Indian App Developer Viewpoint - Platforms, Monetization and more

The mobile app economy really kicked off with the launch of the iOS App store in 2008. Platforms like Ovi for Symbian and S40, Windows Mobile and Blackberry were around earlier, but none generated the excitement or the revenues of the iOS App store.

Competitors followed suit: Google launched the Android marketplace in 2008 (later rechristened as Google Play), followed by the Windows Phone marketplace in 2009. The much acclaimed Qt-based MeeGo was stillborn, with Nokia announcing its demise before its official launch, and served more as a developer playground.

In the period between 2012 and 2013, five new mobile platforms - Tizen, Blackberry 10, Firefox mobile, Ubuntu, Sailfish - have been announced or commercially launched. Read more about these platforms here.

Suddenly, it seems, everyone's courting developers.

Blackberry committed $10,000 to every developer who’s made at least a $1000 dollars on the app world. Microsoft offers Nokia Lumia phones and Surface Tablets to developers who made apps for Windows Phone 8 and Windows 8. Firefox, Blackberry 10, Ubuntu and Sailfish offer easy ports of Android apps to reduce friction of building for a new platform. All know that the success of their platforms depends not only on the UI polish, sexy hardware or whizz-bang software features, but also on the number of apps that are supported on these platform.

The large number of platforms are an opportunity as well as a distraction for developers.

Both the iOS app store and Google Play list nearly 800,000 apps each. There are over 500 million phones, devices and tablets running iOS and over 750 million devices running Android. While these offer the largest 'reach' of users, the sheer number of apps makes discovery of a new app that much more difficult. As a developer, one cannot ignore these platforms for the new ones. But given that the new platforms have huge marketing budgets or a immense media clout, building apps for a new platform may prove to be a lucrative option as well.

As an app developer, you have a choice: build for just iOS and Android, or build for one or more of the new platforms. If you choose to build for a new platform, which one do you choose?

Does the platform align to your app's target segment?

The question of target segment may seem passé.

Today, the smartphone bug seems to have bitten everyone. Youngsters, their parents, corporate honchos, doctors, students: all own or want to own a smartphone. Apps have also evolved to cater to much wider target segments. One can claim that a corporate honcho enjoys angry birds as much as his toddler at home. Almost all platforms offer business and consumer features. You can check corporate email and documents on iOS devices, and play around with photography software on Blackberry 10. Windows Phone boasts Office and Sharepoint integration as much as its Xbox gaming lineage. When these phones themselves offer features for different target segments, should app developers build for one platform that has adopters in their target segment, or build across platforms?

Take the music streaming app segment. Saavn, Dhingana, Gaana and the newly released Hungama are available on most smartphone platforms. This suggests an app strategy independent of a platform, targeting as many users as possible, across platforms.

Sunil Patro of SignEasy differs. SignEasy is an app that allows you to imprint your signature on e-documents. It has a dedicated segment of users because it solves a business problem. When quizzed about which platform he would build for next, he opts for Blackberry 10, as there have already been requests for the app on the Blackberry. He said, “A large portion of Blackberry’s user base are business professionals. With BB10’s entry into larger touch screen displays, a lot of this population will also move to BB10 full touch phones, which is why we’re making a BB10 app, after the iPhone and Android versions.”

Blackberry's heritage and the resurgent brand appeal is a big draw. Annie Matthews, director for BlackBerry India and SAARC, said in an earlier interview: “The focus is going to be on our fundamentals; the developers. Over the last three years, we have grown from a mere 3000 BlackBerry developers to over 38000, and this is the general direction that we’ll be heading in. How we did this is by extensively providing training support, device support, being there when they needed help on go-to-market and how to market their apps better. This is our mainstay and this will continue.”

Business potential

Every app developer wants to make money. Even free apps have advertising enablers for their revenues.

Two factors affect business models for platforms: number of users that defines the reach, and willingness/options to pay for content.

For any app to make money through advertising, it large active user base is a must. In the early days of the app economy, there were limited options for advertising. Apple's own iAds was launched with fanfare, but has not been the industry killer it was expected to be. Google, on the other hand, acquired AdMob in 2009 to extend its reach into the mobile platforms. Other firms too have capitalized on providing ad enablers: InMobi, Vserv, AdNear and Komli Media are all Indian stalwarts who power global app and mobile advertising.

