Noise around digital clout grows, says Adobe study findings

Adobe recently released its second annual Adobe APAC Digital Marketing Performance Dashboard, a study done by the CMO Council in partnership with Adobe. The study shows a significant growth in marketers embracing new digital marketing platforms and analytics tools from 15% in 2012 to 33% in 2013.

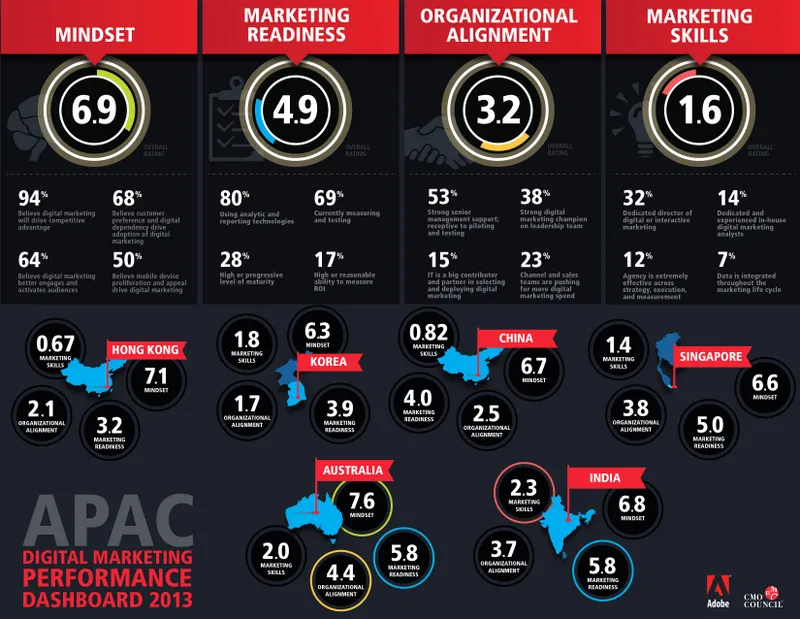

Conducted over a period of six-month in-field program comprising quantitative and qualitative surveys, the study benchmarked levels of adoption, traction and success of digital marketing in Australia, Singapore, Korea, China, Hong Kong and India. 276 senior marketers from a range of industries took part in the study, including 43 respondents from India.

Umang Bedi, Managing Director, Adobe South Asia, outlining some of the key findings said, “Today digital marketing is a boardroom-level conversation which means marketers are dealing with the expectation that they can justify the return on investment on marketing budgets and show results. A big shift is seen in how the marketers have progressed over this one year in this space. Over 80% of marketers are using analytics and reporting technologies for better understanding. Challenges in terms of finding the right skill sets remain, however, Indian marketers lead the APAC region in terms of their growing confidence in their skill sets”, he added.

IAMAI has pegged the opportunity of the digital space in India to be in the region of Rs 3,000 crore. And to see marketers also understanding this is encouraging as shown in the findings.

Changing mindsets of Indian marketers

Digital marketing has seen massive progress in India in last 12 months in terms of understanding, readiness and adoption. 100% marketers in India now believe that digital marketing can create competitive advantage for their company, helping them create a more customer centric organization, helping with brand differentiation and building greater customer affinity and attachment (45%). This is a major shift from 2012 when less than 20% believed it to be able to do so.

Cost-efficiency, effectiveness of these channels and their ability to deliver better ROI is considered the top driver (75% marketers believe so) for the adoption of digital marketing, followed by size and appealing demographics of internet population (72% marketers believe so). Other drivers include ability to better engage and activate audiences, and proliferation, appeal, and capability of mobile devices (60%), followed by better campaign analytics, insight, and accountability; customer preference and digital dependency; social networking and gaming account (50%)

Overall digital marketing budget spend has increased

The percentage of marketers spending over 50% of their budgets in digital marketing has also increased substantially; from 2% in 2012 to 22% in 2013.

Social has been a clear priority for marketers this fiscal year, followed by increasing and improving paid search and online display advertising; and customer listening, feedback and community. In terms of spend, 75% of marketers have been allocating their digital marketing funds on websites (content development and performance optimization), SEO and SEM, social and email.

Better organizational alignment

A notable shift between 2012 and 2013 is the increase in the number of marketers indicating that the CMO or the dedicated head of marketing is the lead of digital marketing. Today, Indian marketers enjoy the support of senior executives in their organization. However, for 40% of respondents, their digital marketing strategy is developed and executed from global head office and for 20% it is localized and executed in APAC and country level.

Challenges and opportunities faced by Indian marketers

Budget limitations, making a business case for digital marketing spend and developing a comprehensive strategy for Indian markets continue to be a challenge for marketers. While asking for funding, a marked shift is that more marketers are looking at assessing overall needs and presenting business case. They are increasingly relying on parameters like customer data on digital media consumption preferences and patterns, analytics on generating customer leads more effectively and overall strategic assessment of potential business impact and contributions (50% each). However, a good proportion of marketers feel their current ability to measure the value and RoI of their digital marketing spends is “Getting Better” or “Needs Improvement”.