What has been Flipkart's funding journey that led to the latest billion dollar round?

With rumours of Flipkart having successfully raised a war chest of nearly a billion dollars doing the rounds, here is a look at the company’s funding journey since its inception. The chart below shows their funding journey from 2010 onwards. The initial rounds from 2007 to 2010 have very sketchy details available in the public domain, with records becoming clearer after institutional investors came into the picture.

Flipkart’s valuation too has kept pace with the increasing rounds of funding, with the latest round estimating its value at $5 billion. Flipkart has been moving at a blistering pace in the last few months ever since Amazon formally launched its e-commerce marketplace and ramped up aggressively:

- After a long courtship, the firm finally acquired Myntra in May 2014 to become the largest player in the highly lucrative fashion category

- Within a few days after announcing the Myntra acquisition, the Flipkart founders revealed their successful next round of funding of $210 million led by Russian investment firm (Digital Sky Technologies) DST Global. The notable thing in this round is the participation of DST Global led by Russian Yuri Milner, who rose to fame when he struck a deal for buying 1.96% of Facebook for $200 million in 2009. This investment not just brought muscle in the fight against Amazon, but also the wherewithal to go global with blue chip credentials

- Hired Rajnish Baweja as Finance Controller in July 2014. Rajnish had previously worked at Bharti Airtel in an international finance role, raising speculations about Flipkart’s intentions to raise funding from global capital markets

The trigger for these rapid plans to be set in motion was the global big daddies of e-commerce – Amazon, ebay, Walmart – launching large scale initiatives focused on the Indian e-commerce sector. With the developed economies saturating their e-commerce potential, these major companies have been looking towards high-growth emerging markets such as India. The e-commerce retail (non-travel) is expected to grow over ten times from its $2-2.5 billion base in just six years, making it an attractive destination. Amazon launched its marketplace and quickly expanded into 25 categories and listed more products in Flipkart. It also launched numerous innovations such as rapid delivery, easy pickup and drop for sellers listed on its platform, tie-ups with kirana stores for package delivery and so forth. Ebay quietly invested and then upped its stake in Snapdeal for hundreds of millions of dollars over two rounds, essentially buying an option in the company. Walmart too has launched e-commerce portal for B2B retail given the current FDI norms.

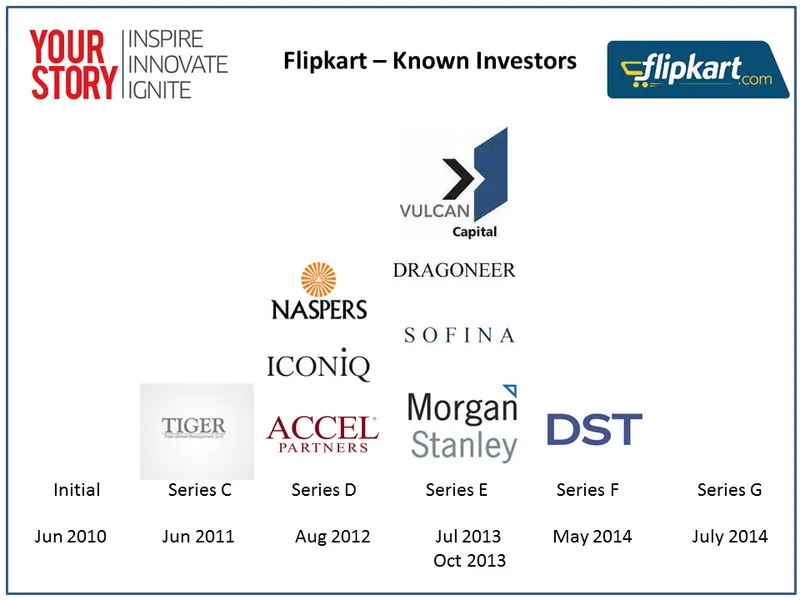

This enormous kitty of $1.75 billion dollars is unheard of in the Indian ecosystem. Further, it is a big-ticket round even by global standards, with Uber recently announcing a $1.2 billion round. It takes close to 10 different investors to achieve this humongous scale. The chart below lists the different investors that came on board for specific rounds of funding. It does not include the investors that got on board Flipkart through the Myntra acquisition, namely, Kalaari Capital, PremjiInvest and IDG Ventures.

With Flipkart already listed in Singapore and its recent announcements about funding and hiring, the path to a global IPO seems to be paved and ready.

What do you think is the best outcome of this rumoured funding of $1 billion in Flipkart’s battle against global biggies? Share your thoughts below!