Dipak Khurana, co-founder of Vserv believes that developers should target multiple platforms, including feature phones, for their apps. He says, "Emerging markets (such as India, South East Asia, Middle East and Africa,Russia and Latin America) will continue to see a substantial mix of feature phones and smart phones. All phones are getting smarter by the day and internet is now a basic feature on all devices and applications will get downloaded on types of devices and These handset manufacturers are also expected to bundle popular applications into these phones; which was until now the prerogative of smart phone users solely."

Many platforms recognize that reach and apps are intertwined: if you don't have the reach, app developers may not build for you. If there are no apps for your platform, people don't buy phones, limiting reach for apps.

Microsoft looks to solve this with Hackthons, which it conducted on a regular basis during the launch of Windows 8. Be it the world record attempt to get the most number of developers under one roof to code for Windows 8, to the student only WOWZAPP, Microsoft has been big on providing their end users with a large and varied app base, as well as get enough people to work on their Windows 8 platform.

Microsoft also has the large Nokia marketing machine backing it up with Lumia campaigns. India and emerging markets are expected to spur the revival of Nokia's fortunes with well-priced Lumia handsets, a fact not lost on developers.

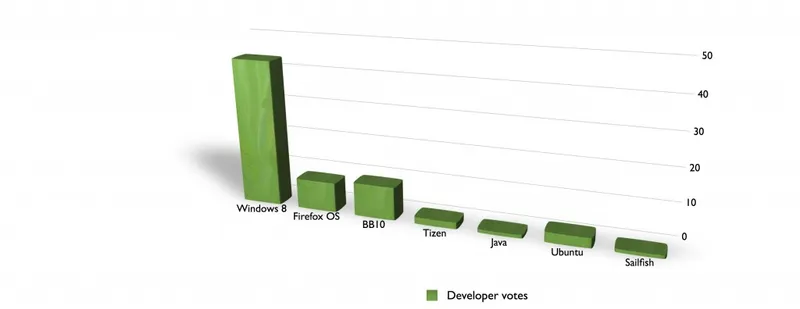

A straw poll we conducted amongst Indian developers echoes this sentiment. Though the sample size of 70 developers is not enough to read a trend, Windows was seen as having the best chance of success after iOS and Android.

"As a startup, you are tight pressed for time and resources, so you’re going to build an app, you’d want to put it out in a marketplace which has the most number of potential users,", says Sidhant Jena of Jana Care, which makes healthcare apps. “If we were to build our app for a third platform, we would definitely build for Microsoft as a third alternative.”

Girish Ramdas, founder of the popular magazine app, Magzter echoes this sentiment. In an earlier interview with Girish, he said, “Magzter was featured on Microsoft’s Facebook page, where they announced the availability of Magzter on Windows 8. That page has close to 10 million followers, and we got some great traction for the Windows 8 app because of that.”

Then there is the issue of payment options and terms for listing on app stores.

Anand Hariharan, VP, Marketing, Vigyanlabs Innovation Pvt. Ltd. opines that the new platforms have much to learn from Google' Play store policy. Vigyanlabs is a technology startup specializing in mobile devices power optimization. VigyanLabs offers a paid version of their product for Android. Says Anand about the Google Play store, "Google has a great set of policies when it comes to listing software and payments on the store. When I list software on Google, I know the time by which my payments roll in and what the tax implications are. Google also offers me advice on how to price my software in different countries when I set a dollar price, which is very useful info. It offers reports on devices and countries where the software has crashed and has an excellent review system."

Vigyanlabs explored porting their software to Ubuntu's mobile and desktop OS, especially since China has chosen Ubuntu to be the basis for its national, open source software. This could evolve into a huge market, but Ubuntu's policies are not clear about frequency of payments and tax issues.

Says Jayanth Kolla, partner at Convergence Catalyst, a leading telecom consulting and research firm, "With over 95% of the Indian mobile market on prepaid connections, and less than 18 million credit card holders in the country, operator billing is a key requirement for building payment options."

However, the operator billing integration has gotten off to a slow start in India. Amongst the different app stores, Nokia has integrated with the Vodafone and Airtel for payments on its Nokia Store, and RIM is in talks for the same. There have been many announcements but few alternatives when paying for apps.

