7 proven hustles that raised over $720M in funding

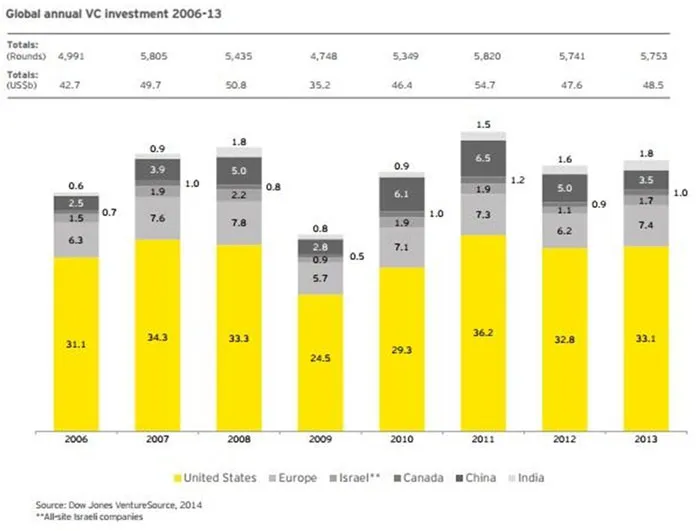

Securing a venture capital or angel investment isn’t easy. Though the startup ecosystem is strengthening and the gap among investors and entrepreneurs getting narrowed, most start-up still miss on the opportunity to seize funding or getting through an incubator or accelerator. Despite these odds a total of USD 48.5 billion was pumped by various venture capital firms in recent time. This was irrespective of a recuperating US economy that controls almost 68% of global VC activity as stated in the Global Venture Capital Insights, 2014 by E&Y. The study hints that road to success isn’t far.

(Image Source: Global Venture Capitall Insights, 2014 by E&Y.)

Though quite resilient in their outlook, most startups have an excellent product that they boast of, but how many of them catch the attention of investors, is a question worth pondering, which in a way contrasts the opportunities available.

A new breed of entrepreneurs climbed their way up the ladder and caught the eye of the investors despite cut throat competition. Hustlers, as we know, sold that ‘one in a billion idea’ with the right tactics. Here’s a list of 7 proven hustles that got these companies the required funding and the attention!

InstaCart

Same day delivery is a dream come true for many households .What stood as a challenge for many e-retailers, caught the eye of Apoorva Mehta. While the idea was brilliant Apoorva missed the deadline to apply at the Y combinator, an American seed accelerator. He unfurled his contact list and got talking for a last minute consideration. A series of negations, led him to understand that though there was a bleak hope (dependent on a slightly positive e-mail) none of the decision makers had experienced the product firsthand.

What worked for them- Apoorva, decided to place an instant order through this app and the ‘six pack’ of beer is the reason that got them the required funding. He got this order delivered to Garry Tan at the Y combinator’s office. Garry’s response to this delivery was baffling and he called InstaCart to understand ‘this’ and that’s when Apoorva explained the power of ‘InstaCart’ to them.

Lessons to learn- Funding is one aspect of business; whether your investors understand your product is another. Pull them to the battleground and beat them to it. Innovative ideas also work around.

Funding Status - $54.8 Million

InMobi

What began as mKhoj transformed itself to InMobi- a mobile advertising giant by understanding the changing dynamics of business. Desperate times call for desperate measure adage stands true to the growth of InMobi’s success today. The only hope for the founders was securing a ticket and travelling to the Silicon Valley to convince investors about the product.

What worked for them- Having exhausted major funds, and a being left with a balance of meager $2000, buying a ticket was also a dream! Abhay Singhal, one of the co-founder, conceived of a ‘hustling’ idea and cracked a deal with a travel agent getting them an opportunity to repay after almost 3 months of travel (He told the travel agent that InMobi was a sizable organization, which would need business class tickets throughout the year!) . Having battled the first roadblock, they set the right cord with the investors through cold calling.

The first big break for the company came within a fortnight of travel, when it received the desired funding.

Lessons to learn- It all begins with taking the right step and pushing the limits. Some sales and marketing tactics need to be re-introduced often to rework the magic, something as simple as cold-calling is one of them.

Funding Status - $215.6 Million

Vungle

Back in 2011, marketing apps through video trailers was unheard of. However Zain Jaffe, Co-founder and CEO, believed in this futuristic concept.

The only challenge for them was the tight approachability to reach investors and like any other start-up then, they didn’t want to fade away. The task was to approach and catch the attention of Thomas Korte, founder of AngelPad, an American start-up incubator.

What worked for them - Vungle’s approach has been the most unique till date. They used the power of social media to reach Thomas Korte, however with a twist. They bought ads and lead micro search along with hyper-local ads on Facebook to reach him. The message was positioned as ‘urgent’ and anyone who knew Thomas Korte was supposed to intimate him about the same. The message had a clear call to action button and a landing pitch with Vungle’s pitch. Soon Thomas Korte was flooded with emails and that’s how the team at Vungle got their big break.

Lesson to learn - Evolving with marketing tactics is the key to be noticed. Ads are one of the most controlled ways of drawing the attention of investors. However this tactic would work best in moderation and should not be overdone.

Funding Status- $25.5 Million

AdPushup

With a modest beginning in 2013, Ankit Oberoi and Atul Agarwal have scaled up the funding chart quite brilliantly. AdPushup is an innovative platform for the marketers that help them to increase their ad revenue by advanced A/B testing. In a brilliant blog post, Ankit lists the process on how they hustled their way up.

