Is consolidation on the cards for the Indian cloud telephony segment?

Over the past few years cloud telephony has come a long way in India. With easy to use service, cloud telephony offers a number of advantages over traditional PBX (business phone system) to startups and SMEs. “I have started using Voicetree’s IVR service to handle more than 1,000 calls every day for my organization, Yuva Kalyan Parishad, this year. The service geared us to receive greater number of calls and capture actionable data,” says Alok Priyadarshi, COO, Yuva Kalyan Parishad.

For the uninitiated, cloud telephony refers specifically to voice services and more specifically the replacement of conventional business telephone equipment (such as a PBX) with third-party VoIP service.

At present, there are close to five serious startups, including Ozonetel,

Exotel, Knowlarity, Sonetel, MyOperator and Sipper Global Informatics among others are evangelizing cloud telephony space in India.Recently Knowlarity had raised $16 million funding from Sequoia Capital and Mayfield Advisors and is eyeing multiple acquisition in the space.

A quick look at growth of startups in IVR space

Ozonetel currently handles about 10 million call minutes every day and almost 40,000 hours of calls happen on a daily basis on the Ozonetel platform, KooKoo. It’s the only cloud telephony player who owns the complete stack, including the hardware.

“We did Rs 6 crore business last year, while this year we have already crossed 4 million ARR, so we will close this year at a minimum of Rs 25 crore. Since we are bootstrapped, we concentrated on the bottom line,” says Chaitanya C, Founder of Ozonetel.

Another strong competitor, Bangalore-based Exotel has more than 600 companies that trust them. “We handle about 2 lakh calls a day and present in six states in India,” says Shiv Kumar Ganesan, Co-founder, Exotel.

Meanwhile, Knowlarity which is the largest player in the field claims over 6500 paying customers worldwide, ranging from mom-and-pop startups to very large blue-chip companies. With its series B funding it’s in a better position to deal with competition and expand globally.

A year-old startup MyOperator, has over 8000 plus registered users, including 500 paying clients like Aam Aadmi Party, Aamrapali O2, Lenskart, Snapdeal, and Shop.IRCTC.

Acquisition and investment in Indian cloud telephony space

- In February 2013, Ozonetel acquired customers of Resolivity’s Voicegain platform. Post this acquisition, Ozonetel had taken over the Indian customers of Voicegain.

- Earlier this year, Gurgaon-based Knowlarity acquired Unicom Techlabs, and another Delhi-based startup in the same space.

- Knowlarity Communications had secured $16 million in series B funding from Sequoia Capital and Mayfield. Earlier in January 2012, it had raised Rs.34 crore in funding from Sequoia Capital.

- Exotel raised 2.5 crores Series A funding from Mumbai Angels & Blume Ventures – for a 25% stake in the company – on ET Now’s Super Angels show in March 2012.

Cloud telephony is a niche, will take time & effort to become mainstream

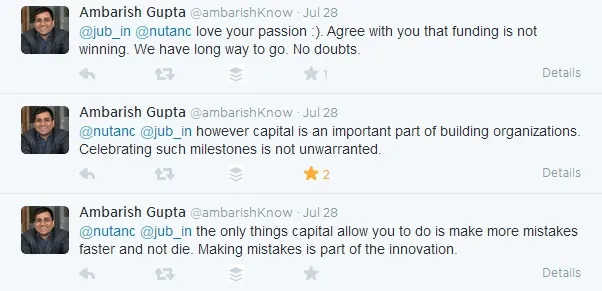

While announcing the recent funding, Ambareesh Gupta, CEO of Knowlarity hinted about consolidation in the space (read about the Unicom TechLabs acquisition). Knowlarity is bullish about acquisitions in this space but its counterparts hold a different line of thought. Shiv believes that cloud telephony is currently a niche. “We need to make it mainstream. There are millions of SMEs who don't know what this is all about. Education is the key,” he says. Unlike e-commerce which impacts millions of people, cloud telephony is probably impacting only a few thousand companies. “We are still in the process of getting people to understand what it means and in turn, learning what the market actually wants,” says Shiv. They believe consolidation to be a wrong term to use as it happens in a saturated market. “If there are millions of SMEs in India, clearly, we are all far from saturation,” adds Shiv. There have been exchanges on social media as well:

Follow the twitter threads for more on the exchanges. The cloud telephony space is in a very interesting space and we're at the cusp of a shift that'll point towards a way forward.