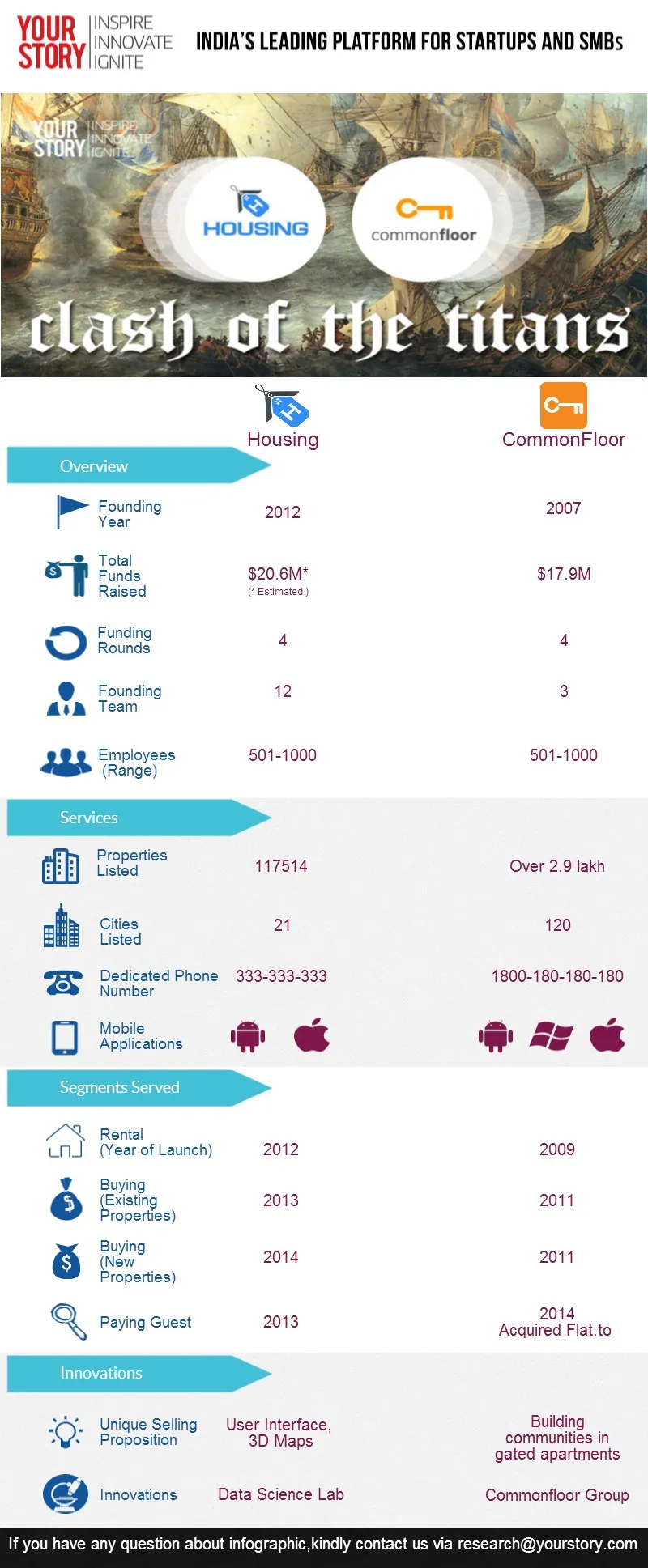

[Infographic] Clash of the Titans: CommonFloor vs. Housing

We start a new series called "Clash of the Titans" from today, where we look at the top two or three competitors in some of the interesting sectors in India and bring to you a comparative analysis of the strategies being employed by them.

The Indian real estate sector has come a long way and is today one of the fastest growing markets in the world. As the market has matured, the services that serve this market have evolved too. The market size of the Indian real estate sector stood at US$ 55.6 billion in 2010–11 and is expected to touch US$ 180 billion by 2020. There are newer well-defined segments opening up in addition to the traditional rental and purchase market - for PG accommodation, for student accommodation, for flat sharing and so on.

