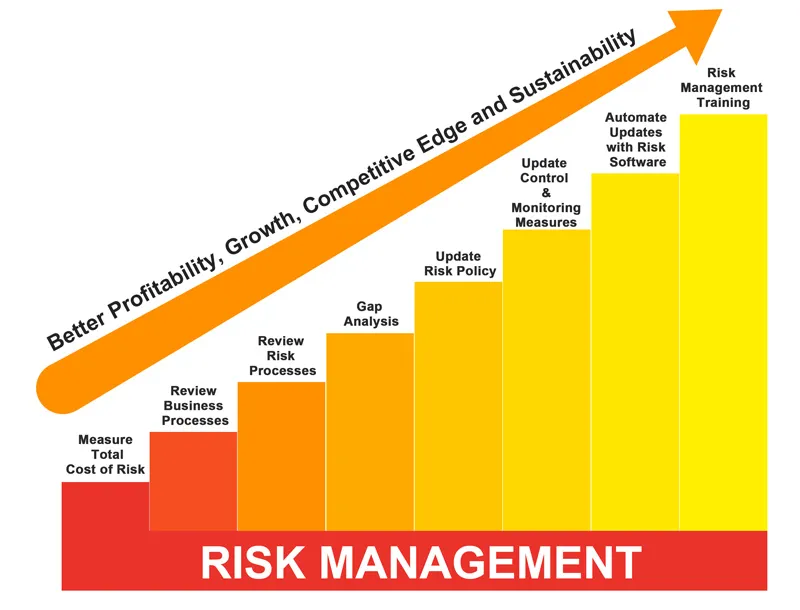

Risk Edge offers risk management for energy and commodity

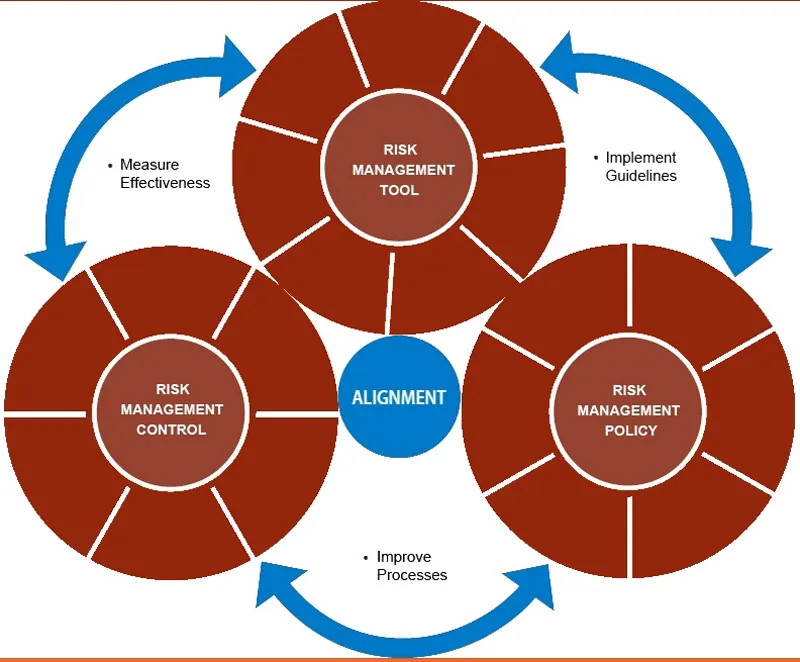

Risk Edge Solutions is a Hyderabad based startup started in May 2013. They provide an advanced risk software designed specifically for energy and commodity companies. It automates their entire risk management process, giving them risk analytics, reporting and control on their fingertips.

Nitin Gupta, Co-founder of Risk Edge, says that currently, the industries use old school methods like excel add-in driven risk systems, which are prone to errors and not scalable as the business expands. And unlike the Banking and Financial Services Industry (BFSI), commodity players generally have less sophisticated systems and processes to manage risk on volatile commodity prices. But given the recent surge in volatility across all commodities globally, there is an immediate need to upgrade their systems and processes.

Since the business processes of Commodity Trading Risk Management (CTRM) are different from the risk systems designed for BFSI, the same cannot be used effectively by commodity companies, leaving a handful of vendors with understanding of both risk and commodities to handle this space.

Nitin Gupta claims that the commodity trading has rarely drawn the kind of attention it's peers in BFSI have drawn, in spite of having similar exposure and risks to the portfolio. Several industry leaders in the CTRM industry continued to deliver risk management systems through excel add-ins, downplaying this significant industry need of advanced risk management. The risk management software market for commodities is about USD 500 million annually and it has grown between 7-10% over the last few years as predicted by CTRM Center (leading analyst firm covering CTRM).

The market for SaaS is expected to grow at a greater pace than the enterprise software, and Nitin states that RiskEdge is the only company in the world to have both enterprise and SaaS based risk software for commodities.

“Risk Edge team has previously sold and implemented Risk Software projects for several companies, including many Fortune 2000 companies. We saw a huge gap between market needs and offerings – in price points, usability, delivery mechanism, sophistication and marketing. So we decided to come up with a fresh product offering that can ease these pain points. Today, we have a software that is cost effective (both on Cloud & Enterprise), very easy to use (web-based), advanced (it covers many risk analytics and exotic derivatives) and is one of the best marketed products in this space,” adds Nitin.

The company was started by Nitin Gupta along with Deep Kumar and SantoshiIppili as Co-founders. Nitin Gupta shares that before starting this company, he was actually looking out for a new job and he was approched by a leading companyto expand their risk management domain. Soon he figured that their products were built around excel add-ins, which were not effective incurrent scenarios. That's when he took a dive to build his own company to bridge the gap by offering a sophisticated product with its own algorithms that are not driven through add-ins.

RiskEdge is completely bootstrapped till date but faced their real challenge while selling their product. They could not find any marketing agency that could really understand this domain. And as it's a niche product, it was difficult to build a channel sales partner network to reach their prospects and there were no legal/sales framework to help them get started. So they had to spend time building this on their own and today, he proudly shares that they enjoy a presence in six countries through all their efforts.

You can check out more about Risk Edge Solutions here.