Can Online Classifieds Portals Capture a Major Chunk of OnlineAdvertising Revenue in India?

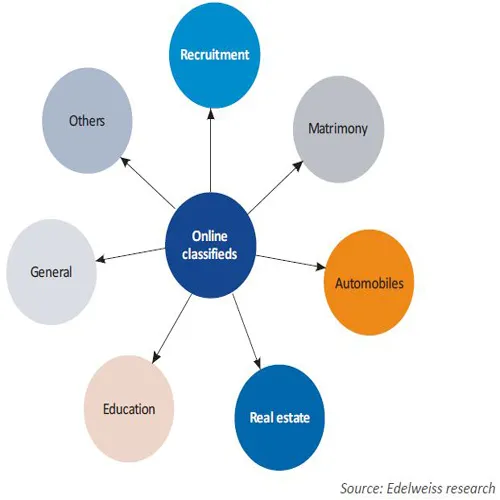

Online advertising has three primary categories, namely search advertising, display advertising and classified. Classified portals cater to various categories like job listings, real estate listings, automotive listings, yellow pages and some even cater to multiple categories.

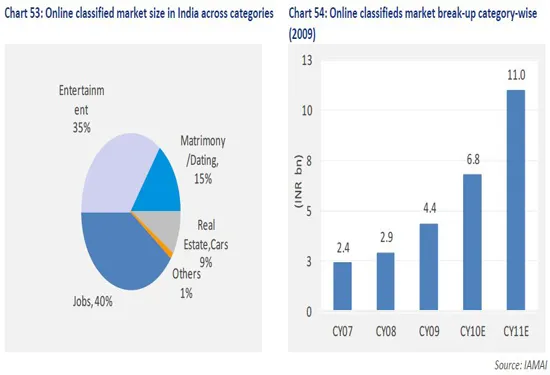

As internet user base grows in India more businesses will be driven online and spending on online classified will increase. According to an Edelweiss report the global online classifieds segment stands at USD 10.5 billion, which translates to 17% of global internet ad revenues. The size of India’s online classified industry is about INR 11 billion and is expected to grow to INR 31 billion by 2016.

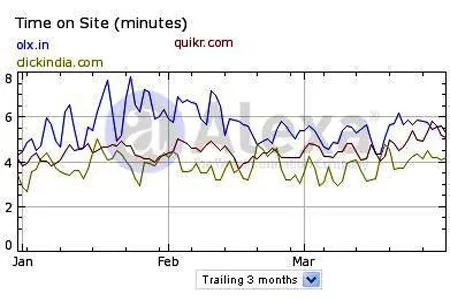

The report also says that the growth potential in segments such as real estate, cars and general classified is ripe to be captured. However, the supply side is not adequate to meet such large demand despite the readiness of users. Further, the online classified industry in India has grown through vertical sites in different segments unlike the US where the biggest classifieds site is Craiglist, a horizontal portal. Some of the Indian classified portals working in with a horizontal model are OLX.in, Quickr.com and Clickindia.com.

Most classified sites generate revenue through content creation or content access. So if a business advertiser makes itself available on Justdial.com then it is an example of content creation and in case of content access an apt example would be Naukri.com, where candidates access a database. Advertising is another revenue channel. “Advertising will remain our main revenue model. We also have Featured Listings that users can buy to get a value added placement on top of the listings or on the home page of the site,” informed Amarjit Batra, Country Head, OLX.in.

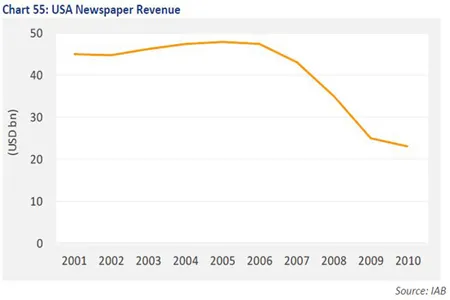

Online classified is expected to hit newspaper revenue as well. In USA internet is second only to television as an advertising medium according to a report by Emarketer. China also had similar experiences, where internet revenues are expected to cross newspaper revenue in 2012 as per iResearch report. In India the share of print advertising revenue in the total ad revenue dropped from 44% to 42% in 2010 according to a Pitch-Maddison report. But the internet market is still comparatively small in India and local language content is very limited, and that is where newspapers still hold the upper hand.

The Edelweiss report also projects that SMBs will emerge as top spenders in online advertising in India. There are 35 million SMBs, of which just 0.2 million have an online presence. Online advertising will help them reach their target audience at a fraction of the cost of traditional advertisement and they will also be able to track return on investment. The report sums it up by saying, “Thus large potential market is there with factors like huge benefits of Internet advertisement, low cost of advertising on Internet, increasing awareness about this sector, increasing global competition as well as opportunity of targeting global market they will emerge as big spenders in near future. This is largely the potential for horizontal classified models.”

“Presently and in the near future, the online classifieds space is clearly going to shift to the horizontal classifieds model as these sites are free to search, free to post ads, free to interact and free to transact; thus providing immense value to users. Moreover these sites are local which is where most of the transactions are sought and completed by an average individual,” said Amarjit. Indians are spending a significant amount of time on these classifieds portals.