InOpen raises strategic investment from Japanese education giant

InOpen Technologies, an Indian education company incubated in IIT Bombay, has raised a strategic investment and Series A round of equity capital from Japanese education giant Benesse Holdings. InOpen had earlier raised a seed investment by VentureEast in Aug 2011.

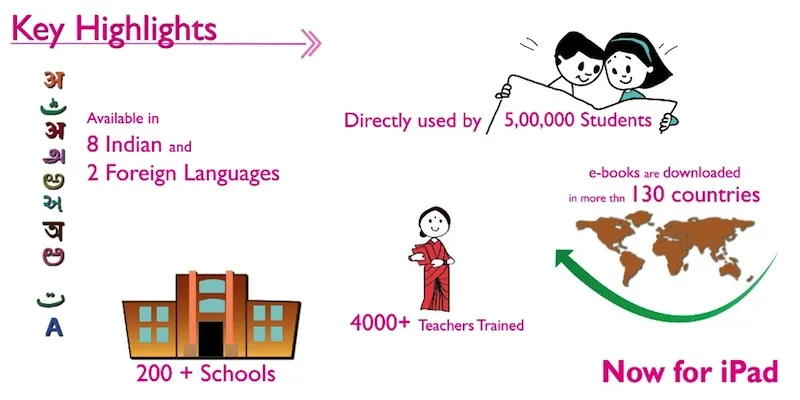

Rupesh Kumar Shah and Dr. Sridhar Iyer started InOpen in 2009 to present content to students so that they are equipped with the right combination of cognitive (thinking) and behavioural (life skills or 21st century skills) skills along with the right attitude (self learning abilities). They have been providing content in 8 Indian languages and 2 international languages to more than 500,000 students in over 200 private schools across India and also for a large scale government project in Assam and other states.

YourStory caught up with Rupesh Kumar Shah, CEO - InOpen Technologies.

As an entrepreneurs, how different was the first round of fund-raising with VentureEast compared to this Series A round with Benesse?

Seed-funding to Series A is definitely a challenge for education companies in India. InOpen has actually raised some angel funding from Dr. Shridhar Shukla (who is also a board member) followed by seed-funding from VentureEast. Prior to that, Dr. Sridhar and I borrowed some money from friends and family.

In fact, Series A is very different to seed-funding. Series A funding is essentially for growth, which in my opinion marks a transition of a startup to a more organised and focussed company. The pitch and people involved are very different and the focus is more on getting the right team, product, service, quality to facilitate scaling. Business and financial model are far more detailed as compared to seed round.

We worked with Investment Bankers firm Unitus Capital on this deal led by Amit Rathi and Abhishek Fogla. If you are planning to raise Series A and rounds beyond that, I would strongly recommend you to go with an investment banking firm of your choice.

Also, it takes much longer to close Series A funding than seedround. The team needs to plan cash flow well in advance. The time to close the deal can be anything between 3-12 months. There are more participants involved in the Series A round, so scrutiny will be more as well. The delays could test your patience and belief levels indeed. VentureEast did not participate in this round, but they are very supportive and played a major role in helping us reach this stage.

Was it difficult to raise fund as an education startup?

It was not very difficult but not very easy either. I attribute it to the fact that we were more keen to raise money from a strategic investor or an impact fund. The market sentiments were not helpful either as education big-wigs have not performed that well in the public and private markets. Investor sentiments are understandable as success stories among education startups are very rare.

Now with Benesse's association, do you plan to expand and grow your market in Japan and outside India?

Yes.The key objective of InOpen and Benesse’s collaboration is to jointly develop products for the global education market, starting with the USA and Japan. We have already set up teams and offices in California and Tokyo. We did group discussions in the US and also exhibited in ISTE conference in Texas. The feedback has been very encouraging. We have received many queries on pilot implementations. We have started our operations there already.

We hear that you are in discussions for further investments. Would you call this the 'Bridge Round' leading up to Series A?

No, I will not like to call it a Bridge to Series A Round. We are targeting to raise a particular amount partly from a strategic investor and partly from an impact or financial investor. It's our strategy of moving ahead. I am happy to see the traction for InOpen and feel excited about it. InOpen is in discussions with investors, both financial and impact funds for further investment. We would be looking to raise further capital to cater to the ever growing demand of domestic and international markets.

How do you see the competition and potential market shaping up in the next 18 months?

InOpen is definitely commanding leadership position with its focus on computer science education in India. We have reached 0.5 million students directly with more than 200 schools and 4000 teachers on board. I believe education market in India is one of the most unorganised and fragmented market. I see a lot of consolidation happening in the next 2-3 years. Companies who rode on the wave of installing Smart Classes ignoring content are shutting down after wasting millions of dollars. Schools have become a lot cynical with education companies as they see more and more companies shutting down unable to sustain themselves. I have always believed that technology is just one piece of equation but content is of supreme importance. I believe there will be more and more focus on companies who provides core curriculum learning solutions. I feel InOpen is moving on right path and expanding to different platforms, geographies and even demographics.

Find more such bright and upcoming education startups from India at EduStars 2013 on Dec 6th at Bangalore.