There’s no doubt your idea is great. But with the boom of startups and the aid that’s available in the country for entrepreneurs, what should be considered while making a decision with regard to actually getting your startup off the ground? What is needed with the quantum of work that has already been done? What bracket of mentorship do you require?

“Some people want it to happen, some wish it would happen, others make it happen” ~Michael Jordan

Image credit "Shutterstock"

Here are some ways for budding entrepreneurs to make their idea happen through incubators, accelerators, angel investment, seed capitaland venture capital.

What is a startup incubator?

The primary purposes of incubators are to create, advice, and/or foster new startups rather than to be a source of investment capital.

They collect rent and hence do not necessarily acquire equity stake in the startup.

- Incubators provide:Infrastructural support i.e. office space, meeting room

- Platform for networking

- Other support services, specific to incubators

In short: If you have the idea, need a space to operate, are willing to have co-workers and are in need of a little investment, try reaching out to an incubator.

What is a startup accelerator?

An accelerator is almost the same as an incubator, with a few variants. Your time in the space is typically limited to a specific period, ranging from a few weeks to a few months, and it involves an application process.

Accelerators acquire stake in the startup, from around 5 to 15% of the equity.

In short: If you are sure of your idea and timelines, and are in need of mentoring, look for an accelerator!

Who is a business angel?

Wikipedia defines angel investor or angel (also known as a business angel or informal investor or angel funder) as an affluent individual who provides capital for a business startup, usually in exchange for convertible debt or ownership equity.

In short: If you need a little more money than just the seed capital you generated, you need to assure your lenders that they have nothing to lose, on paper!

What is seed capital?

Seed capital often comes from the company founders' personal assets or from friends and family. The amount of money is usually relatively small because the business is still in the idea or conceptual stage. Such a venture is generally at a pre-revenue stage and seed capital is needed for research & development, to cover initial operating expenses until a product or service can start generating revenue, and to attract the attention of venture capitalists.

In short: If you have the idea and the money (of course from friends, family and yourself); run the show!

What is venture capital?

Venture capital (VC) is financial capital provided to early-stage, high-potential, growth startup companies. The venture capital fund earns money by owning equity in the companies it invests in.

In short: Your business is highly profitable and your VC sees it. Go for a VC as the capital here is much, much more!

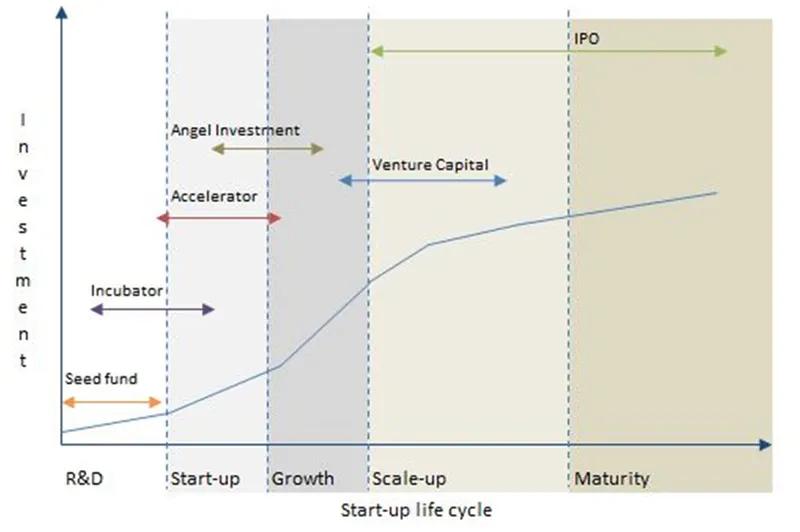

Here’s a chart to enable you to further decide which fragment do you fall under, and what is the type of funding you should need:

About the author: Corraine Santos is Founder Rentalook (www.rentalook.in)