Java: enabling the fortune at the bottom of the pyramid?

In the debate about smartphones, the venerable Java platform is often seen as a has-been. But it currently boasts of the largest active reach, even beating

Android and iOS in India. In a conversation with Ravi Sundararajan from GupShup, the SMS based social network, he stated that there are over 30 million internet enabled Java based devices in India and there is huge excitement to try out apps on them.Nokia, the largest device manufacturer has also been touting apps on its Java platform on the Nokia Asha series as an aggressive marketing tactic. If you are building apps for the emerging markets, Java is too big to ignore.

"There are over 8,000 companies developing Java-based mobile applications in India. Together, they employ over 250,000 developers. It just goes to show that the opportunity is tremendous," says Kolla.

Go native, port or just stick to HTML5?

Apart from monetization, many of the new platforms try encouraging app development by allowing developers to port their Android apps. BalckBerry owing to the qt framework that it is based on, lends itself to easy porting of apps from various platforms for BB10. Sailfish has gone a step further wherein Android apps run as is on the OS. In the launch demo of Sailfish, the smartphone platform built by Jolla that is the spiritual successor of Nokia's aborted MeeGo efforts, Stefano Mosconi, the CTO of Jolla claimed during Jolla's SDK announcement at this year's MWC that the first app was built in 20 minutes of launching the SDK. All Android apps would also run natively without requiring any changes.

App developers in India, however, are cautious. While porting apps is a good way to get a foot in to the door, it means that the app cannot take advantage of native UX features and may have to compromise on the experience. For example, Android apps will work on Sailfish, but cannot use the pulley notification menu. Sailfish, however, has an outreach issue. Many of the Indian developers we spoke to did not know much about it, so it isn't on their radar for building native apps.

Regarding porting existing apps to new platforms, Raviteja Dodda, co-founder of customer loyalty app Delight Circle said, “Porting and cross platforms are great, but the experience is nothing close to what a native app can provide you. There are solutions like Phonegap, which allow you to compile HTML, CSS and JS into packages for specific platforms, but they too have the experience problem. I think this will persist for at least the next few years.”

What about HTML5? Steve Jobs scythed Adobe's Flash platform on mobiles with a public letter on the virtues of building apps or webpages using HTML5. Half a decade later, HTML5 is still not deemed competitive enough. In a rare public confession, Facebook announced that it had erred in pursuing HTML5 as a platform for development and would build native apps.

That hasn't deterred platforms like Firefox OS and Ubuntu. Both claim that HTML5 is robust enough to support full app functionality. Ubuntu offers the option to build apps on the Qt framework or easily adapt HTML5 apps built for other platforms , while Firefox OS relies entirely on HTML5 for its app hoard. However, Firefox OS also has hardware acceleration for HTML 5 apps. Incidentally, Qt5 also offers a means to port apps across platforms.

Despite the imminent launch of Samsung and Intel’s Tizen, developers are ambivalent about it.

Amrit Sanjeev, a senior staff engineer at Intuit says, “If anyone can pull off Tizen, it’s going to be Samsung. OSes are a long term play and require a lot of investment, and Samsung has the muscle to do it. However, app makers, especially the individual developers are going to have a tough time. One more popular platform only means one more OS to cater your apps for, in already crunched circumstances.”

One of most widely read industry observers, Tomi Ahonen, also places Tizen as the strongest contender. In his post about newer smartphone platforms, he notes that Samsung's Bada was a stealth success story in terms of number of phones sold. In the first two years of launch, Bada phones outsold even the iPhone by shipping 30 million phones. Bada has a huge market share in the emerging markets. In a recent announcement, Samsung stated that it will fold Bada into Tizen, making it a primary development platform along with its Android phones. With Samsung's marketing might, Tizen has a great chance at capturing marketing share in the coming years.

Given the pace of developments in the platform strategy, it seems safe to assume that most developers will adopt a wait-and-watch approach to building for new platforms. Windows and Blackberry seem to have winds blowing in their favor; Java remains a favorite for those targeting lower-end phones. If there is no clear player in the third place, developers may continue being courted by multiple players. But they may also have to invest in building apps for more platforms. Life ahead for developers is going to be more opportunities and more decisions to make.

This should be interesting to watch!

- By Shrinath V and Raghu Mohan