Internet. 2 per cent of those people have a credit card or bank account, and those people don’t have a desktop computer, and they don’t have email.”

Understanding local regulations

Every bitcon startup requires strict know-your-customer (KYC) and world-class anti-money laundering (AML) protocols. One thing that is the Achilles hills of bitcoin startups is the struggle with compliance.

Ankur adds, “Compliance is something that is specific to a country or a region. It is hard to replicate it from one region to another. So, as companies are launching in new regions, it is extremely important that they understand the local rules and regulations, and make sure that they are in compliance with them.”

The bitcoin industry is witnessing favourable adoption worldwide from fortune 500 companies like Microsoft, Expedia and Dell. Even New York Stock Exchange (NYSE) has started showing the price movement of bitcoin market value. According to NYSE president, Thomas Farley, “Bitcoin values are quickly becoming a data point that our customers want to follow, as they consider transacting, trading or investing with this emerging asset class.” And this move is the first of many bitcoin-based indexes that the NYSE plans to launch. Here, in India, we don’t know how far away we are from RBI making up its mind on the subject with Sensex and BSE following suit.

The bitcoin evolution in India

Bitcoin regulation in India is still shaky. But there are positive developments, as well, when it comes to adoption. CNET founder, Halsey Minor, is expanding his bitcoin bank Bitreserve to India. Bitreserve protects customers from the volatility of bitcoin by instantly locking deposits to a fiat currency selected by the customer. The company has also announced the launch of the bitrupee (BitINR).

Other local startups like Unocoin, Coinsecure and Zebpay are also pushing the ecosystem for mass adoption of bitcion in India. Coinsecure has joined Nasscom to connect India to bitcoin, and bring it into mainstream usage across the country. Zebpay is also working to bring merchants in its fold. They’ve also sold Farhan Akhtar’s live concert tickets through their app.