For the past 18 months I've been on the road selling the India venture story. It's been quite a process. The process of raising money for a fund makes raising money for a company with revenues and profits (even losses) so much easier - at least you have data and a product to showcase!

Raising money for a fund is all about finding a group of people who believe that you will be able to build a business, out of an idea, that in the future, may over time, generate revenue and profit and hopefully create returns. It's a unique journey, but more on that in a future post.

While selling the India venture story, I often get asked, "That's great, but what about exits?" After hearing the question a few times, like all good entrepreneurs I learned that it was not going away and I would be better off tackling it head on. So we analysed the data to show that while investors may have heard similar stories seven years ago, things were different.

How? Two factors drive liquidity - IPOs and acquisitions. Both are facilitated once companies achieve a certain scale.

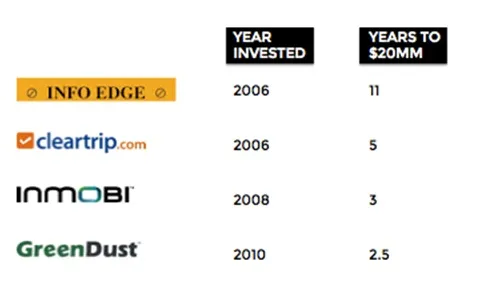

We created Table 1 from a selection of companies from our portfolio over the years, to show how the entrepreneurial ecosystem has matured and to exemplify the fact that companies are growing bigger much faster than they did seven years ago.

Given this increasing pace of scale, companies are able to more rapidly cover their operating costs and thereby generate cash flow (yes, even us venture investors care about cash flows). This in turn will open doors to the public markets as well as attract the attention of acquirers inside and outside Silicon Valley. See Tables 2 &3.

So while we now have achieved scale (albeit at a much slower pace than any of us had hoped would have been the case 7 years ago), we now need growth.

Tech companies are nothing without growth. The real value creation will take place in companies that are able to demonstrate differentiated growth by taking advantage of the imminent technology boom (a result of the explosion in data & apps).

India is such an amazing opportunity today. Old-tech companies like TCS are growing at ~35% (4 year CAGR), agri-tech companies like Kaveri Seeds are growing at ~65% (4 year CAGR). For new-tech companies to earn their place in the public market, they will have to deliver much higher growth rates. (Source: BusinessWorld, Fastest Growing Companies, 11 August 2014). This is not just possible but something that we are now starting to see in some of our Fund 1 companies.

A growing per capita income supported by a nationwide desire (in the farthest corners of the country) to access more products means that technology driven solutions are the only option.

So brace yourselves - with more connected users, here come growth like we have never seen before.