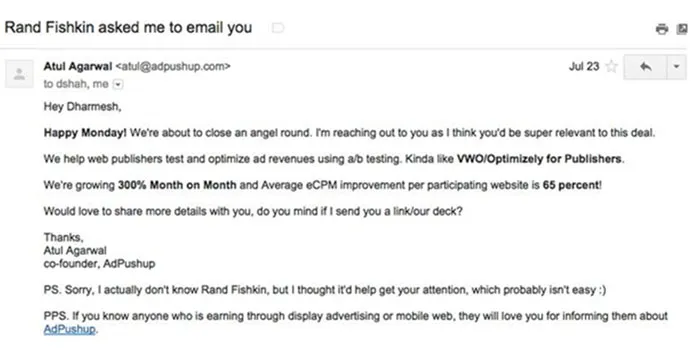

What worked for them- Ankit and Atul used an exceptional e-mail marketing strategy to reach their prospective investors. This however was far away from normal since they turned the complete essence of ‘introductions’ that is a common practice within startup fraternity. The company started mailing key influencers (Guy Kawasaki, Seth Godin and Jeremie Berrebi to name a few) with a catchy headline, which looks something like this >

(Image Source: AdPushup Blog)

A subject line like that cannot be missed. While the approach led them to a good funding, a few influencers found it obnoxious. AdPushup was quick to learn from it and hence they decided to send another round of emails coupled with an apology and an explanation about their action.

Lesson to Learn- Reaching out to investors begins within your own community. E-mail marketing if used effectively can do wonders. Adopt innovative ideas to hike up your chances.

Funding Status - $632K

GetCast

While cold calling may do wonders for one start-up, the same may not to be true for others. Benjamin Evans and his team at GetCast were in talks with investors and in the midst of this mayhem, missed the deadline to apply at Matter- a start-up accelerator for media entrepreneurs. GetCast was quick to realize this lost opportunity and hence decided to approach this with a plan.

What worked for them- A missed deadline may be read as a sign of being nonchalant by investors, and startups do realize the gravity of such a blunder. The team designed a website with an eye catching creative and text explaining the reason for the delay and why should they be considered.

(Image Source: GetCast Website)

The second phase of their campaign was to exploit the existing network of both Matter and GetCast.They sent out e-mails and tapped social media to build traction. While they explained to the community about their story along with an explanation of the delay they were also active in monitoring these engagements on bit.ly. At the end they got the desired attention and the funding from investors.

Lessons to learn- A website that screams attention may be looked down upon, but it’s still catchy. Also clubbing two approaches during a testing time will lead fruitful results.

Funding Status - $90K

Fab.com

They have fab in their brand name, and let’s just say that the hustle was fab too! Fab.com is one of the most coveted e-commerce companies in its space. Jason Goldberg, the company CEO was trying to garner investors’ attention after a failed and much publicized loss of $48 million funding while setting his first start-up. An opening line like that isn’t appealing on a resume and while Goldberg realised it, he was poised and honest with his next product.

(Image Source: Twitter)

What worked for them- While reaching out to Andreessen Horowitz (the sought after name in the VC arena) Goldberg compromised on the face to face interaction and instead proceeded with sharing the internal data of Fab.com with him. Data plays a critical role within an e-commerce setup and both the owners and investors understand its significance. This blatant honesty worked in favor of fab.com and they received the required funding.

Lessons to learn- Sharing data with a prospective investor isn’t easy and an in depth analysis and belief paved the way for fab.com. Therefore, it is critical for start-ups to dissect the big data in- house, before reaching out to investor in the open market.

Funding Status - $336.3 Million

WalletKit

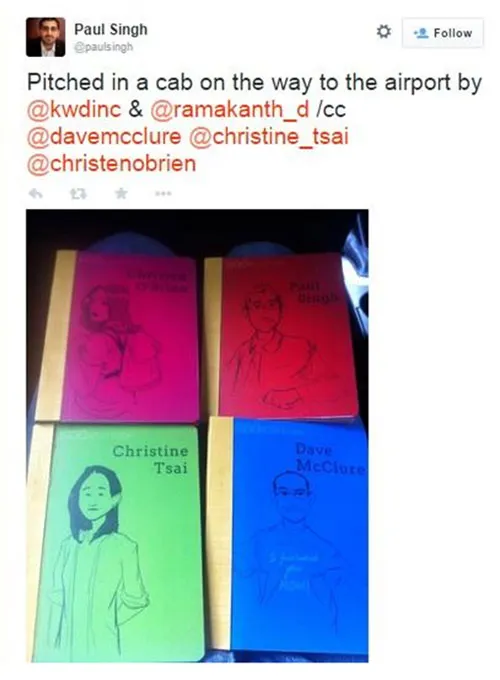

WalletKit is a SaaS based product that delivers digital passes and tickets to mobile wallets. They aimed at being considered for the 500 Startup accelerator program and chose the conventional way of reaching out to Paul Singh, one of the investors.

After repeated ‘no response’ emails from Paul Singh, the team tracked him through a geo-tagged tweet and succeeded in convincing him about the product.

What worked for them- The excited team realized the opportunity, and reached out to Paul’s hotel and handed him their pitch with unique caricatures donning the covers (including Paul Singh as well!). This absurdity, though shocking at first, was well accepted and the team received a place in the program.

Lesson to learn- Knowing your investors is important and monitoring what they say or do on social media has its importance too. The company was also focussed on which accelerator program was suited to them and thus went behind it with full gusto.

Funding Status - Undisclosed

Hustling today has become synonymous with quick growth; however the same should be unique to the business, lest it may be dumped by the investors. It is also important to remember that businesses should follow this path with grace, without considering this tactic as a mandate of some sort. Any hustle with a planned and minimalist approach that doesn’t jeopardize your chance is always welcome and who wants to garner negative publicity , right?

Author: Laxman Papineni is the founder of AppVirality. He can be reached at [email protected].

(image credit: Shutterstock)