In a huge market with players like 99acres, MagicBricks, Sulekha etc, there are two comparatively younger players - CommonFloor and Housing.com, which are creating a well-defined niche for themselves. Both bring different strengths and capabilities to the battleground. CommonFloor, given its origins as a software for connecting people in apartments, has an excellent ability to provide access and reach into these communities even today. For example, they recently launched a community initiative called 'Right Step' where they invite experts from various walks of life to write about ways enhance the quality of life around homes. This deep access to these communities can be sold at a premium to any marketer who wants to reach these individuals for selling their wares. Housing, on the other hand, emphasized on excellent design and interactive user experience, helping in differentiating it from among many standard listing services. In addition, Housing relies heavily on data tracking and analysis through their Data Sciences Lab (DSL) in decision making. It is an interesting competitive landscape to watch and learn from.

Notes:1. Funding amount for Housing.com is an estimate, as the press releases only gave an approximation

2. Housing.com's first 2 rounds were Angel and Bridge rounds

3. CommonFloor.com's first 2 rounds also had undisclosed amount of money that are not included in the number in the infographic

Evolution

2007:

CommonFloor:

- Started as a Community Management Platform service to provide solutions to the people living in a gated society or apartment complex, to share problems and discuss solutions with their neighbours

2009:

CommonFloor:

- Realizing that the one of the biggest problems of the people living in gated societies was to rent their apartments, they got into Rental services

2011:

CommonFloor:

- Started helping their consumers by providing information about new upcoming projects from various builders

- Started listing Brokers and Builders Profile in addition to property listings

2012:

CommonFloor:

- Launched a new map based search feature for property buying and renting, which is integrated with Google Maps

- Got reviewed by MIT Technology Review India, as one of the top 20 innovators in the country

Housing:

- Launched rental services only in Mumbai

2013:

CommonFloor:

- Launched the real estate app with a unique augmented reality feature that lets a user find relevant properties in the direction in which the phone is pointed. It displays all properties for 2.5 km in that direction

- Hired air-conditioned hatchbacks, sedans and luxury cars to ferry affluent and value driven Indians to and from upcoming properties to facilitate ease of discovery

Housing:

- Launched Price Heat Maps, which helps people in gauging the price variations in real estate across the city

- Added a new section as 'land classifieds’ with an aim of covering 10,000 villages, which allows farmers and villagers to list and sell their land assets. A bold move from an urban firm with limited knowledge of this space

- Launched a 3D map-based product that visually represents property details on a city map, making it very interactive

- Started PG Accommodation because their Data Science Lab (DSL) group realized that on the price slider, a large number of people were applying in the low range and the research showed that these were mainly youngsters who are looking for low-end rentals, mainly PG accommodation

- Launched brokers profile along with their listings, creating an additional source of revenue

- Started providing its services in Bangalore, Chennai, Kolkata, NCR, Pune, Hyderabad

2014:

CommonFloor:

- Has been focusing on becoming a full spectrum of services across the entire property cycle from search to purchase or rent

- Controversy on a public forum by an employee who shared his opinions on the startup and its founders, causing a PR nightmare

- Acquired Flat.to to get into PG accommodation and Flatmate search space

Housing:

- Launched Housing.com New Projects (under construction) with 3D buildings to replace real estate brochures

- Started providing its services in many tier-2 towns such as Nagpur, Nashik, Surat, Vadodara, Ahmedabad, Jaipur, Indore, Vishakhapatnam, Mangalore, Vijayawada

What interesting comparative marketing strategies have you noticed between CommonFloor and Housing? Tell us in the comments below!

![[Infographic] Clash of the Titans: CommonFloor vs. Housing](https://images.yourstory.com/cs/wordpress/2014/06/33.-clash-of-titans-Housing_CF_Featured_FINAL.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)