Startup valuation for dummies, how much is your company worth?

One of my techie friend started a venture with two of his mates and they had a product ready petty soon. This was relatively easy as they had the money to build the product but now the problem arises that how he would launch that product in the market? He needs money for which investors will have to come into the picture. But before going to investors, he needs to figure out the amount he requires and also value the product. And he doesn't have a clue about how to do it. (how much is your valuation and equity dilution after first round?)

Valuation is an important part that a founder or an executor always has in his mind. Valuation matters to investors as they are getting the company share in lieu of the money they are going to spent.

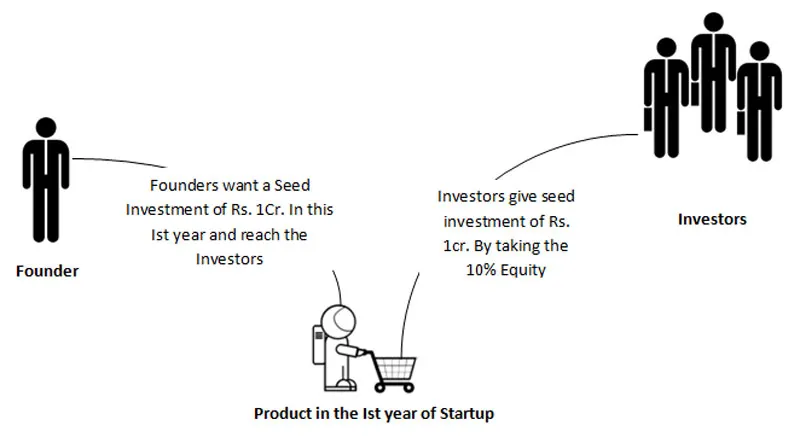

Let us see this situation with the help of an example:

In this above example, founder is looking for a seed investment of Rs. 1cr. And the investors invest Rs. 1Cr. in lieu of the 10% of the equity. Typical deal, the pre- money valuation will be Rs. 10 Cr. But this does not mean that the company has Rs. 10Cr. worth now. Owners probably could not sell the company for that amount.

“Valuation at the early stages is a lot about the growth potential, as opposed to the present value.”

How to determine valuation?

Determine the value of the company at the seed/early stage is commonly described as the art of describing the growth rather than a science.

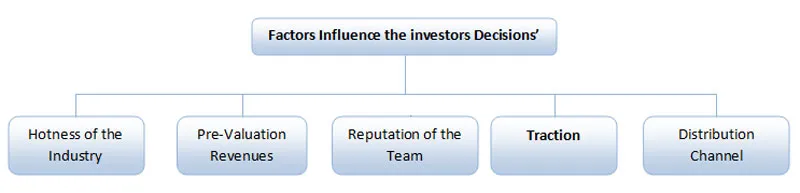

Let us see what factors does influence the decision of the Investors:

Let’s discuss these points One by one:

- Hotness of the Industry:

Investors travel in packets just like they are going behind with others who already take leads in the market. If something is hot and others are already investing in the industry, they may pay a premium so as to stand in that particular industry.

- Pre-Valuation Revenues:

Revenues are more important for the startups. Revenues make the company easier to value. In the initial stage if you have a functioning product and up to the most the product is yielding the revenue from the market, then this could be the most effective point that will affect the investor decision.

- Reputation of the Team:

Before going to take a round for investment one must build his/her authority or the image in the market. The most important thing what a VC looks is the founder capability and his image in the industry or belongs to the particular industry.

- Traction:

Traction is a sign that your company is taking off. Traction is basically quantitative evidence of customer demand. You can always get more traction

In other words, traction is growth. The pursuit of traction is what defines a startup.

Out of all things that you could possibly show an investor, traction is the number one thing that will convince them. The point of a company’s existence is to get users, and if the investor sees users – the proof is in the pudding.

- Distribution Channel:

Even though your product might be in very early stages, you might already have a distribution channel for it. This will help a lot for the VCs to get to know what the startup is and can become the turning point of the decision of that investor.

Methods of doing Valuation

Some of the valuation method that may be used in the valuation of a start up or the methods by which the valuers’ find out the valuations of the businesses:

- Discounted Cash Flow Method:

This Method is the most usable and appropriate method to value the company in the initial stage. The discounted cash flow method takes free cash flows generated in the future by a company and discounts them to derive a present value (i.e. today’s value).

This Method mainly depends on the free cash flows that you are going to earn in the future and affected by the various factors which includes the inflations and unstabilities that will come in the market at the future stage.

- Venture Capital Method:

The venture capital method reflects the process of investors, where they are looking for an exit within 3 to 7 years. First an expected exit price for the investment is estimated. From there, one calculates back to the post-money valuation today taking into account the time and the risk the investors takes.

- Market comparables method:

The market comparables method attempts to estimate a valuation based on the market capitalization of comparable listed companies.

4. Decision Tree analysis:

Decision trees are used to forecast future outcomes by assigning a certain probability to a particular decision.

The name decision tree analysis comes from the ‘tree’ like shape the analysis creates where each ‘branch’ is a particular decision that can be undertaken.

Does a startup need high valuation at initial stage?

It is not compulsory. When a startup gets a high valuation for the seed round, then for the next round they need an even higher valuation and, that means the startup needs to rise up in his position a lot. There are two ways of looking at this:

- GO BIG or GO HOME: It means that in the seed round raise as much as possible at the highest valuation possible, spend all the money fast to grow as fast a possible. If it works you get a much higher valuation in the next round, so high in fact that your seed round can pay for itself. And, if it doesn’t works then there is also no problem.

- Raise as you Go: Raise only that which you absolutely need. Spend as little as possible. Aim for a steady growth rate. There is nothing wrong with steadily growing your startup, and thus your valuation raising steadily.

Conclusion

In conclusion, market forces right now greatly affect the value of your company. These market forces can do a favorable job or unfavorable job for the company in the field of the growth and yielding revenue from the market for the appraisal of the company. The best thing a startup can do to arm itself with a feeling of what values are in the market before you speak to an investors is by speaking to other startups like yours that have raised money and see if they’ll share with you what they were valued and how much they raised when they were at your stage. This will help a startup in getting better valuation at an early stage.

Bonus Infographic from Funders and Founders on How Startup Valuation Works – Measuring a Company’s Potential:

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)